The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

You can file bankruptcy multiple times in a lifetime, though the mandated wait times between bankruptcies vary. After filing Chapter 7 bankruptcy, you need to wait eight years to file again or four years to file Chapter 13. If you originally filed Chapter 13, you must wait two years to file again and up to six years to file Chapter 7.

Bankruptcy can be a complicated process, and many people don’t understand it perfectly. For example, did you know that although you can file bankruptcy more than once, you must wait a certain number of years between filings?

The common bankruptcy filings for individuals are Chapter 7 and Chapter 13 bankruptcy, and each type of filing has its own limitations. By the time you finish reading, you’ll know how many times you can file, what double filing is and what your alternatives to filing bankruptcy are.

How many times can you file bankruptcy?

Although there is a wait time between bankruptcies, you can file as many times as you’d like. However, your waiting period between filings depends on how you previously filed. In order for the wait times to apply, a court will need to successfully discharge your bankruptcy case. A discharge is when the court decides that you qualify for bankruptcy and can go through with the process.

If your case wasn’t discharged, the wait times don’t apply, and you can apply for bankruptcy as long as none of the following occurred:

- You received a voluntary dismissal of the case

- Your case was dismissed because you failed to show up for court

- Your case was dismissed because you failed to obey court orders

If your case was discharged, it’s possible that you’ll end up in a situation where you’ll need to file again. But how long do you have to wait between bankruptcies if you need to file again?

How often can you file for Chapter 7 bankruptcy?

Chapter 7 bankruptcy is the type of filing individuals use when they want to have debts eliminated. During this process, you’re assigned a trustee who decides how many of your nonexempt assets need to be sold to pay off your outstanding debts.

If you want to file Chapter 7 bankruptcy again, the U.S. courts state that you’ll need to wait eight years after the date of the original filing. If you filed Chapter 7 bankruptcy and want to file again with Chapter 13, the wait time to file is only four years.

How often can you file for Chapter 13 bankruptcy?

When you file Chapter 13 bankruptcy, if approved, you’re put on a repayment plan to pay back your debts. This typically helps people get on a schedule that works for them and is affordable if everything goes to plan. After filing Chapter 13 bankruptcy, the wait time to file again is only two years. If you paid 70 percent of your Chapter 13 debts, the U.S. courts offer “good faith” with no wait period if you want to file for Chapter 7 the next time. Those who haven’t met this 70-percent threshold must wait six years before filing for Chapter 7.

| Original filing type | New filing type | Wait time between filings |

|---|---|---|

| Chapter 7 | Chapter 7 | 8 years |

| Chapter 7 | Chapter 13 | 4 years |

| Chapter 13 | Chapter 13 | 2 years |

| Chapter 13 | Chapter 7 | Up to 6 years, but there’s no wait time if 70% of the original debt has been paid |

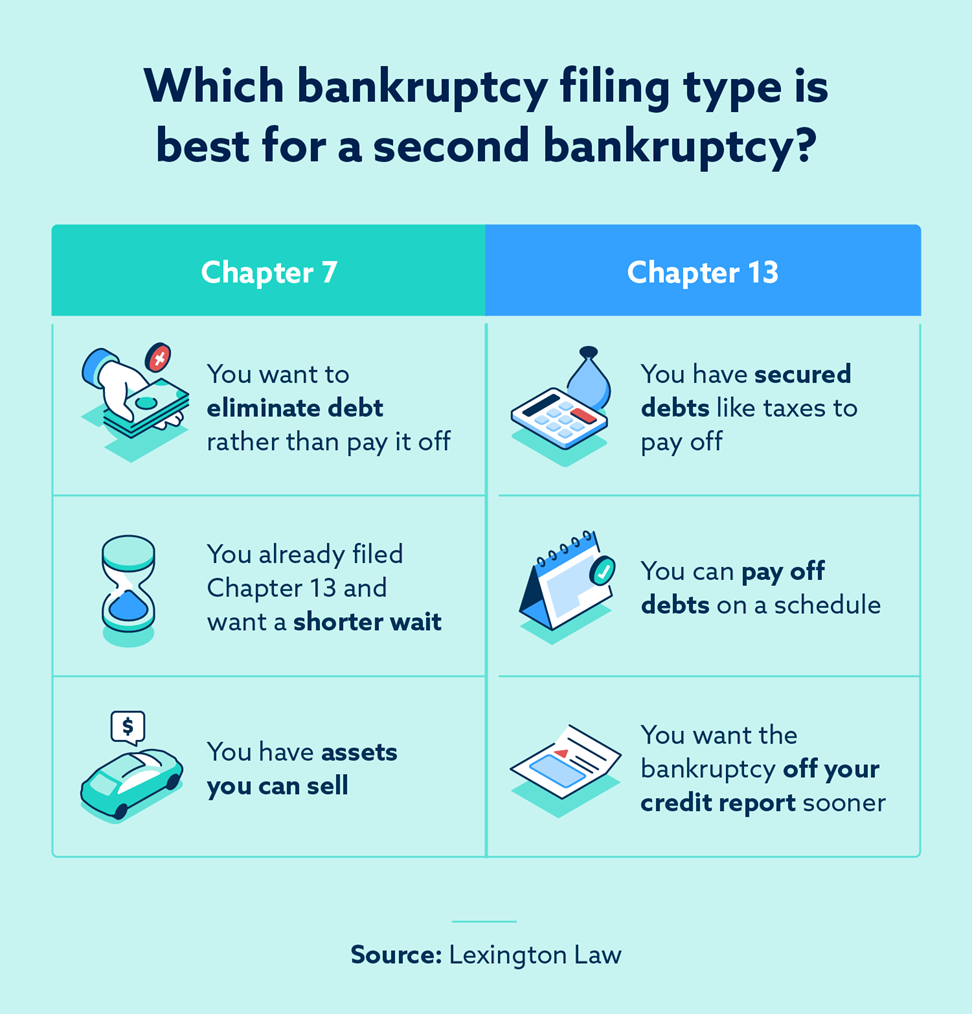

When should you switch your bankruptcy filing type?

Which bankruptcy filing you choose is very specific to your personal situation, so when you file again, you may find that it’s better to switch your filing type. The following are some considerations before your new filing:

- Do you still have secured debts after filing Chapter 7? Chapter 7 doesn’t cover secured debts, so filing for Chapter 13 bankruptcy can put you on a repayment plan to pay these off. These include debts like tax debt, child support, court fees and alimony.

- Would it be more beneficial to sell assets and eliminate debt? Chapter 13 is a repayment plan that’s typically for people in a better financial situation than those who file Chapter 7. Switching to Chapter 7 may be a good option if it’s better for you to sell assets and have other debts removed.

- Have you accumulated more debt and just need a better payment plan? If you originally filed Chapter 13 and can benefit from a new repayment plan, you may want to file Chapter 13 again.

If you need help deciding which bankruptcy to file, a bankruptcy attorney can help you discover which option is best. They may also be able to assist you with any questions you may have about whether you can remove a bankruptcy from your credit report.

Should you file bankruptcy without a discharge?

When you don’t meet the requirements of the original bankruptcy, the court may dismiss your case without a discharge, and you’ll need to file again. After dismissing your case without a discharge, you typically have to wait 180 days before filing again. The only caveat is that if the court says otherwise, you’ll need to meet other requirements to file again.

Another situation some individuals run into is when the court denies a discharge rather than dismissing it. A court may make this decision should you disobey the original guidelines for the bankruptcy or don’t show up for court. In these cases, you may not be able to file again.

Should you find yourself in this situation, a bankruptcy attorney can provide you with advice that may help you file again.

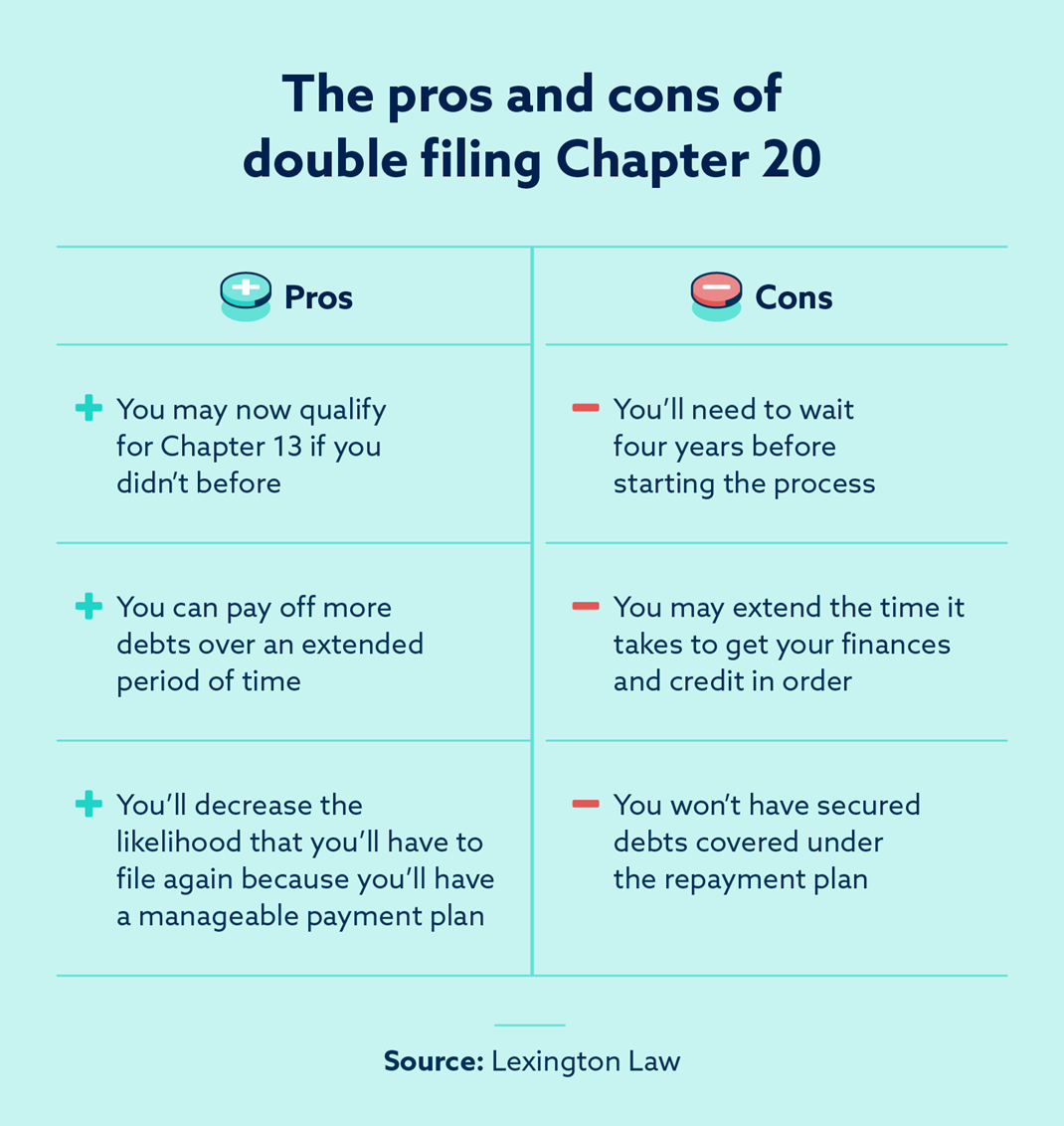

Double filing with Chapter 20 bankruptcy

Chapter 20 bankruptcy, also known as “double filing,” is a colloquial term because it’s not an official type of filing. It’s called Chapter 20 because this is when you file Chapter 13 bankruptcy right after your Chapter 7 bankruptcy is discharged.

Pros

People often choose to double file if they still have unmanageable debts after completing Chapter 7. The Chapter 7 filing doesn’t cover secured debts, so even after it’s discharged, there may still be a significant amount of debt left. Some of the benefits of filing Chapter 20 bankruptcy include:

- You may now qualify for Chapter 13 if you didn’t before

- You can pay off more debts over an extended period of time

- You’ll decrease the likelihood that you’ll have to file again because you’ll have a manageable payment plan

Cons

Much like your original filing, choosing to double file with Chapter 20 will be specific to your situation, so it’s helpful to know the downsides as well:

- You’ll need to wait four years before starting the process

- You may extend the time it takes to get your finances and credit in order

- You won’t have secured debts covered under the repayment plan

When to file Chapter 20 bankruptcy

Now that you know the pros and cons of filing Chapter 20 bankruptcy, here are some things to keep in mind before making the decision:

- Is filing Chapter 20 more advantageous than seeking alternative options for debt relief?

- Will the repayment plan help you become debt-free?

- Can you manage to wait the four years between filings?

- Would it be better to wait the full eight years to file Chapter 7 again?

How multiple bankruptcy filings affect your credit report

Before filing for bankruptcy again, keep in mind that both bankruptcies will stay on your credit report for seven to 10 years. When you file for bankruptcy again, both will show up on your credit report if the original bankruptcy has yet to expire.

Some of the negative effects of having multiple bankruptcies on your credit report include:

- You may see a significant decrease in your credit score.

- It can be more difficult to get approved for loans and lines of credit.

- Multiple filings can increase your required deposit when renting.

- If you are approved for loans or credit, you’ll have much higher interest rates.

Not only does having two filings on your credit report cost you additional money, but it can cause you to lose an automatic stay, which prevents creditors from collecting debts when you file for bankruptcy. Filing again may remove this benefit, which means you’ll be paying even more money on a regular basis.

Alternatives to filing for bankruptcy again

Bankruptcy is often the last resort for people, but there are alternatives to filing for bankruptcy again that you may want to keep in mind. If you’re able to take advantage of these alternatives, it could be better for your credit health.

Here are some alternatives people use to avoid bankruptcy:

- Seek the advice of a credit counselor

- Try settling debts with your creditors

- Sell assets to pay off debts

- Consider taking out a debt consolidation loan

- Find additional sources of income through side work

- See if it’s possible to work extra hours at your current job

Repair your credit after bankruptcy

As you can see, there are advantages and disadvantages to filing for bankruptcy multiple times. The biggest downside to filing for bankruptcy is that it harms your credit for years, which can make it difficult to manage your finances. But sometimes, bankruptcy is your best option, and in these cases, you could use additional help from professionals to repair your credit.

Lexington Law has a team of qualified legal professionals, and our clients have seen over 77 million removals from their credit reports since our founding in 2004. Our goal is not only to help you repair your credit but also to provide you with financial services to maintain healthy credit and avoid financial hardship in the future. To learn more about how we can help, contact us today for more information.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.)