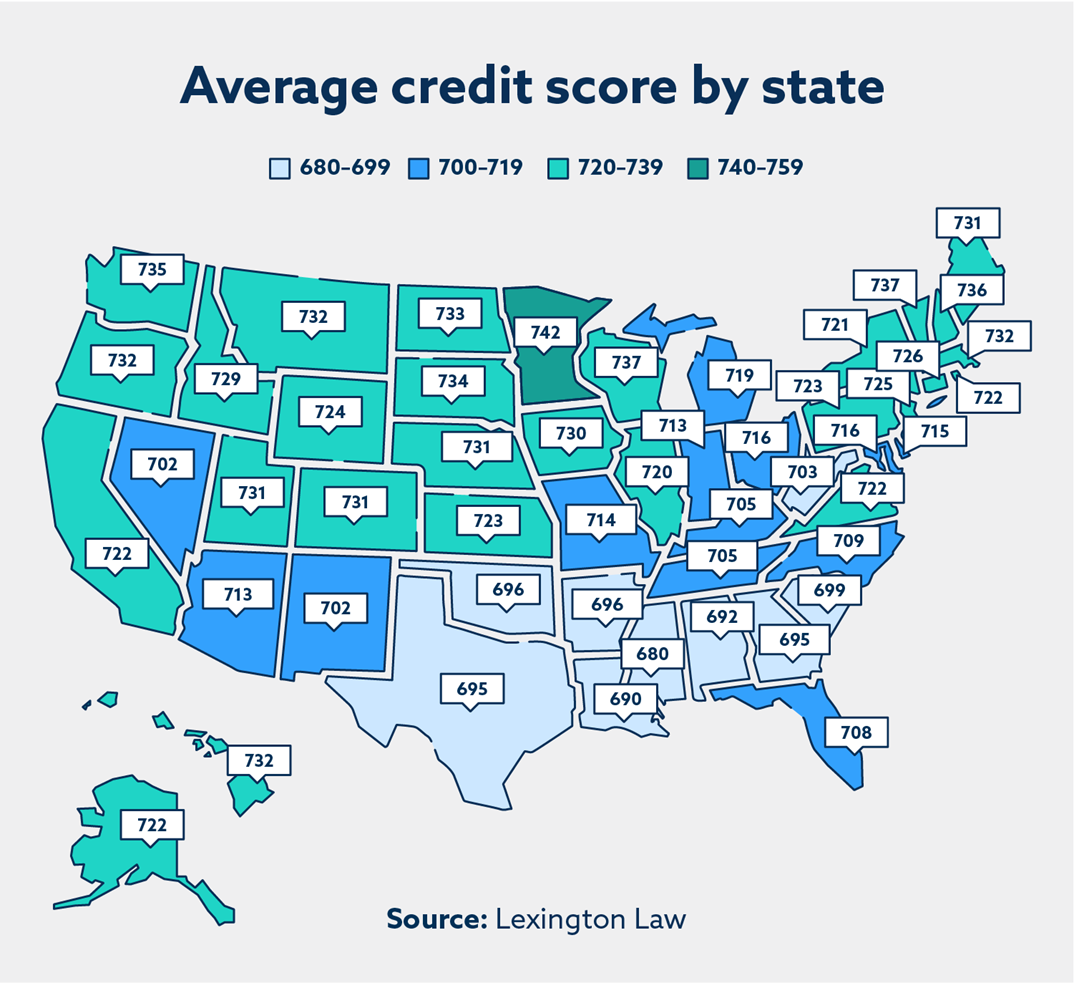

The average credit score of each state ranges from Mississippi’s score of 680 to Minnesota’s 742, and we’ve got details for every state below. Plus, discover helpful tips to improve your credit score no matter what state you live in.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The average credit score by state varies quite a bit — the difference between the highest and lowest average scores is more than 60 points. Minnesota has the highest average score at 742, with Wisconsin (737), Vermont (737), New Hampshire (736) and Washington (735) also in the top five.

The average score of each state ranges from 680 to 742, and we’ve got details for every state below. Knowing the average credit score in your state can help you evaluate your own score and gauge your credit standing relative to the other residents in your area.

Read on to see this data, as well as helpful tips for improving your own credit.

State-by-state average credit scores

The average credit score for each state varies, though most states are within 30 points of the national average score of 717.

Below is a list of the average American credit score by state as well as how the average changed between 2022 and 2023, according to data from Experian®.

| State | Average credit score (2022) | Average credit score (2023) | Change (year-over-year) |

|---|---|---|---|

| Alabama | 691 | 692 | +1 |

| Alaska | 723 | 722 | -1 |

| Arizona | 712 | 713 | +1 |

| Arkansas | 694 | 696 | +2 |

| California | 721 | 722 | +1 |

| Colorado | 730 | 731 | +1 |

| Connecticut | 725 | 726 | +1 |

| Delaware | 714 | 715 | +1 |

| District of Columbia | 716 | 715 | -1 |

| Florida | 707 | 708 | +1 |

| Georgia | 694 | 695 | +1 |

| Hawaii | 732 | 732 | 0 |

| Idaho | 727 | 729 | +2 |

| Illinois | 719 | 720 | +1 |

| Indiana | 712 | 713 | +1 |

| Iowa | 729 | 730 | +1 |

| Kansas | 721 | 723 | +2 |

| Kentucky | 702 | 705 | +3 |

| Louisiana | 689 | 690 | +1 |

| Maine | 728 | 731 | +3 |

| Maryland | 716 | 716 | 0 |

| Massachusetts | 732 | 732 | 0 |

| Michigan | 718 | 719 | +1 |

| Minnesota | 742 | 742 | 0 |

| Mississippi | 680 | 680 | 0 |

| Missouri | 712 | 714 | 2 |

| Montana | 731 | 732 | +1 |

| Nebraska | 731 | 731 | 0 |

| Nevada | 702 | 702 | 0 |

| New Hampshire | 734 | 736 | +2 |

| New Jersey | 724 | 725 | +1 |

| New Mexico | 699 | 702 | +3 |

| New York | 721 | 721 | 0 |

| North Carolina | 707 | 709 | +2 |

| North Dakota | 733 | 733 | 0 |

| Ohio | 715 | 716 | +1 |

| Oklahoma | 693 | 696 | +3 |

| Oregon | 732 | 732 | 0 |

| Pennsylvania | 723 | 723 | 6 |

| Rhode Island | 723 | 722 | -1 |

| South Carolina | 696 | 699 | +3 |

| South Dakota | 734 | 734 | 0 |

| Tennessee | 702 | 705 | +3 |

| Texas | 693 | 695 | +2 |

| Utah | 730 | 731 | +1 |

| Vermont | 736 | 737 | +1 |

| Virginia | 721 | 722 | +1 |

| Washington | 735 | 735 | 0 |

| West Virginia | 700 | 703 | +3 |

| Wisconsin | 735 | 737 | +2 |

| Wyoming | 723 | 724 | +1 |

Over the past year, credit scores remained the same or increased by just one point in most of the 50 states, although some states saw a decrease of a point. The average increase was one point, though some of the states saw a slightly larger increase. The biggest increases were in Kentucky, Maine, Oklahoma, South Carolina, New Mexico, Tennessee, and West Virginia, where the average scores increased by 3 points in one year.

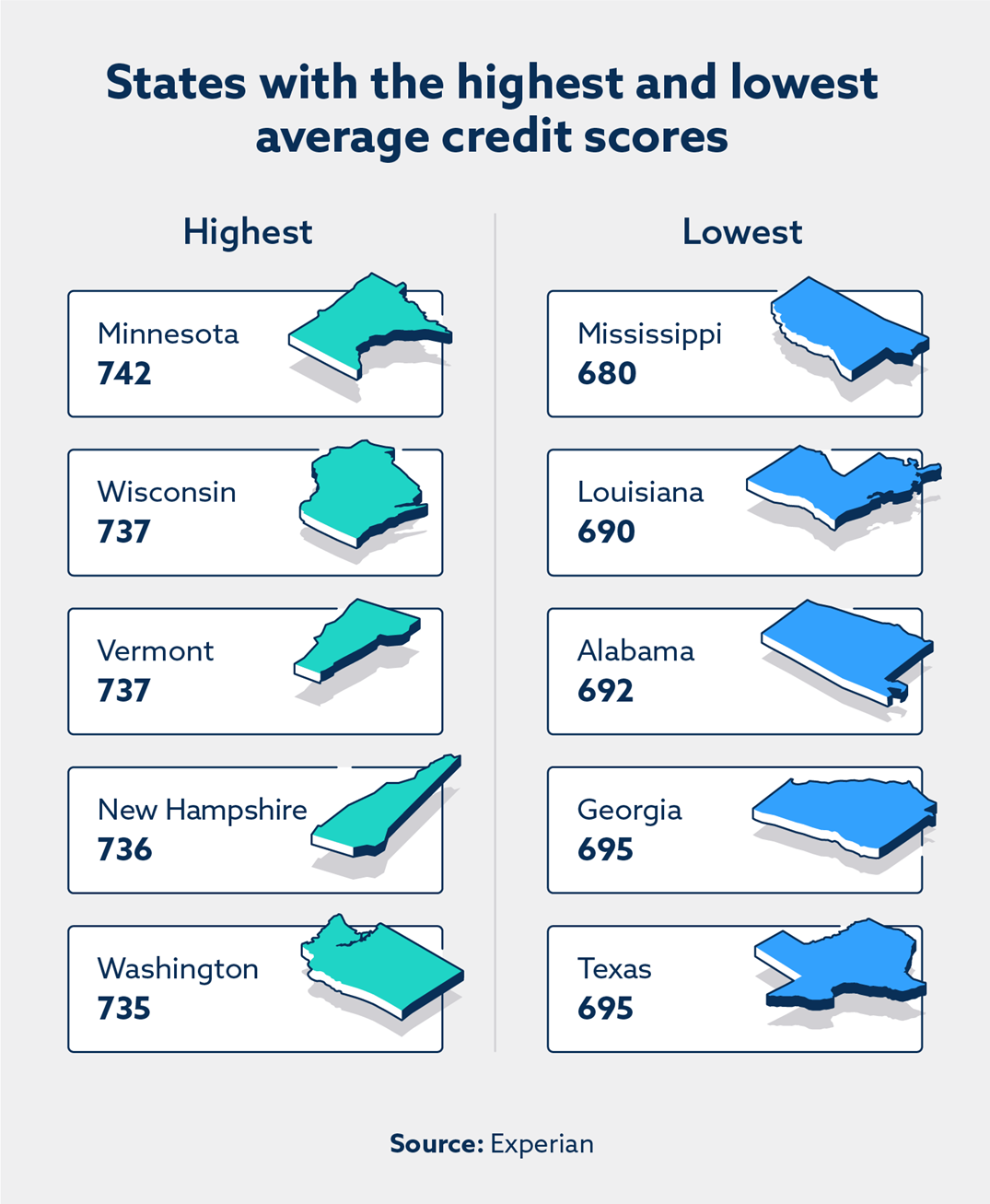

States with the highest and lowest credit scores

The states with the highest average credit scores include:

- Minnesota: 742

- Wisconsin: 737

- Vermont: 737

- New Hampshire: 736

- Washington: 735

On the other hand, these states had the lowest average credit scores:

- Mississippi: 680

- Louisiana: 690

- Alabama: 692

- Georgia: 695

- Texas: 695

Average credit scores by state vary due to economic conditions and the financial habits of each state’s residents. Notably, the variation in credit scores doesn’t necessarily correspond with the amount of credit card debt. For example, the states with the highest and lowest average credit scores—Minnesota and Mississippi, respectively—are within $500 of each other when it comes to average credit card debt data (Minnesota’s average is around $5,900, Mississippi’s average is around $5,400).

Regardless of current placement, the vast majority of states saw a slight increase in average credit score over the past year. Individuals can make an impact on their own credit by learning a bit more about how scores are calculated and taking small steps to manage their credit more favorably.

How to improve your credit regardless of your state’s average

No matter what the average credit score in your state is, your own score comes down to your individual choices with credit. Understanding the factors that affect your score—payment history, credit utilization, length of credit history, different types of credit, and new credit—can help you make savvy decisions that may improve your credit.

Experian, one of the three credit bureaus, reported that Americans increased their credit card debt by 10 percent from 2022 to 2023. In turn, this raised overall credit utilization by 2 percent—this means that Americans are using slightly more of the credit available to them, which can potentially lead to lower credit scores.

According to FICO®, a credit score between 670 and 739 is a good credit score, a score between 740 and 799 is very good and a score above 800 is exceptional. If you’re looking to improve your own credit, consider starting with these tips:

- Lower your credit utilization. Consistently using less than 30 percent of your total available credit can significantly improve your credit health.

- Make on-time payments. Late payments and delinquent accounts can negatively affect your credit, but paying on time will improve your payment history, which is one of the most important credit factors.

- Avoid carrying a balance. As we explained, carrying a balance can hurt your credit utilization, but it can also cause your debt to swell over time due to costly interest payments. While difficult financial circumstances can sometimes make this impossible, try to make all payments on time and in full to avoid late payments or being sent to collections.

In addition to regularly monitoring your credit score, you’ll want to consistently review copies of your credit report, which lists your credit history, including both open and closed accounts. Scanning your report can help prevent inaccurate negative items from unfairly hurting your credit.

Consider working with a credit repair consultant to look for errors on your credit report and identify other ways you can help your credit. Get started with your free credit assessment now.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.