Salary is clearly a touchy topic for many, in fact, only one in five Americans would ask a friend their salary, but this is one taboo that just isn’t serving us. Openly discussing money, whether it’s with a financial advisor or just a friend, has been shown to boost financial literacy and as a result, money management skills. Our tight-lipped culture is doing little to help us become better with our finances.

Additionally, people don’t really understand what a “fair” pay is. A recent study shows that even one-third of people who are being paid above the market rate believe they’re underpaid. This may come as no surprise in a consumer culture that focuses on spending on material goods to attain a certain lifestyle. However, even 17 percent of those paid below the market rate believe they’re paid at or above it.

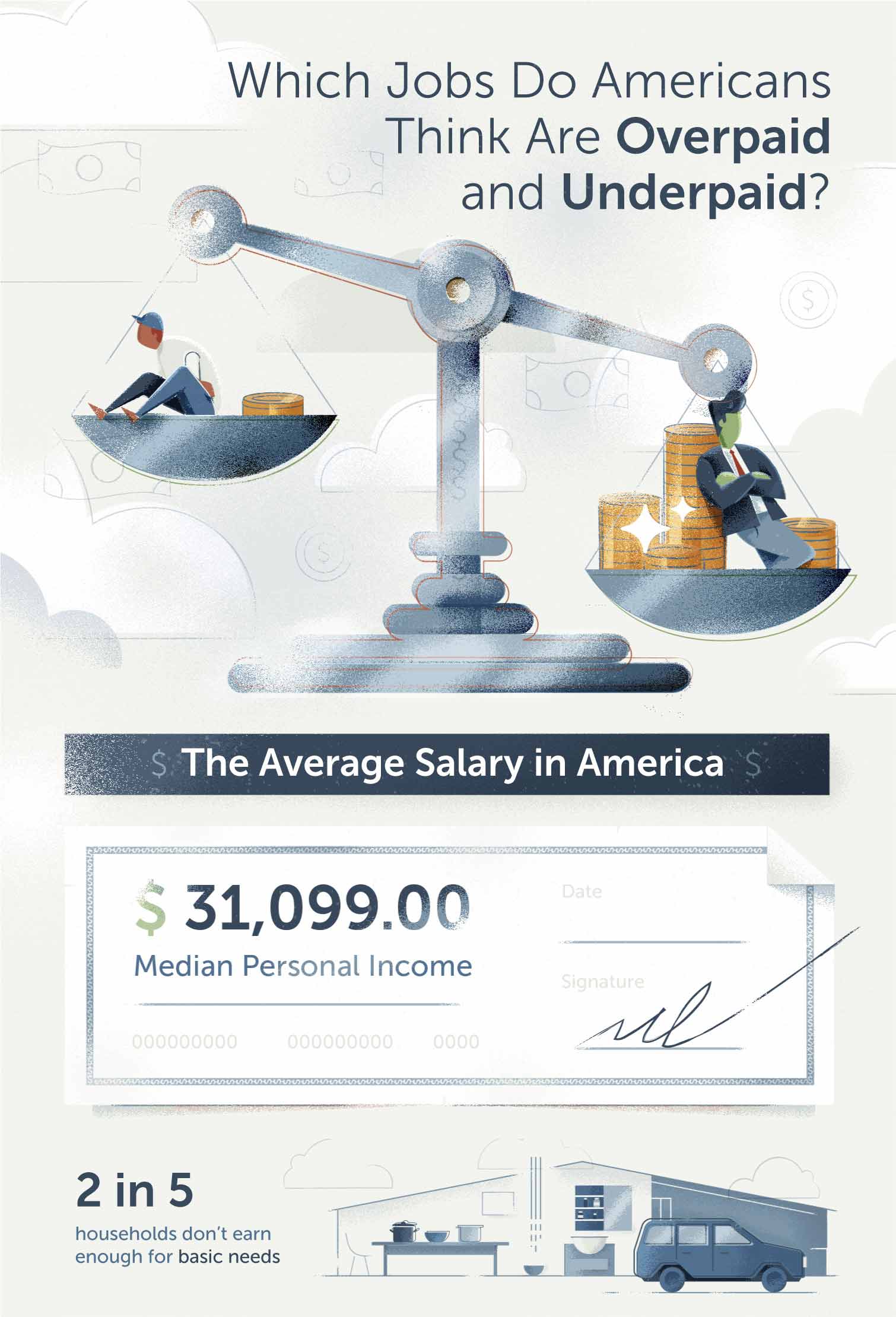

While studies have been done on how Americans perceive their own salary, we wanted to know more about how they perceive other people’s salaries. To determine this, we polled 2,000 Americans about professions that are commonly considered overpaid and underpaid. You can view our analysis below or go straight to the infographic summary.

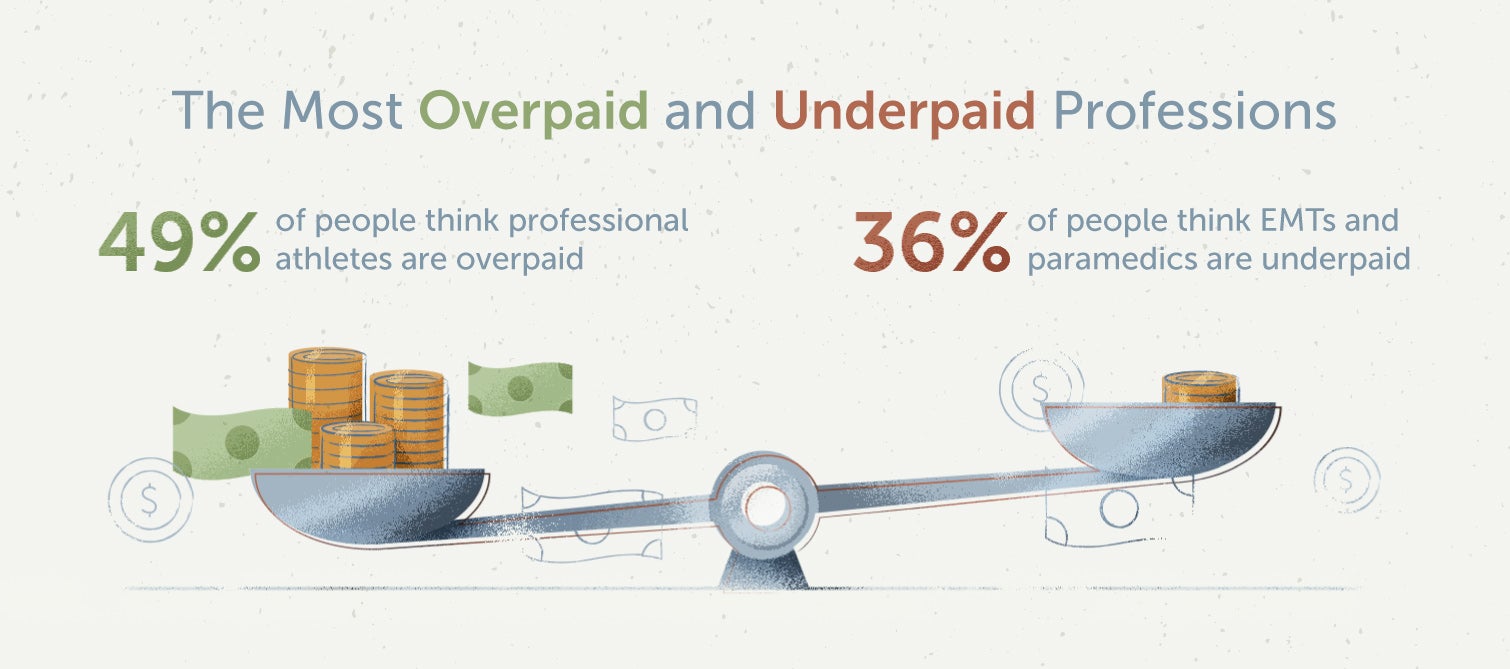

- Paramedics & EMTs ($37k) are considered the most underpaid profession with 36 percent of respondents answering as such.

- Nearly half of respondents feel Professional Athletes ($4m) are overpaid.

- Women are 10% more likely to feel a profession is underpaid.

More people feel that professionals are underpaid than overpaid. Though nearly half of Americans think athletes are overpaid, the majority feel that professionals in the medical, financial and tech fields are paid fairly.

Percentage of Americans who think the following professions are overpaid

- Professional Athletes – 49%

- Chief Executives – 16%

- Lawyers – 11%

- Financial Managers – 11%

- Surgeons – 6%

- Computer Engineers – 5%

In comparison, nearly 1 in 3 people feel that physically demanding jobs (EMTs and agricultural workers) and professions that work with children are underpaid.

Percentage of Americans who think the following professions are underpaid

- Paramedics and EMTs – 36%

- Childcare Workers – 34%

- Agricultural Workers – 31%

- Elementary and Middle School Teachers – 29%

- Waiters and Waitresses – 25%

- Customer Service Representatives – 13%

Women are more likely to feel a profession is underpaid

When compared by gender, both men and women answered virtually the same about professions that are perceived as overpaid, but our survey shows women are 10 percent more likely to feel a profession is underpaid. This is likely because women feel the impact of unfairly low wages disproportionately to men making just $0.80 for every dollar earned by a man in 2016.

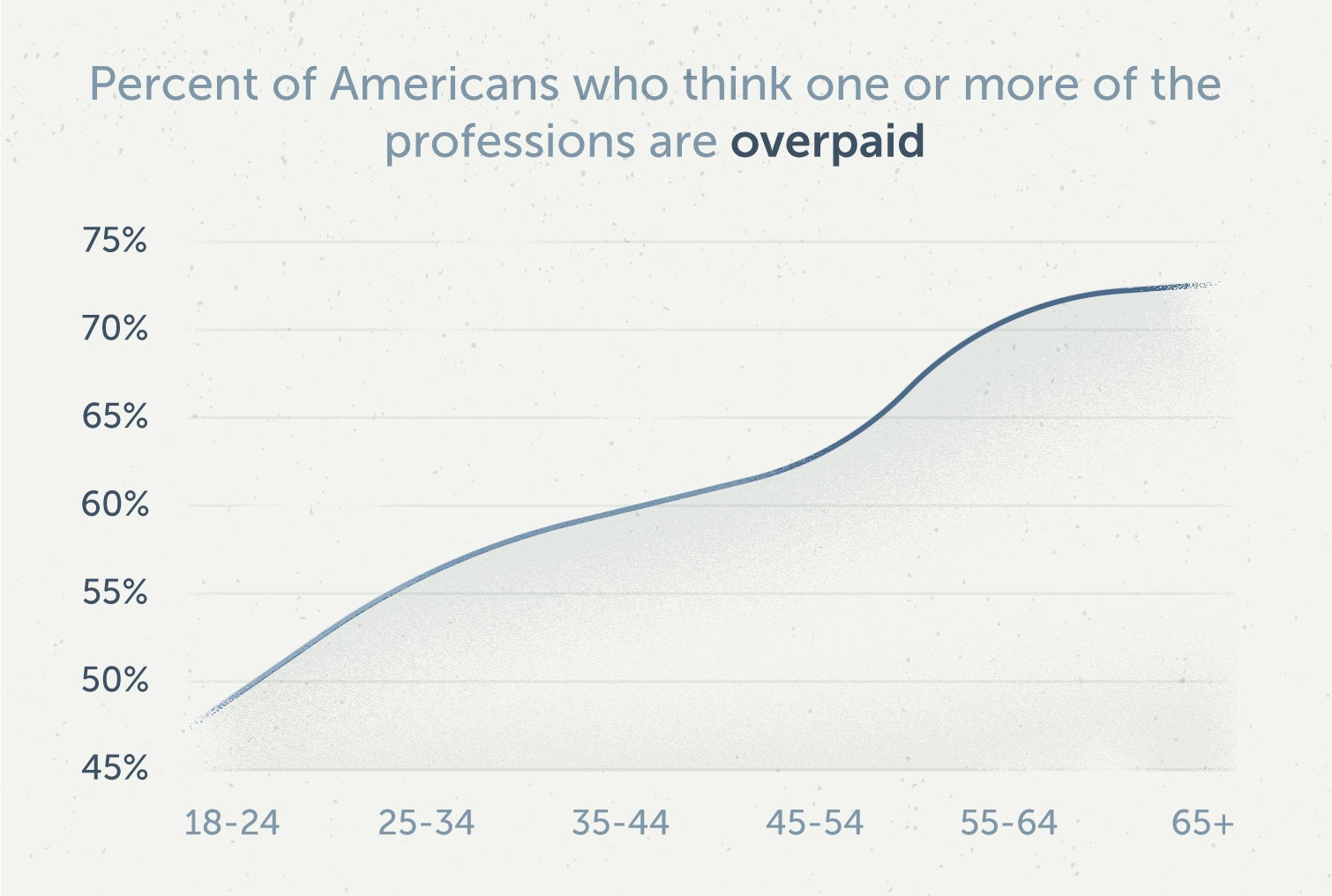

Younger Americans are less likely to think people are being overpaid

Interestingly, age played a big factor in whether respondents felt that the professions were receiving adequate pay. Only 48 percent of the youngest respondents between the ages of 18 and 24, said they believed one or more of the professions are overpaid. Comparatively, 72 percent of those in the 65+ age group responded the same way. Whether it’s a result of being jaded by age or just understanding the workforce better, the trend continues that as age increases the perception of overpaid workers also increases.

Overall, about the same percentage of Americans believe one or more of the professions are overpaid as underpaid. However, with wages for low-income workers falling flat while wages rise for upper-middle and top-income earners, this perception could change over time. The best thing to do no matter what job you have, is to save, make smart decisions with your finances and build your credit over time. Doing so can help set you up for financial success later in life.

Sources: Bureau of Labor Statistics | Society for Human Resource Management 1 | Harvard Business Review | Payscale 1, 2 | Money | Fred Economic Data

You can also carry on the conversation on our social media platforms. Like and follow us on Facebook and leave us a tweet on Twitter.