The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A home equity loan is a lump sum of cash that is repaid with fixed payments during a set period, while a home equity line of credit is a flexible loan that allows you to borrow and repay multiple times up to the maximum amount agreed on by the lender.

A home’s equity is a key advantage of owning a home. However, you can only access it when you sell your home, take out a home equity loan or take out a home equity line of credit (HELOC).

Using either a loan or line of credit can be helpful if you need to access a sum of money with favorable rates or low fees. There are some key differences to consider when it comes to choosing which one is best for you. Take a look at our guide below to learn about the differences between both home equity loans and home equity lines of credit.

Home equity loan vs. line of credit

There are a handful of similarities between these options, including:

- Collateral: Your home is used as security for lenders in the event you cannot pay back the loan.

- Equity: Both options borrow against the value of the home you actually own, known as your home’s equity. We’ll go into more detail about how to calculate this later.

- Second mortgage: These options are commonly referred to as second mortgages since you’re borrowing against the value of your home.

- Tax deductible: Interest payments for either option are potentially tax deductible if the loan is used to improve or remodel your home.

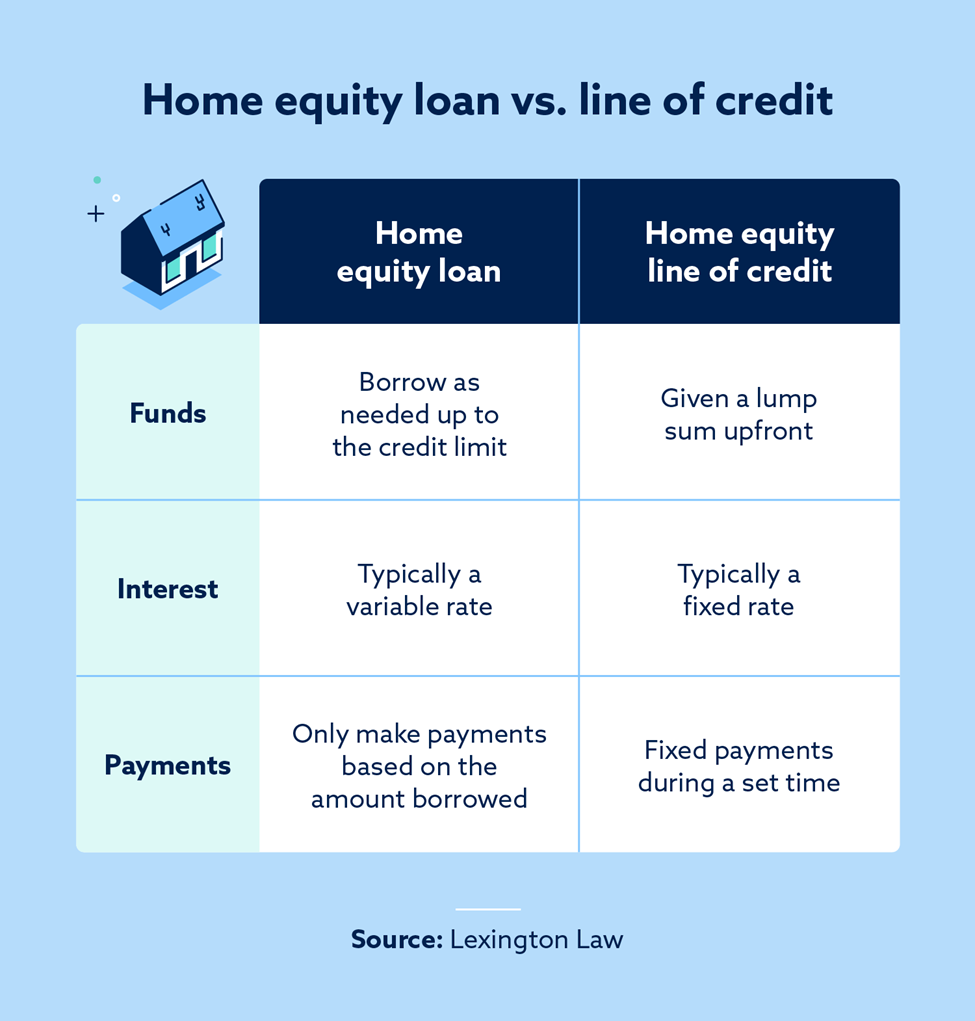

Here are the key differences between both:

| Home Equity Loan | Home Equity Line of Credit | |

| Funds | Borrow as needed up to the credit limit | Given a lump sum up front |

| Interest | Typically a variable rate | Typically a fixed rate |

| Payments | Only make payments based on the amount borrowed | Fixed payments during a set time |

What is a home equity loan?

A home equity loan is a lump sum of cash that is repaid with fixed payments during a set period. It works similarly to other loans except the loan amount is based on your home equity.

How does a home equity loan work?

A home equity loan may be a good option for those who have large one-time expenses like a home renovation project.

Some also use a home equity loan to wipe out a large amount of debt since it’s sometimes more affordable to get a lump sum like this using a home equity loan compared to other loans. However, its affordability in comparison to other options is heavily reliant on an individual’s financial situation.

This option is also great for borrowers who prefer consistent terms and want a predictable payment plan.

Home equity loans pros and cons

Home equity loans are a consistent option that can make it easier to predict your monthly budget. They’re also great if you need funds up front for a large expense. However, you can end up paying a lot, especially in the beginning, since you are paying interest on the entirety of the loan.

Pros

The biggest benefit of a home equity loan is its predictability. Below are a few other benefits to using home equity loans.

- In some instances, it has a fixed interest rate.

- It has fixed monthly payments.

- There is a set payment period.

- It’s an amortizing loan, meaning payments reduce the loan balance and cover some interest costs.

Cons

Home equity loans fall short in their inflexibility and potentially high long-term costs. Here are a few other drawbacks to consider:

- There are high interest costs in the beginning since you’re borrowing a large sum.

- You may pay more than your home is worth if your home loses value over time.

- If you end up not needing such a large loan, then you’ll end up paying more.

What is a home equity line of credit (HELOC)?

A home equity line of credit is a flexible loan that allows you to borrow and repay multiple times up to the maximum amount agreed on by the lender, similar to a credit card.

How does a home equity line of credit work?

This option may be more appealing for those with expenses that occur in stages. For example, you may want to use a HELOC for something like college tuition when you don’t know how much aid you’ll receive from other financial sources. With HELOCs, you have the flexibility to only borrow what you need.

A major difference to note between home equity loans and HELOCs is that HELOCs typically have a “draw period” and a “repayment period.”

- The draw period is the time in which a borrower can access the funds. You’re able to continually borrow and repay during this time, up to the maximum allowed amount. During the draw period, borrowers are required to pay at least the monthly minimum payment.

- The repayment period is right after the draw period. This is the time during which borrowers are required to pay back the outstanding balance.

HELOCs are also great for borrowers who don’t want to be locked into a long payment plan and don’t want to initially borrow more than what they might need.

Home equity line of credit pros and cons

HELOCs are flexible options that allow you to borrow only what you need when you need it instead of dispersing the entire amount. This way you only pay interest on what you borrow, but you’ll have variable interest rates as a result.

Pros

HELOCs are great for those who want more flexible payment options. There are a few other benefits to consider with this option.

- You can borrow only what you need.

- You’ll pay interest only on what you’ve borrowed.

- Some lenders offer a fixed-rate loan option that allows borrowers to convert variable-rate HELOC balances into a fixed-rate option.

- Some lenders offer options to delay the repayment period.

- Some lenders offer interest-only periods that allow borrowers to pay only interest for a fixed time.

- Borrowers can keep interest costs low if they carry a small or zero balance.

Cons

Variability with HELOCs comes at a price—you may end up paying higher interest rates depending on when and how much you borrow. Below are some other HELOC drawbacks.

- Interest rates can fluctuate based on the market and result in higher-interest debt.

- Flexible borrowing may entice some to overspend.

- You may need to meet minimum withdrawal amounts and other requirements to borrow.

- Lenders can lower or close your HELOC.

Deciding between a HELOC or home equity loan

Do your research when comparing these offerings with each other and other options to ensure you’re making an informed decision. Here are a few things to consider:

- Interest rates: Although second mortgages generally offer more favorable rates than other loans, the amount lenders offer can vary. This variability increases if you choose a HELOC.

- Fees and penalties: Expenses like closing costs and appraisals can drive up the initial cost of either option.

- Foreclosure risks: Both options put you at risk of losing your home if you’re unable to pay back what you borrow.

You also need to consider your home’s value. You may end up paying a lot more than what your home’s actually worth, depending on market fluctuations and the loan type. Home equity loans may result in higher-interest debt since your rate is locked in from the beginning. If you need to sell your house while you’re using either second mortgage option, you may end up owing more than your home’s worth or end up upside-down on your loan.

You should also consider other types of loans and financing options depending on your needs and financial standing. Work with a trusted mortgage provider or financial provider to help guide you through your decision.

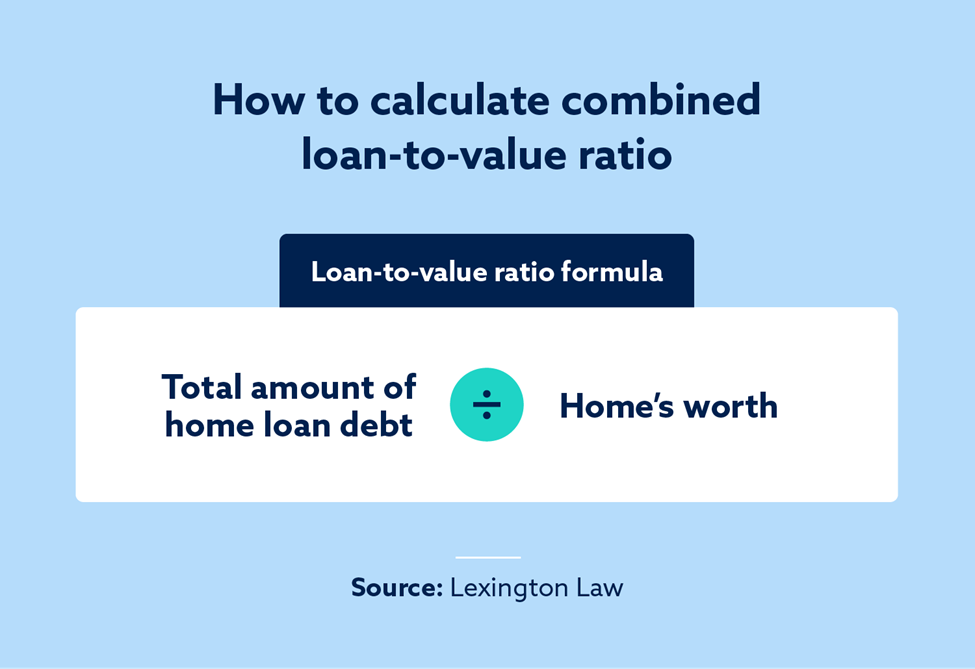

Calculating your home’s equity and CLTV ratio

You can determine your home’s equity by subtracting the amount you currently owe on your mortgage from the value of your house.

Another number you’ll need to know is your combined loan-to-value (CLTV) ratio—a percentage found by dividing the total amount you owe on all home loans by your home’s market value. The lower your CLTV, the lower your credit risk and higher your chances for receiving the loan.

Using home equity loans and HELOCs to stay afloat

Home equity loans and HELOCs are both practical options for cash if you’re tight on funds.

The flexibility of HELOCs may be your best option if you don’t know what the immediate future will look like. You can use funds as you need as long as you’re following the terms from your lender. The rates are typically variable, so you want to ensure you’re always paying at least the minimum payment to reduce the principal and pay down your overall balance.

On the other hand, home equity loans are best if you prefer a lump sum up front and want fixed monthly payments. This may be a better option if you prefer to know what you owe ahead of time.

How using your home’s equity affects your credit

Just as your credit impacts your home equity loan or HELOC, applying for one or both will also affect your credit. Here’s how:

- More credit inquiries: You’ll gather at least one or more hard credit inquiries while you’re shopping around.

- Lowered average credit age: The average age of your accounts will go down when your lender approves your home equity loan or HELOC.

- Potentially better credit mix: Depending on your other credit accounts, a home equity loan or HELOC may positively impact your credit by diversifying your accounts.

- Affects your payment history: Your credit can positively or negatively benefit from your payment history depending on your ability to make on-time payments

Home equity loans and HELOCs affect your credit utilization differently because they fall under different categories of credit.

A home equity loan is installment credit, while a HELOC is revolving credit. Installment credit is not factored into your credit utilization ratio. With a HELOC, however, your available credit increases and your utilization can go up or down depending on what you use and pay back.

You can use your home’s equity to keep up with bills and continue purchasing necessities. However, the long-term effects on your finances and your credit are important factors to keep in mind before making that decision.

Frequently Asked Questions

What is the difference between an equity loan and an equity line of credit?

The key difference between an equity loan and an equity line of credit is that a loan is a lump sum you pay back in fixed monthly payments, while a line of credit gives you a maximum borrowing amount in a set period of time. For lines of credit, you can borrow a variable amount, then pay it back as you use it with variable monthly payments.

Why would a homeowner choose to get a line of credit rather than a home equity loan?

If a homeowner isn’t sure how much money they’ll need to cover their expenses, a HELOC could be a less expensive option. This is because you’re only responsible for paying what you use, rather than being responsible for the maximum amount.

What is the downside of a home equity loan?

A home equity loan is dependable, but if you end up needing less than the amount you’re granted, then you may end up overpaying because you’ll still be responsible for the interest on the full amount of the loan.

What are the requirements for a HELOC or a home equity loan?

For a HELOC or a home equity loan, you’ll typically need:

- 15 percent or more equity in your home

- A history of making payments on time

- A good credit score

- A low CLTV and debt-to-income (DTI) ratio

Lexington Law Firm supports your personal finance goals, offering credit monitoring, personal finance manager access and credit repair support. Whether you’re exploring home equity loans or HELOCs to help you cover expenses, learn if we could help you with your credit.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.