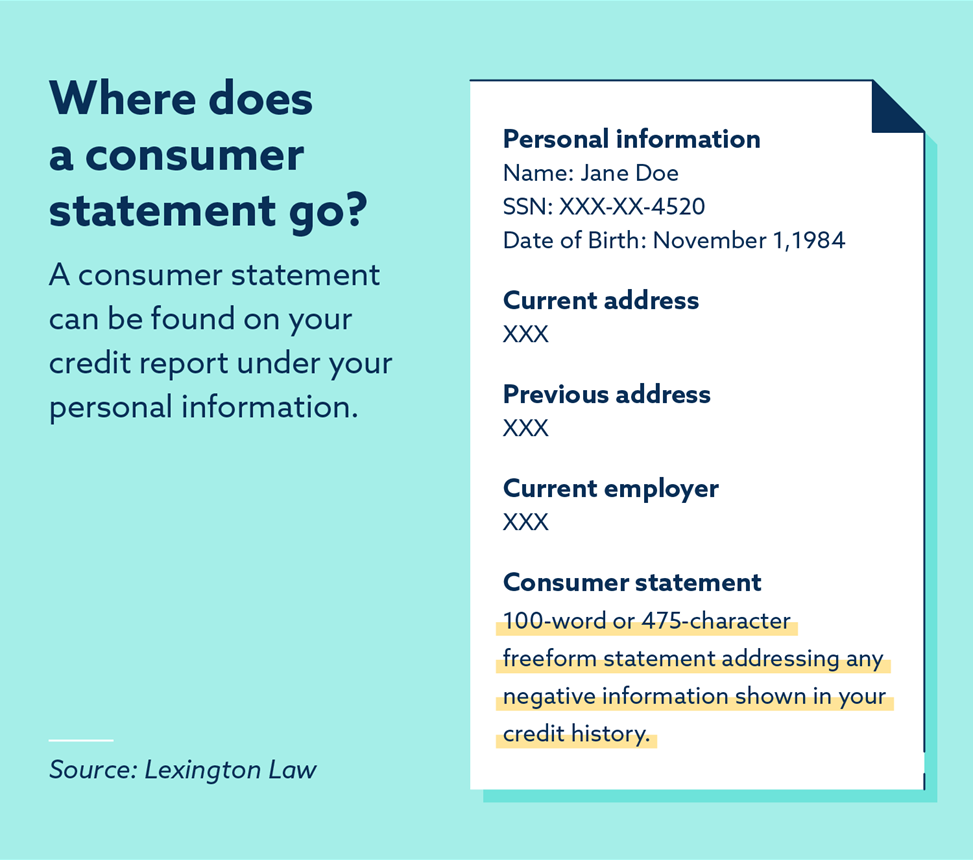

A consumer statement on your credit report is a voluntary 100-word or 475-character statement that provides context to any negative information impacting your credit history.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you’ve experienced financial distress or want to address items on your credit report, you could use a consumer statement to explain derogatory credit information to credit bureaus and potential lenders. While these statements won’t hide negative credit items in your history, they may help answer some questions to reduce lender concerns and give a lender the clarity they need to extend you a line of credit or loan.

If you’re wondering if adding a consumer statement to your credit report is right for you, read on as we outline what a consumer statement is and a few instances where you may need one.

What is a consumer statement on a credit report?

A consumer statement is a voluntary 100-word (200 words for residents of Maine) or 475-character statement that you can add to your credit report to address any negative information shown in your credit history. Once placed, potential lenders may review this statement to help clear up their concerns about your creditworthiness or ability to pay back a loan.

A consumer statement should clearly explain any negative history or discrepancies on your credit report. See an example of a consumer statement below:

“On May 22, 2023, I was laid off from work as a result of the economic downturn. Due to this unexpected job loss, I fell behind on my monthly debt payments. I found employment on Aug. 7, 2023, and I am working to catch up on all missed payments. While my credit rating was in good standing before losing my job, I believe these late payments associated with my [name of creditor] account are not a true reflection of my creditworthiness.”

Once a consumer statement has been added to your credit report, it will be visible to a lender or creditor each time they view it. Once you’ve straightened out the financial situation on your consumer report, you can elect to remove the consumer statement so it no longer shows up on your report.

When to add a consumer statement to your credit report

There are a few reasons why you may consider adding a consumer statement to your report. The first is to provide context for derogatory information on your credit report. For example, if you made a late payment because you lost your job or were dealing with a medical emergency, you could explain these circumstances in the consumer statement.

The second scenario where adding a consumer statement to your credit report would be beneficial is to dispute any errors that may be negatively impacting your credit. For example, if you previously disputed a late payment but disagree with the investigation’s conclusion, you could explain that here.

Remember that adding a consumer statement to your credit report won’t change your credit score, but it could help improve a lender’s confidence in you as a borrower.

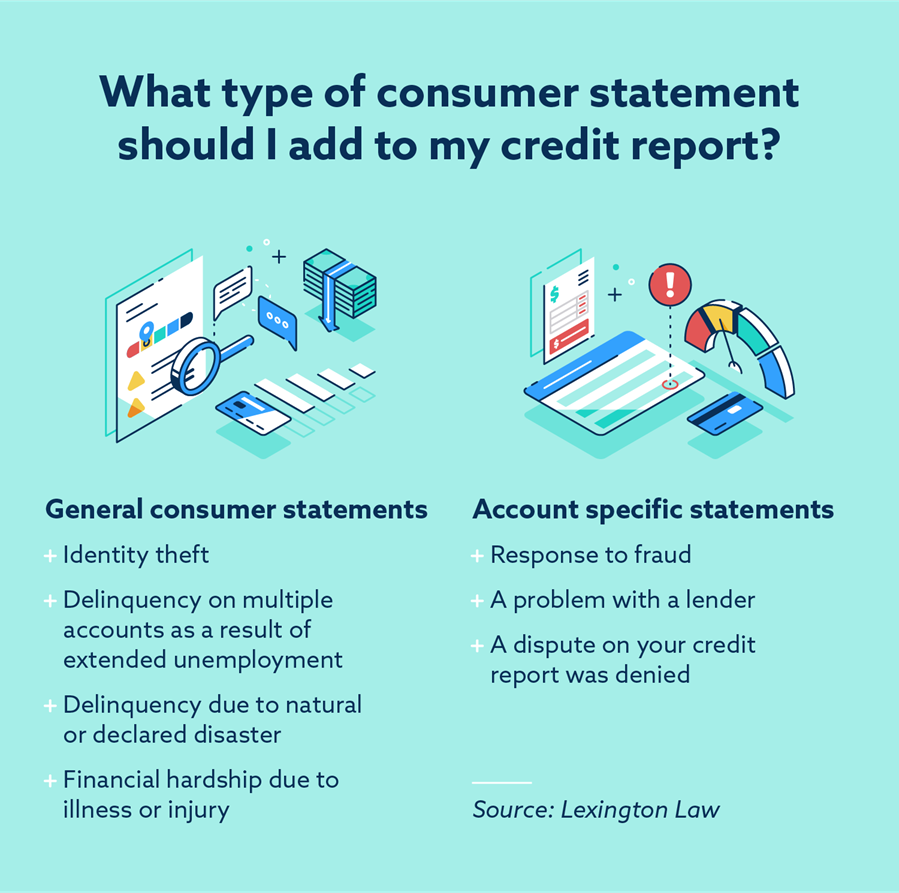

Types of customer statements on a credit report

There are two basic types of consumer statements that can be added to an individual’s credit report:

General consumer statements

These provide background information on your entire credit report, and they can stay on your report for up to two years. An example of when to add a general consumer statement to your report might be after an instance of identity theft or financial hardship due to an illness.

Account-specific statements

These statements apply to individual accounts and can help explain items that may be negatively impacting your credit report. Account-specific statements can remain on your credit report until the accounts they’re associated with are removed. An instance where someone might include an account-specific statement on their report might be to address a late payment due to a mailing or shipping delay.

How do I put a consumer statement on my credit report?

If you’d like to add a consumer statement to your report, you can do so free of charge. You’ll need to write a statement and submit it to your preferred credit bureau at its mailing address or online.

You’ll need to look online or call your credit bureau of choice for instructions on adding a consumer statement to your report, as each bureau may have its own guidelines. For example, Equifax® allows up to 475 characters, while TransUnion® allows up to 100 words.

You can contact each credit bureau via the address or phone numbers listed below:

Equifax

P.O. Box 740256

Atlanta, GA 30374-0256

1 (888) 378-4329

TransUnion

Consumer Solutions

P.O. Box 2000

Chester, PA 19016

1 (800) 916-8800

Experian

P.O. Box 4500

Allen, TX 75013

1 (888) 397-3742

Consumer statement FAQ

Below, we’ve answered a couple common questions regarding consumer statements on credit reports.

Does a consumer statement hurt my credit score?

A consumer statement will not change any accurately reported information on your credit report. However, explaining your financial distress or poor credit history may help a creditor or lender better evaluate your creditworthiness or ability to make payments on time.

Can I remove a consumer statement?

If you take steps to improve your credit, you can elect to remove a consumer statement so lenders and creditors can’t see it on your credit report anymore. It’s best to remove a consumer statement as soon as it is no longer necessary, as it may notify potential lenders that you had a negative credit history in the past and could be a cause for concern when evaluating your creditworthiness. Typically, you can request a removal the same way you submitted your consumer statement to the bureau. If you have any questions, contact the credit bureau directly.

For more insight on ways to improve your creditworthiness, get your free personalized credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.