Although credit and debit cards are easier and safer than using cash, Americans still have some anxieties when it comes to using their cards online or in public. Credit and debit card processing systems are still not perfect, creating opportunities for scammers to commit fraud. In fact, in 2017 alone $905 million was lost to fraud in America, sparking fear in many. With 32 percent of Americans having experienced fraud in 2017, it is a growing concern on the top of many Americans’ minds.

We surveyed over 2,000 people and found that theft and fraud is the leading fear when owning a credit card and found that:

- 1 in 3 Americans are afraid to use their credit cards online, even though using a debit card instead of a credit card can leave you more vulnerable to information hacking.

- Only 20 percent fear overspending on their credit card, even though 1 in 5 Americans currently have more credit card debt than savings.

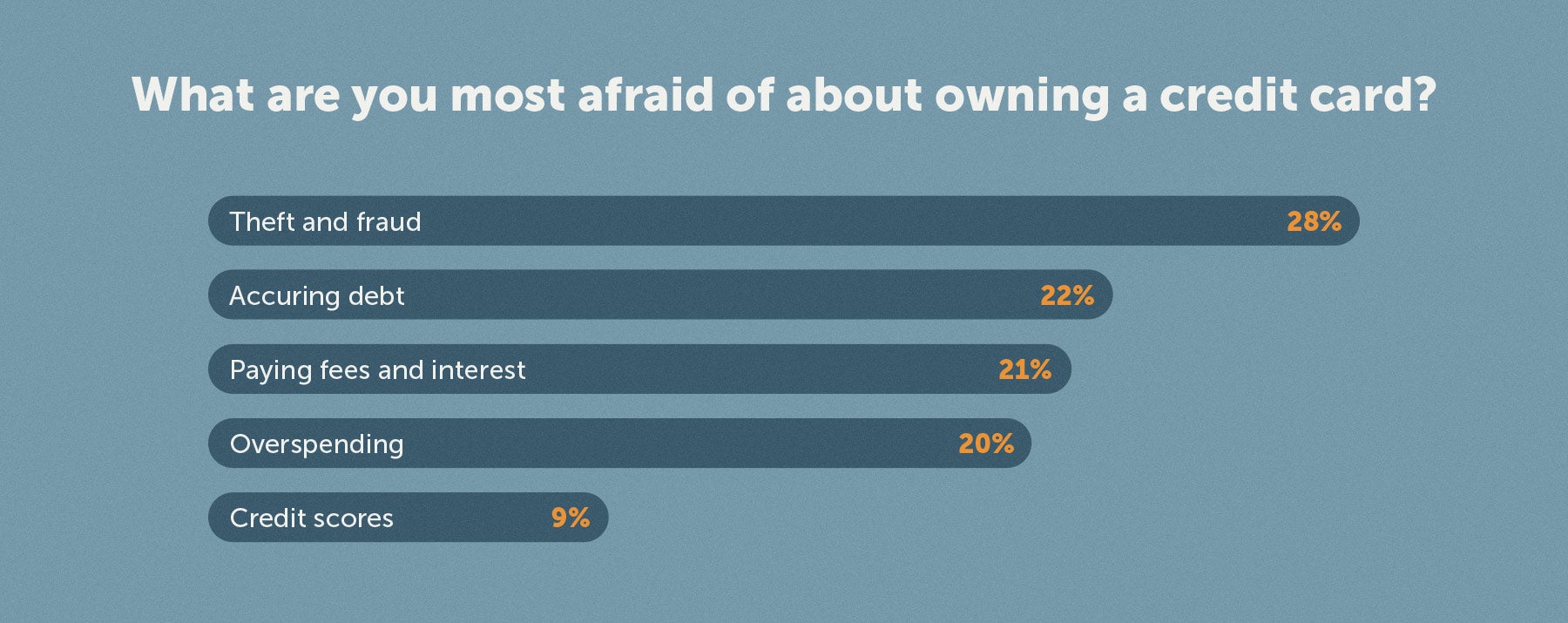

What are Americans most afraid of about owning a credit card?

As 70 percent percent of Americans have credit cards and an even higher percentage have debit cards, we set out to find out what part of credit card ownership Americans fear the most.

The leading fear of credit card ownership is theft and fraud, accounting for 28 percent of Americans surveyed. However, the remaining results are split with 22 percent afraid of accruing debt, 21 percent afraid of fees and interest, and 20 percent afraid of overspending.

As the average American holds a credit card debt of $6,354, it is not surprising that 22 percent of Americans fear going into debt. Credit card debt is a large issue in the United States as the total amount reached $834 billion in December 2017.

Of those who say accruing debt is their biggest fear, 55 percent were men compared to 45 percent of women. According to a National Debt Relief survey published in 2015, 66 percent of women carry credit card debt compared to 33 percent of men, suggesting women likely fear debt less because it more common for them.

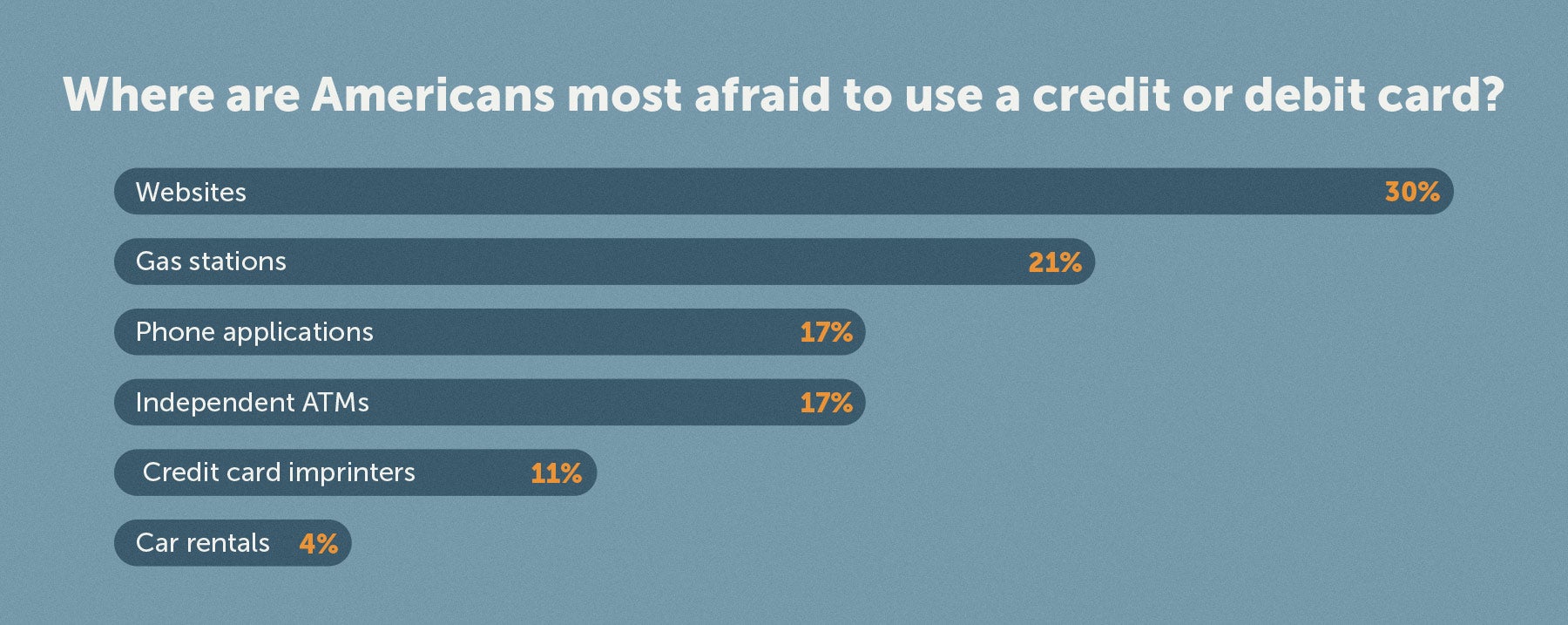

Where are Americans afraid to use a credit card?

As Americans’ largest fear of owning a credit card is theft and fraud, we wanted to find out where Americans are the least confident when swiping their card. Our poll found that online websites are the leading area where Americans are afraid to use their card, with gas stations coming in second.

Although online establishments have become easier to navigate and have tighter security protocols, America is still facing a large online fraud problem. America saw a 40 percent rise in online account takeovers in 2016 from 2015. Online credit and debit card fraud is still the primary leader in all types of fraud because no physical card is needed to complete a fraudulent transaction.

36 percent of millennials reported that websites are the number one place they are afraid to use a credit or debit card. Considering 67 percent of Millennials preferring to shop online, it’s surprising to hear that nearly 1 in 3 fear using this payment method online.

Second to paying for items online, paying at the pump is 21 percent of Americans largest fear when using a credit or debit card. With new credit card shimming and skimming technology on the rise gas pumps are an easy target for scammers to steal credit card information. Americans age 18–24 and 35–44 years old are among the highest age group to report paying at the pump as their largest fear, a surprising statistic given

As Americans spend more and more money using credit and debit cards it is important for industries to tighten down security and focus on the consumer. As an online business, it is crucial for the American consumer to have a checkout system that provides confidence in security. With 22 percent of Americans fearing debt when owning a credit card, it is also up to the consumer to keep better track of their spendings to reach financial success.

If collections or unpaid credit card debt has negatively affected your credit, contact Lexington Law. We’ve helped our clients remove over 10 million negative items from their credit reports.

You can also carry on the conversation on our social media platforms. Like and follow us on Facebook and leave us a tweet on Twitter.