The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Revolving credit, like credit cards, allows you to borrow up to your limit and then again once you pay down the outstanding balance. Home, auto and personal loans are installment loans, which means you receive a lump sum that you pay back over a set period.

If you’re one of the millions of Americans who has outstanding debt, it can be helpful to better understand the difference between installment loans vs. revolving credit. Although debt can harm your credit, responsibly managing a mix of installment and revolving debt can help build your credit. Read on to learn more about installment loans vs. revolving credit and how to use them to your benefit.

| Installment debt | Revolving credit | |

|---|---|---|

| Definition | A borrowed lump sum that is paid back over time on a set schedule | A line of credit that enables for spending up to a predetermined limit |

| Examples | Mortgage, student loan, auto loan or personal loan | Credit cards and personal lines of credit |

| Interest rates | Typically fixed when the loan is established | Usually variable, and often higher overall |

| Payments | Consistent monthly payments on a set schedule | Payments vary based on spending |

| Effect on credit score | May increase credit score due to improved mix of credit, payment history and length of credit | Tends to have a larger effect on credit score, and score increases are possible with responsible usage |

What is revolving credit?

Revolving credit allows you to spend up to a certain limit. As you pay down your outstanding balance each month, you can re-borrow up to the credit limit. If you need to borrow more, you can request a credit limit increase. It not only gives you access to more funds, but when used responsibly, it can also help improve your credit by reducing your credit utilization ratio.

When you have a revolving credit account, you can pay the monthly minimum or choose to pay more. Many lenders charge interest, but some lines of credit come with introductory offers, like 0 percent interest for a certain amount of time.

One way revolving credit is different from installment credit is that your account stays open until you close it. As you continue to make your payments and don’t spend more than the limit, you can continue to use your revolving credit.

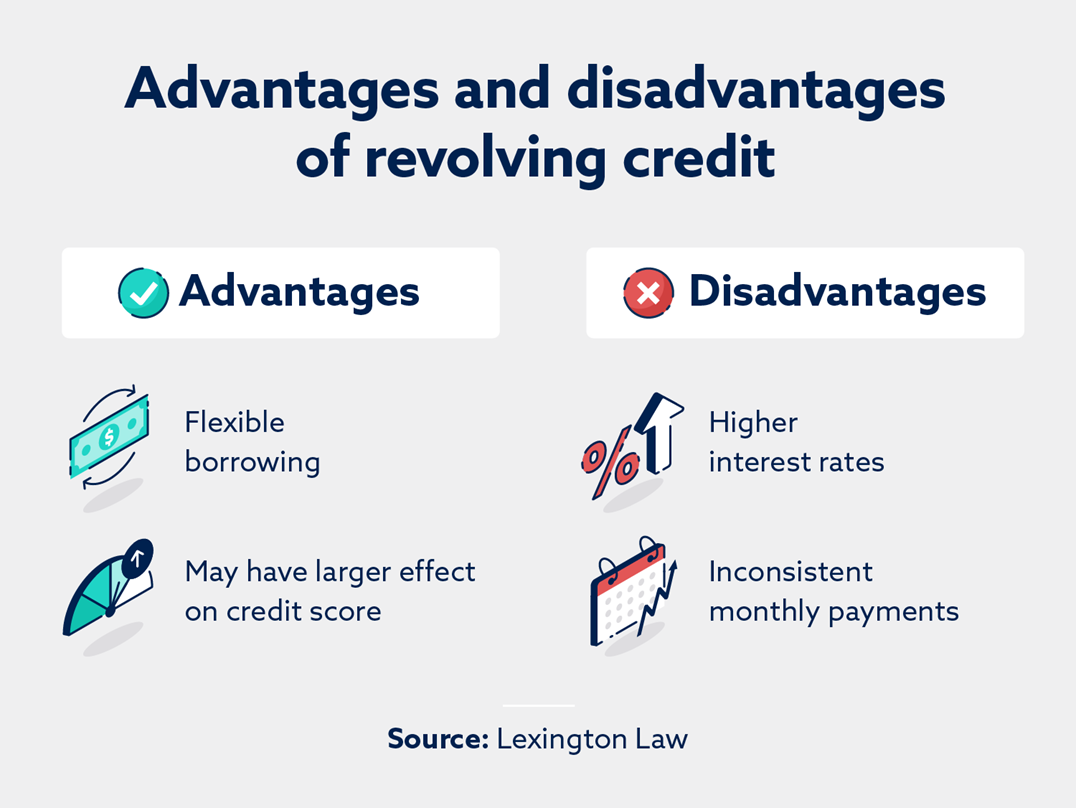

Pros and cons of revolving credit

The biggest benefit of revolving credit is its flexibility, which can also be a downside. You can borrow up to your credit limit, but the ability to increase it may tempt you to overspend and get into debt. Below, we break down some of the additional pros and cons, starting with the benefits:

- Flexible borrowing

- Bigger impact on your credit when paid on time

- Ability to only borrow what you need

- Some credit cards come with periods of 0 percent interest

- Can easily access funds

Some of the downsides to revolving credit accounts include:

- Higher interest rates

- Set borrowing limits

- Due to ease of access, it can be tempting to spend more

- Inconsistent monthly payments due to variable interest

How revolving credit accounts affect your credit

Revolving credit accounts typically affect your credit score more. With the FICO® scoring model, your payment history accounts for 35 percent of your score, and your utilization accounts for 30 percent of your score.

Your credit utilization is the amount you owe vs. your max credit limit. To benefit from this, you should keep your utilization below 30 percent. This is based on the credit limit of all your revolving accounts minus the amount you owe.

For example, if you have two credit cards, one with a $5,000 limit and one with a $3,000 limit, your total limit is $8,000. To stay lower than 30 percent, you would never want to owe more than $2,400. If you opened up a new credit card with a limit of $10,000, you could then spend up to $5,400 (30 percent of $18,000).

What is installment credit?

An installment loan account allows you to borrow a lump sum of money and pay it back in installments. Unlike revolving credit accounts, you have a set amount of money to pay back with interest before the account closes.

There are various installment loans, and you may need additional funds. Rather than increasing the loan amount, you would need to apply for a new loan.

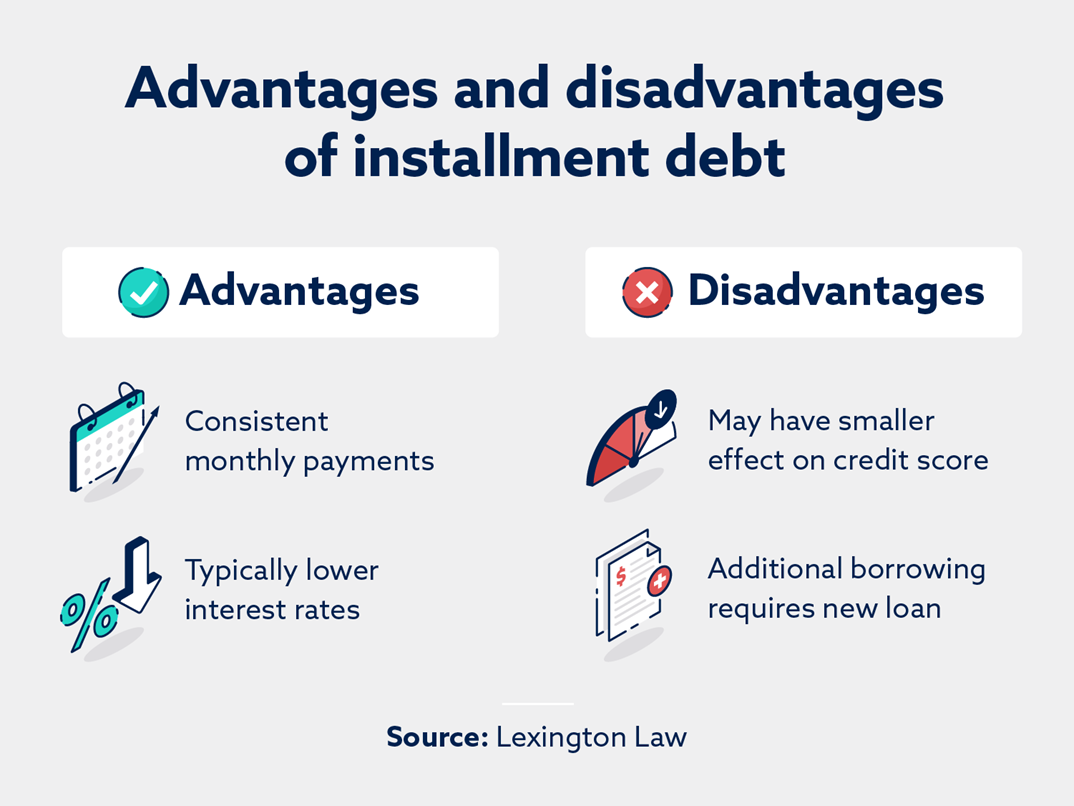

Pros and cons of installment credit

Although credit cards are the most common form of credit, it’s helpful to have at least one installment credit account. One aspect of your FICO® credit score is “credit mix,” which accounts for 10 percent of your overall credit score.

The following are some of the additional benefits:

- Predictable payments

- Lower interest rates

- You can receive a lump sum

- Flexible terms for repayment

Some of the downsides include:

- May not help credit score as much

- Need to apply for a new loan to borrow more

- Stricter qualification requirements

- Some require collateral

How installment credit accounts affect your credit

Those who only open revolving credit accounts are missing out on the benefit of credit mix and improving their credit. Having installment credit accounts like auto or student loans can help improve your credit mix. Installment loans can also help with your credit history if they’re open for a long time, like when you get a home loan.

Similar to revolving credit accounts, you want to make your payments on time each month to improve your payment history. This is a positive signal of creditworthiness to future lenders.

Examples of installment credit

Now that you understand what installment credit accounts are, it can be helpful to see some examples:

- Home loans

- Auto loans

- Student loans

Personal loans are forms of installment credit as well, but you often won’t need to use the funds for a specific purpose. Many people use personal loans to pay for large purchases or expenses, consolidate their debt or pay for home repairs.

Examples of revolving credit

The most common forms of revolving credit accounts include:

- Credit cards. These are the most common form of revolving credit. People typically use credit cards for everyday purchases, and they can also be helpful in an emergency when you don’t have access to cash.

- Home equity lines of credit (HELOCs). If you’re a homeowner, you can use a HELOC to borrow against the value of your home. People often use a HELOC for home renovations and repairs.

- Personal line of credit. A personal line of credit works like a credit card but without one. To borrow the money, you go to your bank or credit union to withdraw money up to your maximum limit.

Can you get approved for revolving and installment credit accounts?

Whether you’re hoping to open a revolving or installment credit account or both, the first step is to have good credit. Good credit not only improves your chances of getting approval but can also help you get lower interest rates, saving you thousands of dollars. To start working on your credit score, first find out what it is. Lexington Law Firm offers a free credit assessment, and if you have errors on your credit report, we provide additional services to challenge them on your behalf. To get started, sign up today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.