The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

You can get an apartment with bad credit by being open about your credit issues, providing reference letters and documentation, providing sufficient income or savings, being willing to pay more up front, setting up automatic payments, getting a cosigner or offering to move in immediately.

When it comes to renting an apartment, having bad credit can make the process challenging and discouraging. Many things could impact your credit score, like missing payments or losing a job. Luckily, you can still get approved for an apartment despite your bad credit.

As an applicant, you may have to go the extra mile to prove to landlords that you won’t be a high risk tenant. The steps in this article will help guide you through the process of how to get an apartment with bad credit.

1. Review your credit report

The first step in getting approved for an apartment is to make sure you know and understand your credit score. The three major credit bureaus—Experian, TransUnion and Equifax—allow you one free credit report per year. Space these out throughout the year so you can regularly check in on your credit health. There may be errors on your report that you were unaware of, so try your best to dispute them immediately. According to a study conducted by the Federal Trade Commission, one in five people experiences an error on one of their credit reports. Reports can contain incorrect account numbers, an errant late payment notification or an incorrectly listed loan, all of which can affect your overall credit.

When disputing an error, make sure you present a solid case. Disputes can take some time, so take a thorough look at your report before looking to rent. This will put you in a better position when it’s time to get approved for an apartment.

2. Be open about credit issues

When speaking with potential landlords, it’s important to be up front about any credit issues that could sway their decision to approve you for an apartment. Your landlord will eventually review your credit report, so be open about anything that could cause concern during your initial meeting.

If there is anything on your credit report that may raise concerns, such as an eviction on your record, be ready to provide some insight to support your case. If there is an error on your report that you are currently fixing, consider giving your potential landlord written documents that explain the discrepancy. Any form of documentation to build your case will be helpful.

While some independent landlords may be more understanding, it’s important to keep in mind that larger rental management companies may be less likely to make exceptions.

3. Provide reference letters and documentation

Providing potential landlords with reference letters and documentation regarding your rental history and proof of income is a great way to help build your case. Ideally, the reference letters should be from previous landlords and your current employer. If you can get multiple letters, that’s even better.

Getting a letter from previous landlords or property managers will help prove you’re able to pay rent on time and that you’re a reliable tenant. If possible, provide copies of payments you made on your last rental or bank statements showing your utility payment history. Aside from that, requesting a reference letter from your employer can help show landlords you make enough money to afford the apartment.

Remember, you want to show potential landlords that you’re a great tenant despite having bad credit, so make sure the reference letters you’re providing are credible and from someone you trust.

4. Prove sufficient income or savings

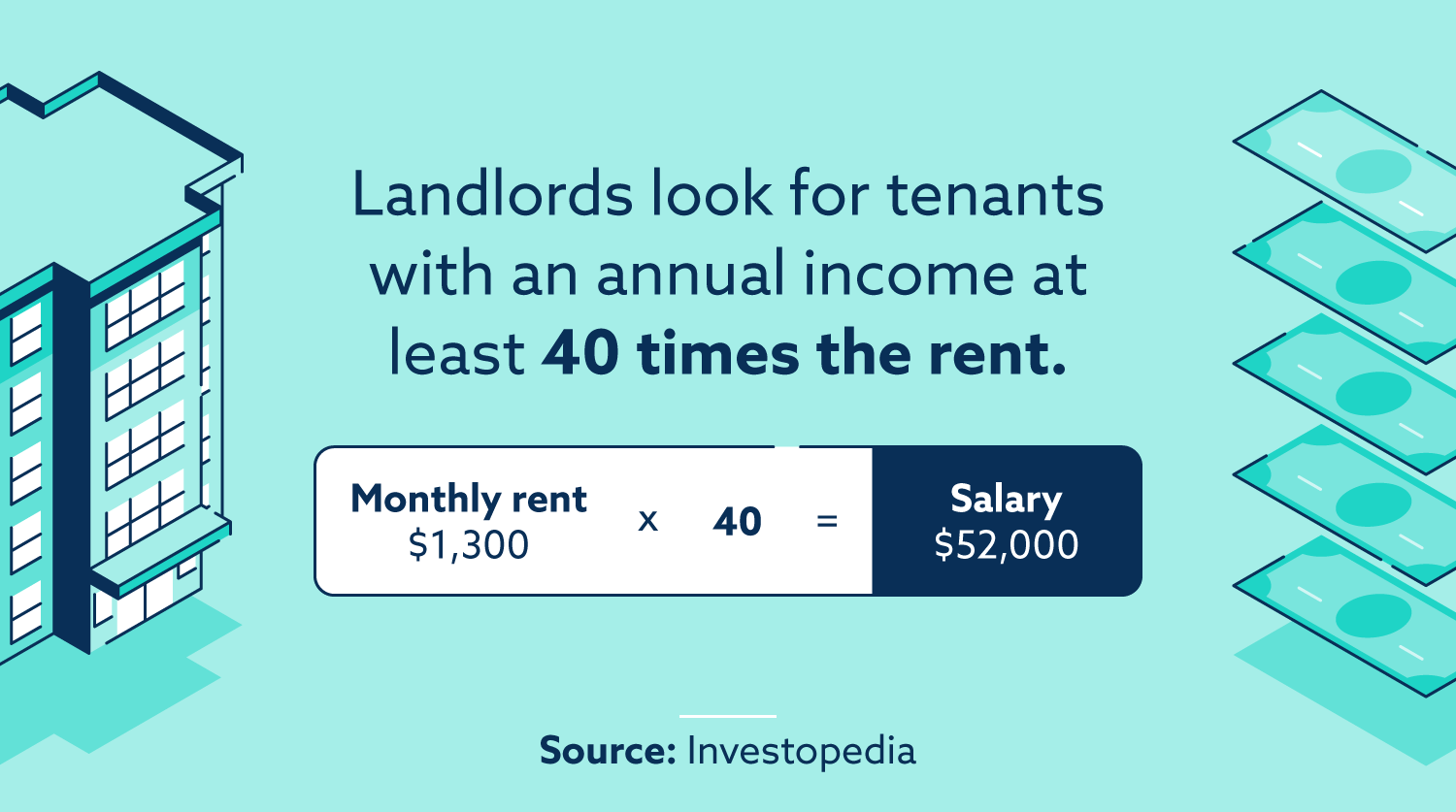

Generally, landlords will request pay stubs to prove your employment and income. They typically look for tenants with an income of at least forty times the rent. For example, with a rent of $1,300 per month, they’d want you to make at least $52,000 per year. If you’re making a salary that is closer to fifty or sixty times the rent, you’ll appear to be a stronger candidate to prospective landlords. If you have bad credit but high income, it increases your chances of being approved for a lease.

Proof of significant savings is another way to sway an indecisive landlord. To show you’re financially responsible, offer to show bank statements of your savings account. For example, if you have an emergency fund where you’ve built up enough savings to pay for a few months’ worth of rent, don’t be afraid to prove it. This helps provide further evidence that you’re paying attention to your financial health despite your bad credit.

5. Be willing to pay more up front

Apartments typically require tenants to pay a deposit equal to one month’s worth of rent before moving in. To help you prove you’re a reliable candidate, offer to pay more up front. In some areas, it’s common to pay the first month and last month’s rent along with a security deposit. If the prospective landlord isn’t already requesting this, consider offering this incentive. Showing you have the means to pay more up front will help you prove you’re financially responsible and take the focus off of your bad credit.

6. Look for apartments that don’t require credit checks

Most landlords require a credit check for all tenants, but there may be some instances where they don’t. Though this is less common, these properties are usually rented out by independent landlords as opposed to more established management companies. These types of landlords may be more willing to see past your bad credit report as long as you can prove to them you’ll pay your rent on time.

7. Set up automatic payments

To prove you’ll pay rent on time, offer to set up automatic payments with your prospective landlord. Of course, you’ll need to show your landlord you have a steady income and have the means to cover these automatic payments. Landlords can set up a direct deposit straight from your bank account or use an online rent payment system. Doing this is a great way to help ensure you pay your rent on time each month and will put the landlord at ease.

8. Get a cosigner

Finding a cosigner is great for people who have bad credit or who don’t have credit at all. If someone you trust, like a parent or family member, has great credit and is willing to cosign your lease, it can help you land an apartment. Keep in mind that your cosigner is also responsible should there be a reason you can’t pay rent, so make sure this person is someone you have a great relationship with and is willing to support you should any issues arise.

9. Consider a roommate

If you’re unable to get a cosigner, getting a roommate could be your solution. If your roommate has better credit than you and positive rental history, having them on the lease can help influence a landlord’s decision to accept you as a tenant. Though the landlord may still require running credit checks for all tenants, having a trustworthy roommate with good credit can help take the focus off yours. Since the rent will be divided among more than one tenant, it makes it easier for the landlord to trust that you’ll be able to make your portion of the monthly payment.

10. Offer to move in immediately

Landlords that are sitting on empty properties are more than likely looking to fill the vacancy quickly, especially if they’re seeing little interest. Offering to move in right away and having a deposit ready up front can increase the likelihood of a landlord accepting you as a tenant despite your bad credit.

11. Build up your credit

If you’re not in a hurry to move in, consider waiting and focusing on building your credit. Doing this can put your credit health in good standing and, when it’s time to shop around for rentals, you won’t have to be as worried about proving you’re a good tenant to prospective landlords. There are plenty of strategies that you can use to help increase your credit score, like focusing on paying off existing debt.

Renting an apartment with bad credit FAQs

Below, we’ve answered some common questions regarding how to get an apartment with bad credit.

Do you need credit to rent an apartment?

In most cases, you will need credit to rent an apartment since landlords and property managers typically require a credit check. However, you may be able to rent an apartment with no credit if you establish proof of income, get a cosigner, or live with a roommate.

What credit score do you need to rent an apartment?

While there is no hard and fast rule, most landlords prefer a credit score that’s at least in the “good” credit score range, which is a minimum of 670 according to the FICO model.

What do landlords look for on your credit report?

Landlords will often look at your payment history and rent-to-income ratio in addition to any negative items on your credit report that may indicate you haven’t been able to make payments in the past, such as items in collections or a bankruptcy.

Finding an apartment is exciting, but worrying about your credit can make it challenging. While you may have to put in a little extra work to prove you’re a desirable tenant, following the strategies in this article may help increase your chances of getting an apartment even with bad credit.

The best thing to remember is that bad credit isn’t forever. With planning and patience, you may be able to improve your credit score.

Get your free credit assessment today if you’re ready to take the next step toward improving your credit.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.