There isn’t a specific debt threshold you must meet to file for Chapter 7 bankruptcy, but you must meet certain criteria to qualify for it under the means test, which may consider income from the last six months and compares to the median income in your county for your family size.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The world of personal finances can be difficult to navigate, and unexpected events occasionally result in stressful debt. Sometimes people consider declaring Chapter 7 bankruptcy as a way to get some relief from their debts. Chapter 7 is a legal process that can provide a fresh start by discharging certain debts, but it’s essential to understand the requirements and implications.

How much do you have to be in debt to file Chapter 7? Since everyone’s financial history and situation varies, there is no absolute amount required to file Chapter 7—but there are criteria.

In this guide, we’ll cover the factors that determine eligibility for Chapter 7 bankruptcy as well as the benefits of filing, things to consider before you file, alternatives to filing and tips to help you avoid bankruptcy.

Table of contents:

- Signs that filing for bankruptcy could be an option

- How to know if you’re eligible for Chapter 7

- Benefits of Chapter 7

- Things to consider before filing Chapter 7

- Chapter 7 alternatives

- 7 tips to avoid Chapter 7

Signs that filing for bankruptcy could be an option

Filing for bankruptcy is a significant and complex decision that you should base on careful consideration of your financial situation and options. Here are signs that you may be eligible for Chapter 7:

- You’re dealing with an overwhelming amount of debt.

- Bill and loan payments are being missed consistently.

- Creditors are threatening to take legal action, wage garnishment, foreclosure or repossession of your assets.

- You’re facing lawsuits due to unpaid debts.

- Emergency funds and savings have been depleted.

- You’re at risk of losing essential items such as your home or car.

How to know if you’re eligible for Chapter 7

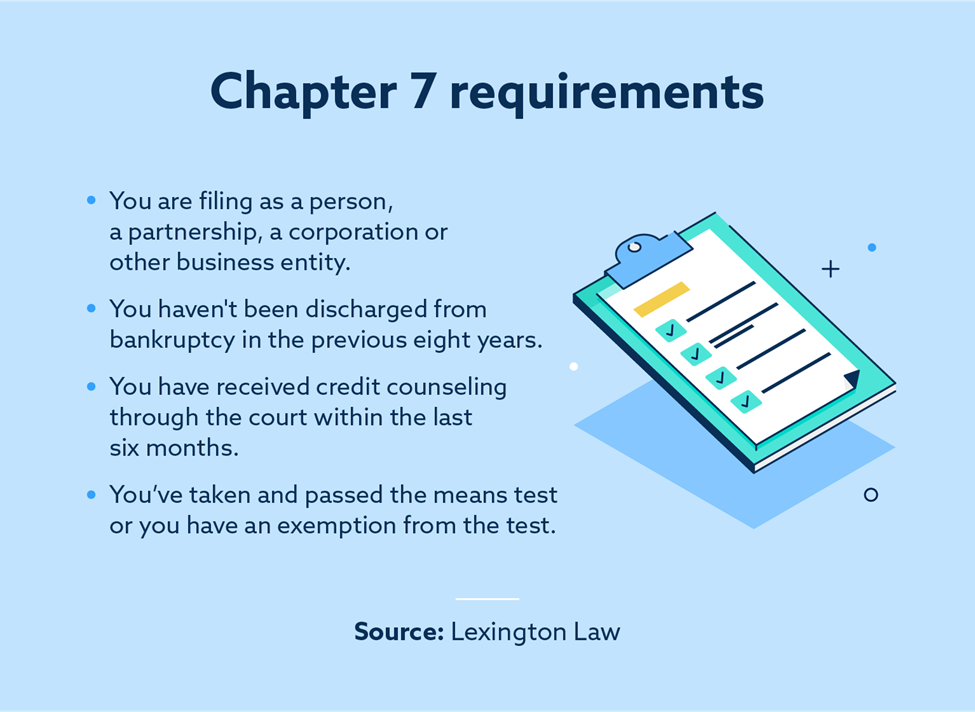

Even though there’s no debt threshold for filing for Chapter 7, there are still other criteria that need to be met to determine if you’re eligible. Here are some key qualifications you likely need to meet:

- You are filing as a person, a partnership, a corporation or other business entity.

- You haven’t been discharged from bankruptcy in the previous eight years.

- You have received credit counseling through the court within the last six months.

- You’ve taken and passed the means test, or you have an exemption from the test.

Learn more about the Chapter 7 means test below.

Chapter 7 means test

During the Chapter 7 means test, your average monthly income over the previous six months is compared to the median income in your county. This test is a crucial factor in determining your eligibility—the court will essentially compare your financial situation to other similar-sized households in your area.

Typically, someone can qualify for Chapter 7 if their income is lower than the state median. If your income is above the median in your state, there are further calculations to determine whether or not you have enough money to pay off your bills under a Chapter 13 repayment plan.

Note: You’ll want to work with an experienced bankruptcy attorney to ensure accurate calculations and proper application of the test to your specific financial situation.

Benefits of Chapter 7

Chapter 7 offers several benefits to individuals overwhelmed by debt and seeking a fresh financial start. Here are some of the key benefits of Chapter 7 bankruptcy:

Potential debt discharge

The primary advantage of Chapter 7 is the potential bankruptcy discharge of most unsecured debts, such as:

- Debt from your credit cards

- Bills from medical-related expenses

- Personal loans

Now that the bankruptcy process is complete, the debtor is no longer legally obligated to repay those discharged debts.

Avoid a lengthy process

In general, the Chapter 7 bankruptcy process is faster than the Chapter 13 bankruptcy process. Filing time for Chapter 7 usually takes around four to five months from the filing of the bankruptcy petition to the discharge of eligible debts.

Obtain automatic stay

An automatic stay is put into place after someone files for Chapter 7 bankruptcy. This action immediately puts a stop to all creditor collection actions, including:

- Foreclosure

- Wage garnishment

- Repossession

- Creditor harassment

Get a fresh start

Chapter 7 bankruptcy provides a clean slate for individuals that are having a hard time keeping up with payments. Once eligible debts are discharged, debtors can work on rebuilding their finances without the burden of old debts.

Relief from unmanageable debt

Chapter 7 bankruptcy is ideal for individuals with little or no disposable income to make regular payments under a Chapter 13 repayment plan. It’s designed to provide relief for those facing severe financial hardship.

Receive financial education

Those filing for Chapter 7 must attend credit counseling before they file and a financial management course before receiving a discharge. These courses can provide valuable financial education and help debtors make more informed decisions in the future.

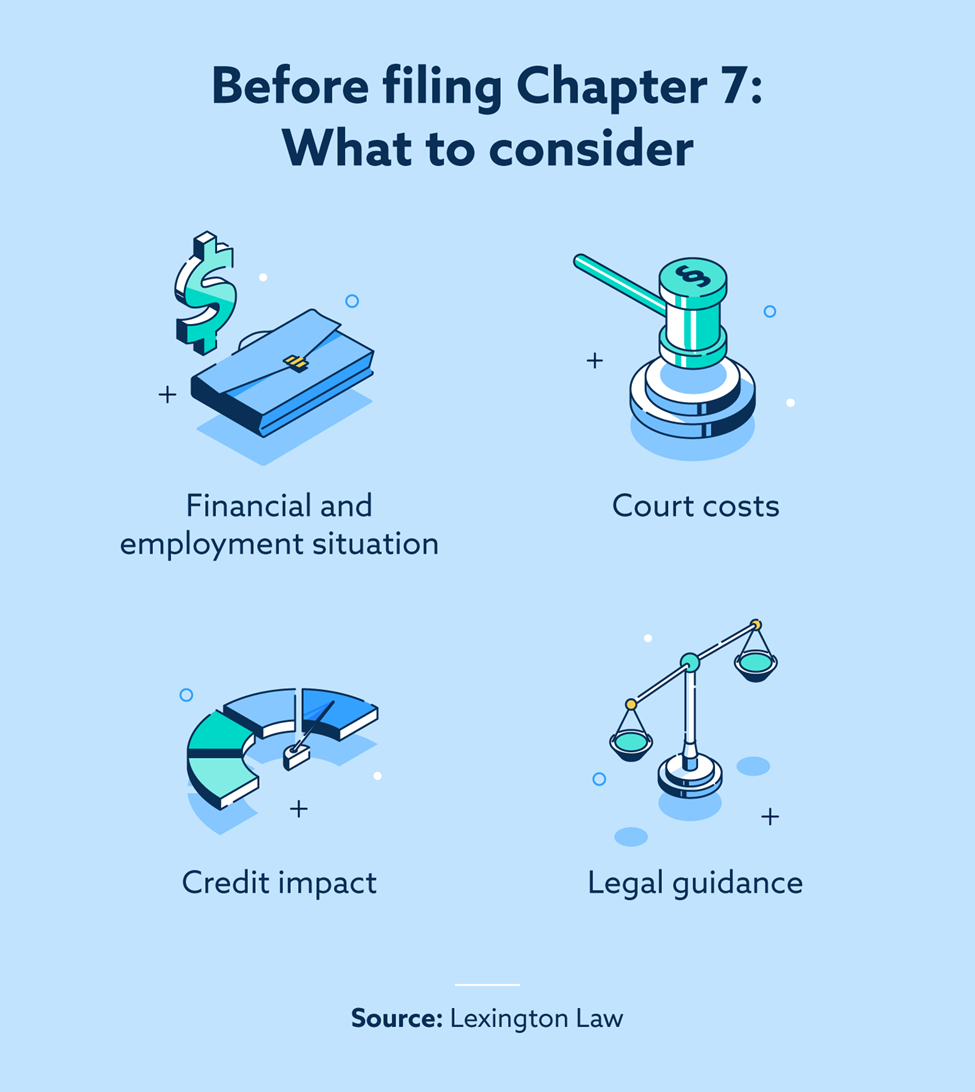

Things to consider before filing Chapter 7

Filing for Chapter 7 bankruptcy is a big financial decision that could have long-term implications. Explore everything you should consider before filing Chapter 7 below.

Financial and employment situation

Evaluate the severity of your financial distress and employment situation. The best candidates for Chapter 7 bankruptcy are often those with excessive unsecured debt and little disposable income to make payments.

Having a hard time keeping up with payments due to unemployment can make you more eligible for Chapter 7 bankruptcy. However, if you’re still struggling to pay your bills while employed, filing for Chapter 7 may help you keep your assets, such as your house and car, by eliminating or decreasing payments on:

- Credit cards

- Medical bills

- Unsecured debts

Court costs

It’s important to factor in the costs to file for bankruptcy, including attorney fees and court filing fees. A court filing fee for a new petition costs around $338. While it might seem like an additional expense, an experienced attorney can help you navigate the process effectively.

Credit impact

Be aware that filing for Chapter 7 bankruptcy could impact your credit negatively. There’s a chance it will stay on your credit report for up to ten years. However, if your credit is already damaged due to missed payments, the impact might not be as drastic.

Legal guidance

Consult with a qualified bankruptcy attorney to discuss your specific financial situation. An attorney can help you consider your options, navigate through the process and make the most informed decision possible. Plus, you could get valuable information about your case that you wouldn’t have thought of otherwise.

Chapter 7 alternatives

Consider investigating other possibilities to resolve your financial troubles before filing for Chapter 7 bankruptcy. Here are several alternatives to Chapter 7 bankruptcy:

Chapter 13 bankruptcy

Chapter 13 is an option for individuals with regular income to restructure their debts. It entails developing a repayment strategy that can last up to five years to progressively repay creditors.

This provides protection from creditor actions like foreclosure and repossession. It allows debtors to catch up on missed payments while keeping their assets. Compared to Chapter 7, Chapter 13 may be a better option if you’re employed and still able to pay down debt but need an extra boost to pay it down.

Debt negotiation and settlement

You might be able to negotiate a lower settlement price for your debts by speaking with your creditors directly or with the assistance of a debt settlement firm. This can lead to reduced payments but could also lead to negative consequences for your credit.

Debt consolidation loan

Taking out a debt consolidation loan to pay off multiple debts can simplify payments and potentially lower interest rates. However, it’s important to be cautious about converting unsecured debt into secured debt (like a home equity loan) that could put your assets at risk.

7 tips to avoid Chapter 7

Avoiding Chapter 7 bankruptcy requires proactive financial management and strategic decision-making. Here are some tips that might help you steer clear of the need to file for bankruptcy:

- Create a budget: Prioritize making a budget for your finances to help lower your risk of debt. Tracking your expenses can be a great way to see areas where you can cut back and use the extra money to pay back debts.

- Pay off debt first: Paying down your debt amount should be the first priority. Consider using the debt avalanche method to speed up the debt repayment process.

- Negotiate with your creditors: If you’re having trouble making payments, contact your creditor to see if you can work out a better deal. They might be open to lowering interest rates, cutting monthly payments or establishing a repayment schedule.

- Start an emergency fund: An emergency fund helps provide padding for you if you are stuck with surprise expenses, which can help you avoid using credit cards or loans.

- Start selling: Sell items you no longer need for extra cash to pay down your debt. Plus, you can clear out clutter in the process.

- Get a side hustle: Consider finding another source of income, like a side hustle or a second job.

- Ask for help: Connect with a financial advisor or credit counselor—they can provide personalized guidance and create a plan tailored to your circumstances.

If you think you may be facing bankruptcy, you may also want to start taking a look at your credit. In this case, consider working with the credit repair team at Lexington Law Firm. They can work with you to address inaccurate items listed on your credit reports, so you can focus on building healthy money habits in the long run. You can also get a credit snapshot that gives you your credit score, credit report summary and repair recommendations for free.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.