The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

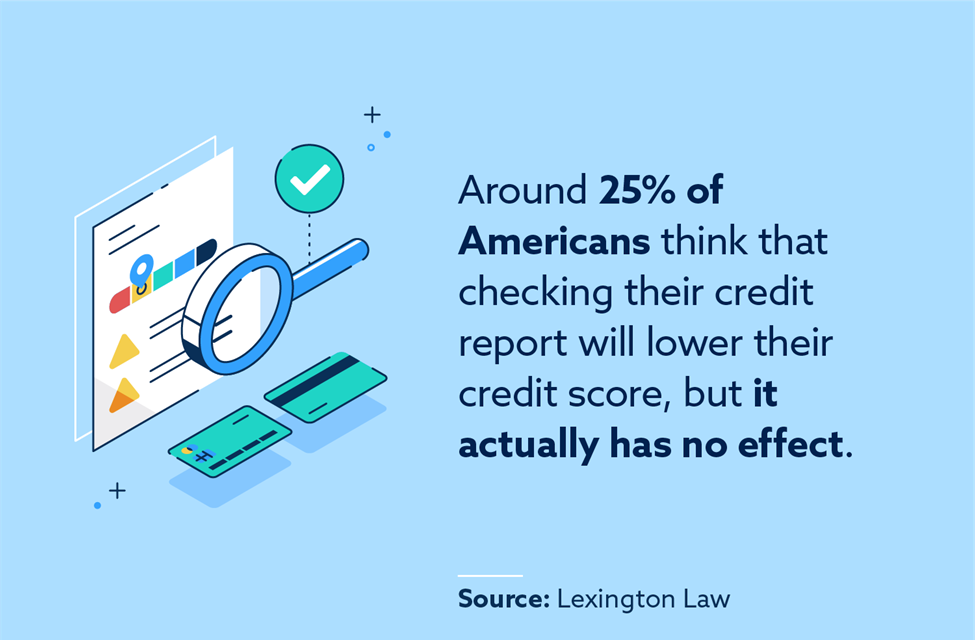

Around 1 in 4 Americans incorrectly think that checking their credit report will cause their credit score to drop.

Very few of us receive any formal credit education, so our credit knowledge is often a piecemeal collection of information we’ve heard from various sources. Whether we pick up our understanding of credit from friends, family, coworkers or the internet, it’s likely that most of us believe some half-truths about how credit works.

We conducted a credit knowledge survey to determine how much Americans know about their credit reports and scores (see methodology below). While average credit scores are going up across the country, many people’s scores are still being held back by long-standing myths and misunderstandings.

Here are our key findings:

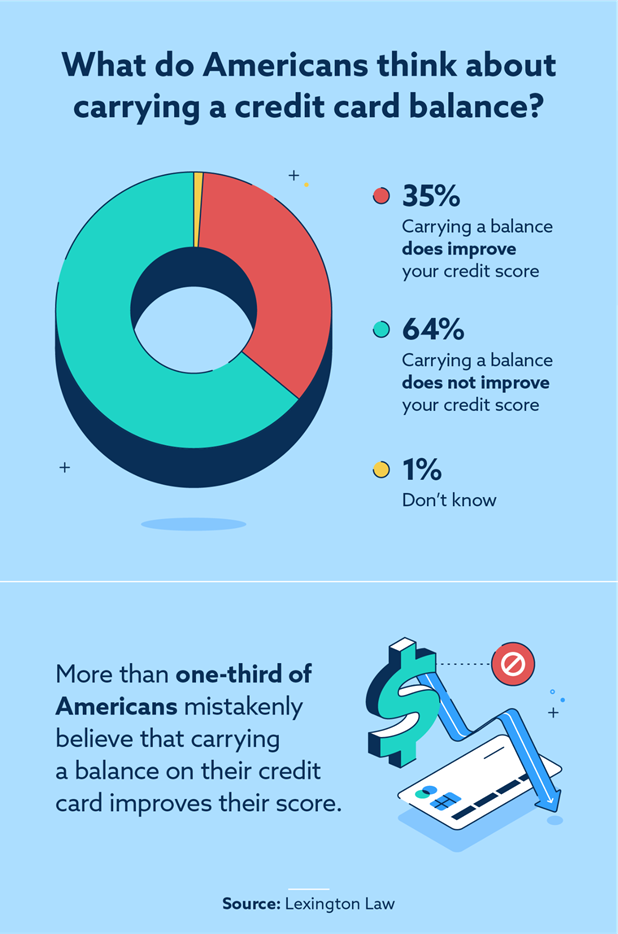

- More than 1 in 3 Americans mistakenly believe that carrying a balance on a credit card will improve their credit score.

- Around 1 in 4 Americans incorrectly think that checking their credit report will cause their credit score to drop.

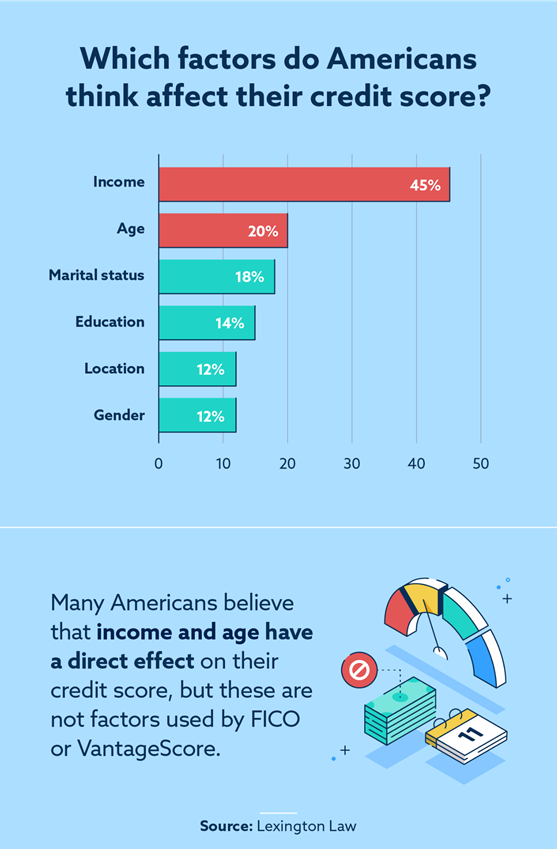

- Almost half of Americans inaccurately assume that their income has a direct effect on their credit score.

Read on to learn more about all of our findings.

Methodology

Note: This survey was conducted for Lexington Law Firm using Google Consumer Surveys. The sample consisted of a minimum of 1,500 responses per question. Post-stratification weighting was used to ensure that the general population is represented accurately by the results of this survey, which was conducted in October 2021.

More than 1 in 3 Americans think carrying a credit card balance improves their credit score

Many people have heard the advice that carrying a small balance on your credit card every month will help your score over time—but, in fact, it is more likely to lower your score.

Like many misconceptions, this one evolved out of a misunderstanding of the truth. You may know that three credit bureaus—TransUnion®, Experian® and Equifax®—compile information about your credit usage to determine your credit score. If you don’t use any credit, such as credit cards or loans, then you won’t have any credit history to report. This means that you need to strike a balance—use you credit enough to build up a history, but don’t use it more than you feel comfortable.

However, carrying a credit card balance from month to month will not help your credit score. That’s because the top two factors in determining your score are your payment history and credit utilization ratio, so failing to pay your credit card bill won’t reflect well on your credit usage. Lenders prefer to see two things: first, that you make all of your payments in full and on time, because that means you’re more likely to pay them if they offer you new credit, and second, that you don’t use too much of your available credit.

Despite the fact that carrying a credit card balance every month is detrimental to credit scores, more than one-third of Americans believe it will help them build credit. If we could end this myth once and for all, millions of people would save money on credit card interest payments and likely see their credit improve as well.

What you need to know: Carrying a credit card balance does not improve your score, and it could actually lead to a score decrease. Paying your full balance every month is a solid strategy for increasing your credit score.

1 in 4 Americans believe that checking their credit report will lower their credit score

Regularly accessing your credit report is an important way to keep on top of your credit usage, but many people have been led to believe that viewing their own report will harm their credit score. In fact, viewing your credit report is not only completely free but also has no negative effects on your score.

It’s likely that so many people believe this myth because they misunderstand inquiries. An inquiry, which is also called a credit pull, appears on your credit report whenever your credit report is accessed. Some inquiries, called hard inquiries, occur when you are applying for new credit, like a loan or a credit card. Hard inquiries can stay on your report for up to two years, and can have a negative effect on your credit report.

However, checking your own credit report and score does not lead to a hard inquiry, so there shouldn’t be any effect on your credit score at all. All Americans are entitled to one free credit report from each of the three credit bureaus annually by visiting AnnualCreditReport.com. This website is safe and free, and checking your report there will help you keep on top of your accounts, balances and payment history.

Although checking a credit report can help make managing credit easier, 25 percent of Americans have been mistakenly led to believe that they’ll risk harming their credit score by doing so. We’re hopeful that promoting education about credit reports will dispel this myth, enabling millions more Americans free access to credit information that will help them make better choices when it comes to their credit usage.

What you need to know: Checking your credit report won’t hurt your score, but it will help you stay on top of your credit. The “hard inquiries” that you’ve heard about that drop your credit score occur when you apply for new credit and a lender checks your credit history.

Nearly half of Americans think their income directly affects their credit score

Even the most savvy credit users are often a bit unsure about exactly what factors affect credit scores. After all, shouldn’t factors like education or income play a role in determining your score? In truth, the credit bureaus don’t have information about your income, education, age, marital status, geographic location or gender—so none of these have any impact on your score.

The most common credit scoring models are provided by FICO® and VantageScore®, both of which have published their scoring factors online for everyone to view. FICO reports that its model uses payment history, account balances, average age of credit, new credit and credit mix to determine its scores. VantageScore has similar factors, though it weights them slightly differently.

Neither scoring model, however, directly includes income or age in its calculations. So why do so many people believe that these play a role in their credit score?

- Having a higher income could help someone get a higher credit limit, but they may also spend more money. Since your score is largely based on your payment history and how much available credit you use, you could still have an excellent score even with a lower income.

- Being older could increase the average age of your credit. However, an older person who has only recently started using credit or routinely closes old accounts could actually have a lower age of credit than someone far younger. Regardless of your age, you can achieve an excellent credit score by using credit regularly and responsibly over time.

Still, nearly half of Americans believe that income directly affects their credit score, and almost one-fifth of Americans think that age and marital status have a direct effect as well. Meanwhile, more than 1 out of every 10 Americans think that education, geographic location or gender affect their scores—but none of these factors are used by scoring models.

Let’s make one thing clear: regardless of who you are and how much money you make, you can achieve a great credit score. The formula is, in fact, quite simple. Use 30 percent or less of your total available credit limit at any given time to keep your utilization ratio low, pay your bills on time and in full every month, don’t open too many new accounts all at once and don’t close old accounts unless you absolutely need to.

What you need to know: Income, age, marital status, geographic location and other demographic or employment information does not directly affect your credit score. While having a longer credit history or a higher credit limit could indirectly affect your score, it’s possible to get a high score no matter how old you are or how much money you make.

Credit knowledge is key for financial success

We conducted this survey because we believe that understanding credit is key to financial success. While financial wellness involves many different aspects—a job that pays enough, a savings strategy and a retirement plan, for example—credit helps support a positive financial experience in many ways.

Things like securing a mortgage or getting great rates on an auto loan, for instance, depend heavily on having a reasonable credit score. And a good score is within reach for most people, but understanding how credit works is crucial to using it successfully.

As you work to build your own understanding of credit, we have plenty of resources to help you.

Read some of the information below to find out more about topics that you’ve always wanted to understand.

- What are the credit bureaus?

- What’s a good credit score?

- How can you improve your credit score?

- What happens if you don’t pay a collection agency?

- Why did your score drop after paying off debt?

- How can credit repair companies help you improve your score?

With so much credit knowledge at your disposal, you’ll be ready to tackle credit responsibly—handling loans and credit cards with ease and potentially seeing your credit score rise in turn.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.