The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

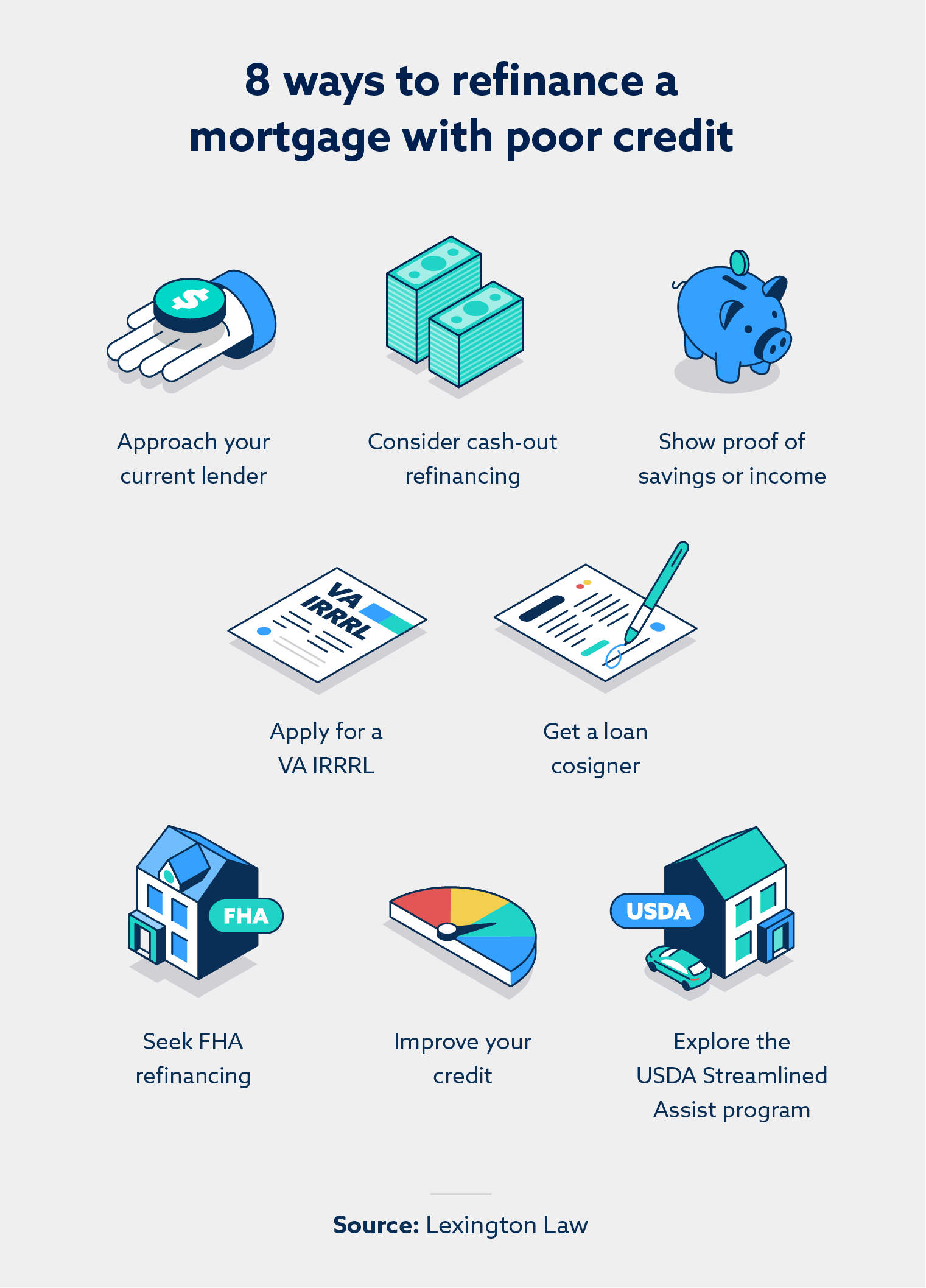

You can refinance your mortgage with bad credit by shopping around for low rates, showing proof of income or savings, getting a loan cosigner, and improving your credit score. Other options include considering cash-out refinancing, applying for a VA IRRRL and seeking FHA refinancing.

Refinancing your mortgage with bad credit is completely possible, but it’s a more complicated process than refinancing with good credit. Because your credit is such a large aspect of any loan application and refinancing process, it’s in your best interest to consider all of your options before moving forward.

Refinancing your mortgage could be a great opportunity to gain some payment flexibility or even take advantage of a lower interest rate. To avoid leaving money on the table, explore the following options for refinancing with bad credit.

How to refinance your mortgage with bad credit

1. Approach your current lender

When approaching your current lender about refinancing your mortgage, it’s important to assess where you stand as a borrower. If you make payments on time and are in great financial health, the lender will most likely want to continue doing business with you. However, if you have been late on payments and are struggling to cover other financial responsibilities, the lender might be more reluctant to refinance your mortgage.

Before approaching your current lender for refinancing options, it’s important to check for other options. To help with any negotiations, you should first check with other banks to see what interest rates are the best. Coming to your current lender after already shopping around for prices will give you more bargaining power to potentially get a lower rate.

2. Show proof of savings or income

If your credit is poor but you have money in the bank, a lender may still offer you a competitive rate. Showing proof of income and savings is a good option for new borrowers with short lending histories. For lenders, any proof that a borrower will be able to make payments toward a mortgage or loan will lower the overall lending risk and make a positive impact on the terms of the refinancing agreement.

If you don’t have a large amount of savings in the bank, you can still demonstrate you’ll make payments on time and carry through with your mortgage agreement by showing proof of income. If you have a well-paying job or have sufficient income coming in, a lender will be more likely to offer a good refinancing option to you. Even without money in the bank or good credit, showing proof of income demonstrates that you are financially stable enough to make payments on the loan.

3. Get a loan cosigner

If you have poor credit and don’t have sufficient money in the bank to lower your overall risk, you can use a loan cosigner. A cosigner shows the validity of an agreement and essentially promises to pay any debts that are outstanding if the borrower cannot pay. Depending on your financial situation, it can be difficult to get someone to agree to be your cosigner. As such, you should only approach people you’re close with.

4. Improve your credit

Before visiting your lender to inquire about mortgage refinancing options, you should first look at your credit report to determine ways you can build your credit. If your credit report is full of negative items like late payments, hard inquiries and delinquent accounts, there could be some areas you could make some improvements. By submitting challenges, sending letters, and making phone calls to the major credit agencies, you can work toward getting better credit. There are also companies that offer credit repair solutions that can get help you on your credit repair journey.

In addition, you can work to make payments on time and in full and reduce your credit utilization ratio. Steps like this can have a long-term positive effect on your credit.

5. Consider cash-out refinancing

Cash-out refinancing is a mortgage refinancing option ideal for people who owe less than their house is worth. It’s important to note that a cash-out refinancing option trades your current loan for a cash payment and a larger loan. Lenders can typically refinance a loan for up to 80 percent of the current market value.

Equity is earned on a home when its market value price increases over the price that you paid for it. Earned equity is normally cashed out with the sale of a home, but it can also be tapped into with cash-out refinancing.

The largest disadvantage to a cash-out refinance is the equity loss of your investment. Although the amount of money between what you currently owe and what your house is valued can be a sizable help for short-term debts, you will still be accountable to pay back the new and larger loan in the long term.

6. Apply for a VA IRRRL

If you have an existing mortgage guaranteed by the U.S. Department of Veterans Affairs (VA), you can apply for an Interest Rate Reduction Refinance Loan (IRRRL) to help decrease your monthly payments.

You’ll need to meet the following requirements to qualify for the IRRRL:

- You have an existing VA loan.

- You’re refinancing your VA loan.

- You can prove that you live or have lived in the home you’re refinancing.

If your current mortgage isn’t a VA loan, but you qualify for one, consider a VA-backed cash-out refinance to replace your current loan. Keep in mind that you must meet the service requirements to be eligible for a VA loan.

7. Seek FHA refinancing

The Federal Housing Administration has a number of refinancing options built to help homeowners with existing FHA secured loans. Unfortunately, the streamlined refinancing is not available for loans that originated outside of any Federal Housing Administration secured lenders. One benefit of refinancing through the FHA is credit or income checks are not part of the process.

If your mortgage is secured with the FHA, there are some prerequisites for the refinancing program as listed below:

- You are up to date on payments and have not missed or been late on a payment for the past year.

- You have owned the house for over six months.

- You use an FHA-approved lender or an FHA-approved bank when refinancing.

If you’re still unsure if you qualify, the FHA mortgage portal includes a step-by-step guide that can give you an estimate of your best refinancing options available.

8. Explore the USDA streamlined assist program

The U.S. Department of Agriculture (USDA) Streamlined Assist program is a great option for borrowers with bad credit since there isn’t a minimum credit score required. To qualify, you must have an existing USDA direct or guaranteed loan and made on-time payments for the prior full year. Even if your home is no longer in an eligible rural region, you may still qualify for the streamlined assist program.

Should you refinance your mortgage if you have bad credit?

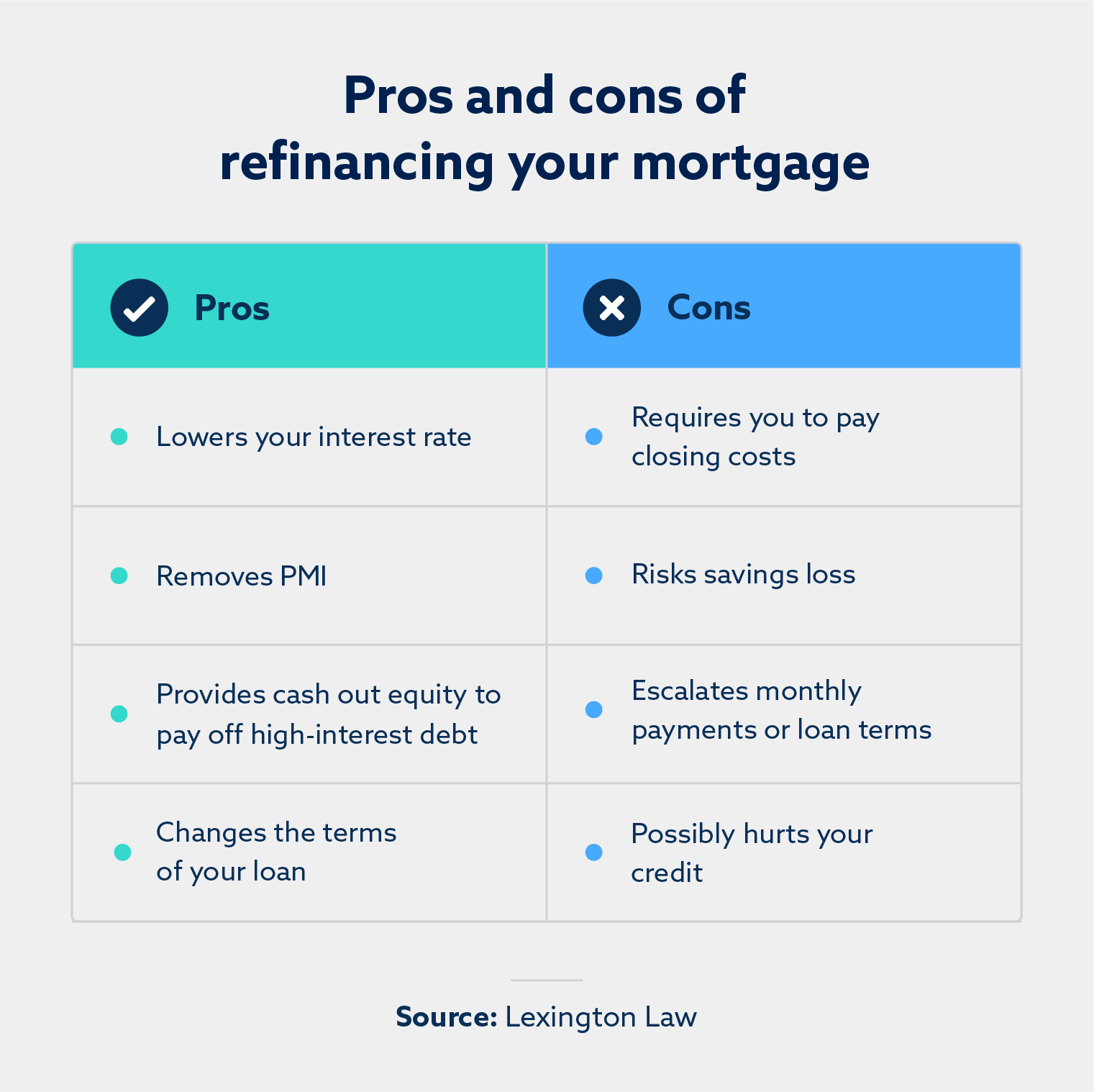

You may be weighing whether you should refinance now, or wait until your credit improves. Below, we’ve listed some pros and cons to consider if you’re thinking about refinancing your mortgage with bad credit:

Pros of refinancing

- Lowers your interest rate: In the event that interest rates have declined since you first got your mortgage, refinancing can help you obtain a better interest rate that saves you money long-term.

- Removes private mortgage insurance (PMI): If you provide a down payment that’s less than 20 percent of your home’s value, you’re required to get private mortgage insurance (PMI) that protects the lender in the event you miss payments. Most lenders require PMI until you have 20 percent equity. If your home has significantly risen in value since you took out your original mortgage, then you may have surpassed the PMI threshold.

- Provides cash-out equity to pay off high-interest debt: A cash-out refinance allows you to take out a larger mortgage that gives you access to the difference in cash. This money can be used to pay off high-interest debt or fund other expenses.

- Changes the terms of your loan: You have the option to refinance to a shorter or a longer loan term based on your current financial needs.

Cons of refinancing

There are always risks that come with refinancing your home. Below are some downsides to take into consideration when weighing whether or not to refinance:

- Requires you to pay closing costs: Most refinancing processes require some sort of fee for processing the request. Depending on your situation, that’s something to consider.

- Risks savings loss: Just like refinancing at any other time, there is no guarantee of savings, and many people end up in the same spot or with a loss in savings due to increased rates or loss of certain benefits.

- Escalates monthly payments or loan terms: For example, refinancing a 30-year to a 15-year mortgage will likely cause your payment to increase. On the other hand, refinancing from a 15-year to a 30-year mortgage will extend the amount of time you’re making payments.

- Possibly lowers your credit: Lenders will review your credit report as part of the application process, resulting in a hard inquiry, which may cause your credit score to temporarily take a minimal hit. Additionally, closing your original mortgage may impact the length of your credit history, which makes up 15 percent of your FICO credit score.

What credit score do you need to refinance?

The credit score you need to refinance your mortgage may depend on the type of loan you have. Some loans, like a FHA refinance, require a significantly lower credit score compared to other loans, like a USDA refinance.

In the chart below, we’ve compiled a list of loan types and the minimum credit score required to qualify.

| Loan type | Minimum credit score |

|---|---|

| Conventional refinance | 620 |

| FHA refinance | 580 |

| VA refinance | No minimum credit score, but many lenders require at least 620 |

| USDA refinance | No minimum credit score, but many lenders require at least 640 |

| Jumbo refinance | 700 |

| Cash-out refinance | 620 |

How to improve your credit before a refinance

Alternatively, you may want to improve your credit before refinancing your mortgage. Consider implementing the following tips to work on your credit over time:

- Review your credit report: First, read your credit report and look for any errors. If you notice any inaccurate information, send a challenge to the credit bureaus. You can get a copy of your credit report for free at AnnualCreditReport.com.

- Create a budget: Take note of your income and expenses and create a plan for how much money you expect to spend per month. Look for ways to reduce expenses.

- Build an emergency fund: Oftentimes, people who live paycheck-to-paycheck rely on credit cards for unplanned expenses. Instead, consider putting in place an emergency fund to help keep you on track during unforeseen circumstances.

- Lower your credit utilization ratio: Your balance divided by your credit limit is your credit utilization ratio. VantageScore recommends keeping it under 30 percent.

- Pay your bills on time: For both the FICO and the VantageScore scoring models, payment history is the most significant factor in determining your credit score.

- Consider credit repair services: If you’re struggling to fix your credit on your own, you can hire credit repair professionals to help you address inaccurate negative items that are impacting your credit.

In the end, there is no one-size-fits-all answer to whether or not you should attempt to refinance your home. We recommend reaching out to an advisor who can evaluate your individual situation. If you’re worried about your credit hurting your chances of refinancing, try a free credit assessment to learn more about your credit and how credit repair could help you.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.