Medical bankruptcy is an unofficial term for clearing out medical debt under Chapter 7 or Chapter 13 bankruptcy.

According to the U.S. Census Bureau, Americans hold nearly $200 billion worth of medical debt. As you can imagine, medical debt can cause quite a bit of financial distress for anyone who has it.

Medical bills can affect your credit and make paying off other bills difficult. Filing bankruptcy due to hefty medical bills may help you eliminate your medical debt and have a fresh start, but it isn’t always a perfect solution. Here, you’ll learn what medical bankruptcy is and how it works so you can decide if it’s the right choice for your situation.

What does medical bankruptcy mean?

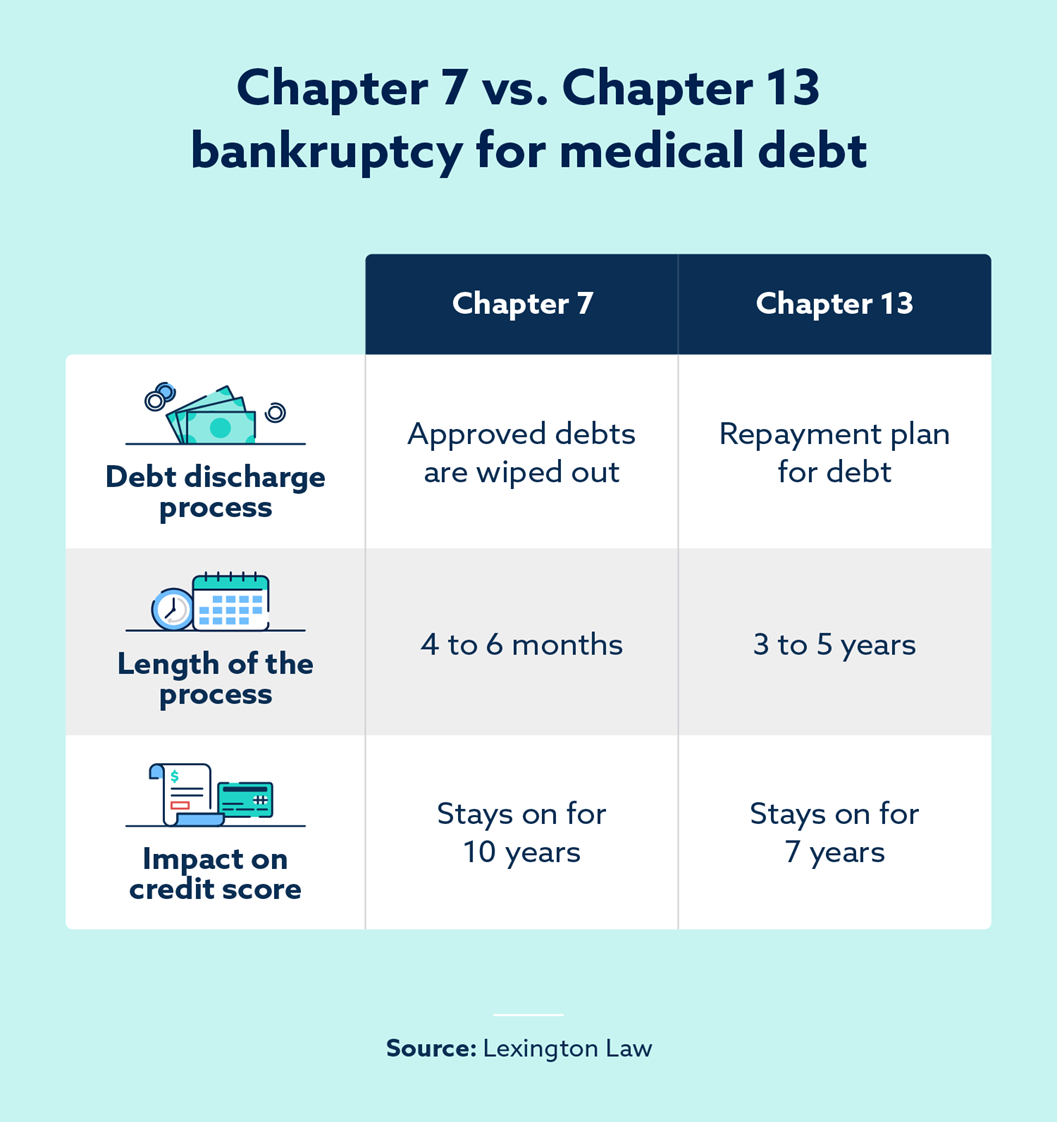

“Medical bankruptcy” isn’t a legal term used in bankruptcy court, but it’s often used unofficially to describe filing for bankruptcy to eliminate medical debt. The most common forms of bankruptcy for individuals struggling with medical debt are Chapter 7 and Chapter 13—they have some similarities as well as differences for discharging debt.

Can you discharge medical debt in bankruptcy?

Both Chapter 7 and Chapter 13 can help you discharge medical debt as long as you follow the court’s guidelines and are approved for the filing. When you file bankruptcy, your debts are categorized as either secured or unsecured debts. Secured debts are types of debts for which you provide collateral or a down payment, like a home or a vehicle. Credit cards and other non-collateralized debts are unsecured debts.

Medical bills fall under the unsecured debts category, which gives you more options when you’re filing for bankruptcy. For example, if you’re approved for Chapter 7 bankruptcy, you may be able to have the entirety of your medical debt eliminated.

Which type of bankruptcy should you file for medical debt?

Choosing which form of bankruptcy to file depends on your unique circumstances as well as what the courts will approve. The primary difference between Chapter 7 and Chapter 13 bankruptcy is that Chapter 7 allows you to eliminate debt after liquidating some of your assets. With Chapter 13 bankruptcy, you’re provided with a repayment plan to pay off debts over time.

How to file Chapter 7 bankruptcy for medical debt

To qualify and file for Chapter 7 bankruptcy, you’ll need to pass a means test. The means test is when the court takes a look at your household income compared to the average in your state. If you’re below a certain threshold, you can file for Chapter 7. When people ask, “Does bankruptcy clear medical debt?” they’re usually referring to Chapter 7.

During a Chapter 7 bankruptcy, you’re assigned a trustee who evaluates your financial situation and your assets. For assets that don’t fall under your state’s specific exemptions, you may be required to sell them in order to pay back a portion of your debt. Once the assets are sold to pay back creditors, the remaining debt is removed.

How to file Chapter 13 bankruptcy for medical debt

People with a steady source of income typically file Chapter 13 for their medical bankruptcy. If your medical condition isn’t preventing you from working and receiving regular pay, this may be your best option for bankruptcy.

Under a Chapter 13 bankruptcy filing, you submit a proposal to the courts, which is based on your income. The proposal contains information on how much you believe you can pay on a monthly basis. You’re given a three-to-five-year timeline to repay your debts based on the court’s decision. Once your repayment plan is complete, the court discharges your bankruptcy.

Alternatives to filing medical bankruptcy

Medical bankruptcy is an option that many people turn to, but it can affect your credit for seven to 10 years. Derogatory marks on your credit can make it difficult to apply for loans, and it can also result in putting down larger deposits when renting a home or turning on utilities.

Before filing for medical bankruptcy, here are some alternative ways to pay your medical bills and avoid bankruptcy:

- Sell assets: Yes, this is part of Chapter 7 bankruptcy, but it does not affect your credit if you do it on your own. You can use these funds to pay down your medical debt.

- Borrow from a friend or family member: This is typically a good option to avoid interest, but medical debt doesn’t accrue interest. It still may be helpful to avoid the debt going to collections.

- Settle your debt: Much like other forms of debt, you may be able to call and negotiate with your medical debt creditors to settle the debt for less.

- Consolidate your debt: Debt consolidation allows you to combine multiple medical bills into one, which can help reduce the number of creditors you have and make repayment more manageable.

- Find extra sources of income: Depending on your medical condition, it can be helpful to work additional hours or find side work to pay down your debt.

FAQ

The following are some of the most common questions when it comes to medical bankruptcy.

What is the difference between bankruptcy and medical bankruptcy?

Technically, there’s no difference between bankruptcy and medical bankruptcy. While medical bankruptcy isn’t a legal term, you can claim medical debt when you file for bankruptcy.

How long does medical bankruptcy last?

Chapter 13 bankruptcy takes three to five years to repay your debt, and it remains on your credit report for seven years. Chapter 7 bankruptcy can take four to six months and will stay on your credit report for 10 years.

How does medical bankruptcy impact credit?

Medical bankruptcy affects your credit score, so it’s helpful to understand the downsides of filing for bankruptcy. Chapter 7 bankruptcy stays on your credit report for 10 years, while Chapter 13 bankruptcy only lasts for seven.

As long as a bankruptcy is on your credit report, it hurts your credit and is also a red flag for lenders and anyone else who checks your credit. This can result in loan rejections as well as higher deposit requirements when you rent or start a utility service.

Can you claim medical debt on bankruptcy?

Yes. You can claim an unlimited amount of medical debt when you file for bankruptcy.

Does a medical bankruptcy affect your spouse?

If you’re married, your medical bankruptcy can affect your spouse, even if you file alone. Your spouse’s assets may need to be liquefied under Chapter 7 bankruptcy, but if you file individually, your bankruptcy will not affect their credit.

How to repair your credit after medical bankruptcy

Medical bankruptcy may be the best way to get back on your feet financially, but it can also affect your credit for years to come. If you’re planning on buying a home or car, or if you’re hoping to make other big purchases using credit, it can be difficult to get approved for these.

Lexington Law Firm has a team of legal professionals who can help you repair your credit. We have different credit repair services like credit monitoring and financial education tools to help you on your journey to rebuilding your credit. To learn how Lexington Law Firm could assist you, contact us today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.)