The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

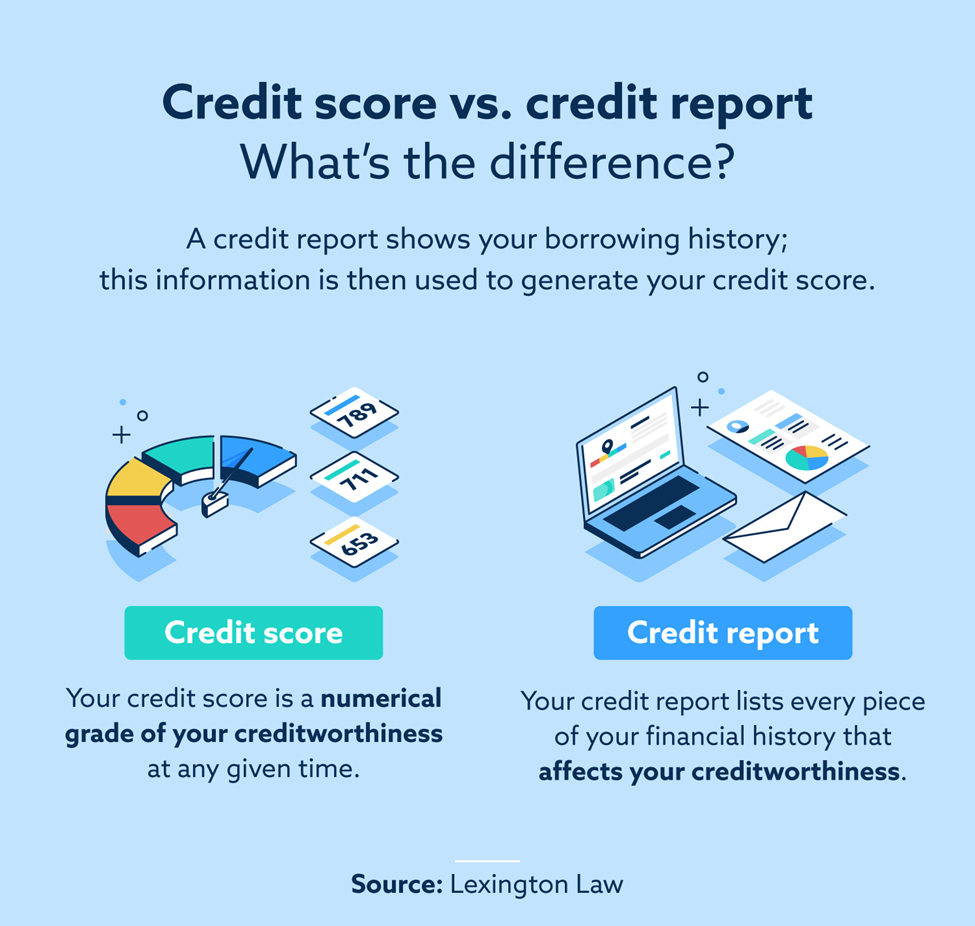

Your credit report is a detailed account of your credit history and current credit situation, while your credit score is a number calculated based on the information in your credit report. Both are used to determine your creditworthiness.

Whether you’re applying for a credit card or financing a new car, you’ve likely come across lenders asking for your credit score or viewing your credit report. These tools are both used to understand your credit risk, but there are key differences between the two. Learning how (and when) to check and manage your credit score vs. credit report is an important part of maintaining your overall financial health.

What is a credit score?

Your credit score is a number between 300 and 850 that lenders use to grade your creditworthiness, or how good a candidate you are for an extension of credit (e.g., a loan or credit card). It also determines the interest rate and loan terms you qualify for.

There are many different scoring models, but your FICO® score is most commonly used to make credit decisions. FICO® offers a variety of specialized scores for credit cards, home loans and more. Another relatively common score issuer is VantageScore®.

Credit scores are updated monthly and determined based on five main factors to predict how likely you are to be a responsible borrower, including:

- Payment history

- Credit utilization rate

- Credit diversity

- Credit history and age

- Recent credit applications

This information is used to calculate your unique credit score. Keep in mind that credit scores can differ depending on the credit reporting agency, scoring model and even the day it was calculated. While scoring models vary, credit score ranges are generally quite similar. These are FICO’s scoring ranges:

- 800 – 850: Excellent

- 740 – 799: Very good

- 670 – 739: Good

- 580 – 669: Fair

- 300 – 579: Poor

Scores below 580 will severely limit a person’s creditworthiness and credit options.

What is a credit report?

Your credit report is an overview of your credit history and activity over the past seven to 10 years. This information is used to calculate your credit score, but it doesn’t include the actual three-digit number assigned to you. Credit reports include:

- Personal information, like your name and address

- Accounts you currently hold

- Public records, such as bankruptcies filed over the last decade

- Accounts you’ve closed

- Hard inquiries into your credit

- Payment history

- Accounts sent to a collection agency

Three credit bureaus generate credit reports: Experian®, TransUnion® and Equifax®. You can get one copy for free from each bureau every year. It’s recommended to request these copies one at a time throughout the year to check for any potential errors that could damage your credit and hurt your chances of getting a loan.

What is the difference between a credit report and a credit score?

| Credit reports | Credit scores | |

|---|---|---|

| What is it? | A detailed document listing credit activities over the last seven to 10 years | A three-digit number given to a borrower based on the information provided in their credit report |

| Who creates them? | One of the three credit bureaus (Experian, TransUnion and Equifax) | Typically FICO or VantageScore |

| How often are they updated? | Once a year | Monthly |

| What are they for? | Understanding a your creditworthiness when applying for a home or auto loan, insurance or a job | Providing a quick glance at your overall credit risk when applying for a new line of credit or rental home | Who looks at them? | Current and prospective creditors and lenders, prospective landlords, insurance companies, current and prospective employers, debt collectors and government agencies | Credit card companies and prospective landlords |