The information provided on this website does not, and is not intended to, act as legal, financial or credit advice.See Lexington Law’s editorial disclosure for more information.

Although using a credit card can be a good option for building credit, there are other options you can pursue that are equally effective.

Most of the time your credit score is calculated based on 5 factors:

- Payment history – When you’ve made on-time payments, late payments or missed payments.

- Credit utilization ratio – The amount of available credit compared to the amount of credit you’ve spent.

- Length of credit history – How long you’ve had a line of credit open.

- Hard inquiries – How many times an external party has officially checked your credit.

- Credit mix – The variety of credit accounts in your name, like a personal loan, credit card, and home loan.

You build credit mostly by making payments on-time, keeping your debt low, and keeping lines of credit open. None of these things can only be done with a credit card.

Here are five straightforward ways you can build credit without opening a credit card.

1. Become an authorized user

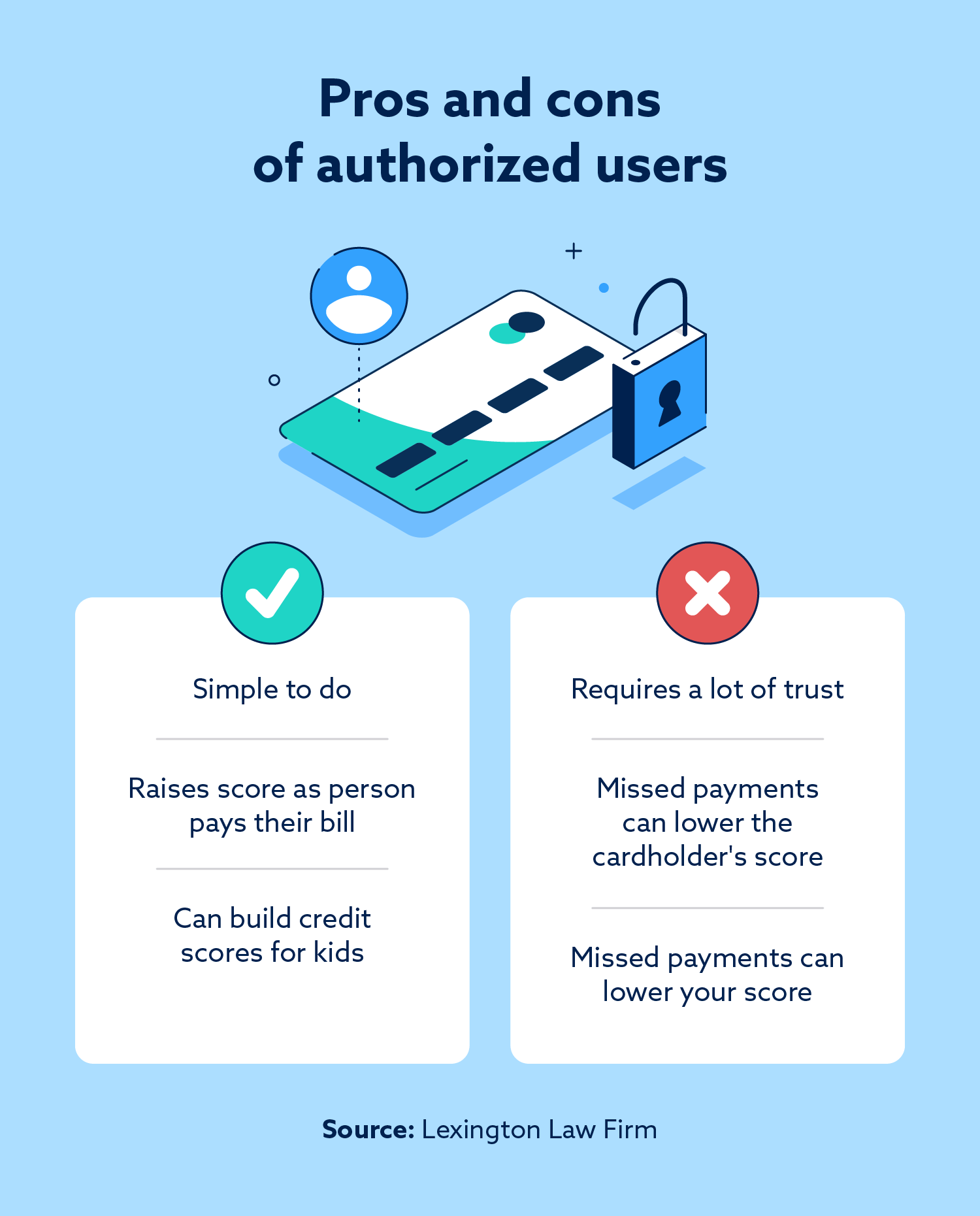

If you can’t or don’t want to get your own credit card, you can still enjoy the benefits of credit cards by becoming an authorized user on someone else’s card. When someone lets you become an authorized user, the credit card is in their name, but you can use it as well. An authorized user can be added without a credit check, so this is a great way to access credit without applying yourself.

Even if you never use the credit card, as an authorized user, you should still get all the benefits (and consequences) of the credit reporting that comes with the card. If the balance is paid on time and the amount spent on the card is kept low (the ideal credit utilization ratio is less than 30%), this can positively build your credit.

However, understand the same is true for negative credit card usage. If the credit card has missed or late payments, your credit will suffer. As an authorized user, make sure you trust the cardholder’s spending habits so you know their activity won’t negatively impact your credit.

Allowing someone to become an authorized user on a credit card is a big request. As an authorized user, you also have the ability to damage the cardholder’s credit.

So, you should have a strong relationship with the cardholder and trust them before you ask them about being an authorized user. Most people turn to a parent or a legal guardian for this request.

If you choose this route, make sure you confirm that the credit card reports activity for authorized users. Some credit cards allow authorized users but don’t report the credit activity for anyone other than the primary cardholder.

2. Take out a credit builder loan

A credit builder loan is structured similarly to other installment loans, like a mortgage, personal loan or auto loan. When you take out the loan, you agree to pay fixed monthly payments.

However, unlike traditional loans, a credit builder loan doesn’t give you access to the cash immediately. Instead, the money is put into a savings account or a CD (certificate of deposit) account. When you’ve paid off the loan, you can access all the cash and interest earned.

As you pay the loan every month, your payments are reported to the credit bureaus. So, if you make on-time payments, you’ll see a positive move in your credit score.

Credit builder loans aren’t commonly offered at traditional banks but can often be found at credit unions. Most often, these loans are between $300 and $1,000 and span from 12 to 24 months. The obvious downside to this option is you don’t get access to the money up front.

Note that credit builder loans aren’t free. You pay interest, which is included in your monthly payment. Generally speaking, credit builder loans have an interest rate between 5% and 16%, depending on the loan’s size and term.

3. Consider another kind of loan

Installment loans are probably one of the most common ways to build credit without a credit card. At some point in their lives, most people will need a car loan, personal loan, student loan or mortgage.

These loans help people fund large purchases, and they can help build credit. Your payment history on installment loans is reported to the credit bureaus and can directly impact your credit rating. You can improve your credit score by building a history of making full, on-time monthly payments on these loans.

Typically, installment loans require a credit check for approval. If you can’t get approved independently, consider asking a parent, partner or family member to cosign the loan with you.

Unfortunately, many of these loans come with high annual percentage rates (APRs), so you shouldn’t take out a loan simply to build credit. Only consider this option if you can afford the loan and need the money for something useful.

4. Make payments on time and in full

If you already have open credit accounts and loans, you must always make payments on time and in full. Every missed or late payment can potentially show up on your credit report and lower your credit score.

Late payments typically don’t show up on your credit report until a minimum of 30 days after you’ve missed a payment. If you miss a payment but can pay it quickly, it might not show up on your credit report. You might, however, incur late fees.

Many creditors who receive a late payment within 30 days of the initial due date refrain from reporting the transgression to the credit bureaus. If you miss a payment by more than 30 days or your lender decides to report you, that one missed payment can lower your credit score by dozens of points. Additionally, you’ll have a negative item on your credit report that can stay there for up to 7 years.

You can ensure you never miss a payment by setting up automatic payments whenever possible. Set up the automatic payment before the payment due date so if something goes wrong, you’re notified and have a few days to fix it.

5. Look into rent or utility reporting

People with thin credit profiles or no credit often turn to alternative credit data to boost their credit ratings. Alternative credit data programs, like Experian Boost, collect credit information from data resources credit bureaus don’t typically examine. These can include data on rent, utility and phone payments.

To go the alternative credit route, you’ll need to sign up for the program of your choice. After that, you’ll have to identify which of your payments can be accepted by the program. For example, if you want to report your rent payments, you or your landlord will have to sign up and report your data.

Not all lenders look at alternative credit data, so you may not see the benefits of this reporting with every lender. Still, this is an excellent way to start building your credit report while simultaneously working to improve your traditional credit data.

Alternative credit works very similarly to traditional credit. If you make on-time payments, your credit rating will increase. However, late and missed payments can be detrimental to your credit health.

If you’re responsible, alternative credit data programs can be very helpful. Experian reports users saw an average boost of 13 points on their FICO 8 credit score after using Experian Boost. However, it’s important to do your research before joining any alternative credit data program.

For example, Experian Boost is free to join and easy to sign up for but comes with some disadvantages. It only works with Experian and can’t help your Equifax or TransUnion scores, and the data is reversed (including the impact on your credit score) when you exit the program.

Work on establishing your credit

Establishing your credit is essential to your overall financial well-being. A solid credit profile can open the door to many opportunities, including loan approvals, lower interest rates and better loan terms. In fact, your credit rating can sometimes aid you or prevent you when getting a lease or a job. Clearly, your credit has a huge impact and should be a priority.

People can have many reasons for choosing to build credit without a credit card. If you know you’re someone who overspends, a credit card might not be a sound financial decision. Instead, consider which of the five options we mentioned above works best for you. Building good credit can take time, but it’s worth the effort.

As you build credit, focus on practicing sound financial habits. Always keep an eye on your payments, and keep your credit utilization low. Check your credit reports and scores regularly to know where you’re at so you can adjust accordingly. If you notice something incorrect on your credit report, consider using Lexington Law’s services for credit repair.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.