The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

The bankruptcy means test determines who is eligible to file for Chapter 7 bankruptcy.

The bankruptcy means test determines who is eligible to file for Chapter 7 bankruptcy. You can think of “means” as your household’s financial resources and situation—like income, expenses and alimony, for example.

When filing for bankruptcy, you’ll provide the court with information about your household size, and your income and expenses, usually with the help of an attorney. The court uses a series of calculations to decide whether you have enough income to repay some of your debts, in which case you may need to file a different chapter, if you meet the requirements and limitations of Chapter 11, 12 or 13. The other types of bankruptcies are for repayment plans as well as businesses.

There are many advantages of filing for bankruptcy, so it’s helpful to understand the process beforehand. Read on to learn exactly how the bankruptcy means test works so you have a sense of whether you’ll qualify for Chapter 7.

How do you pass the bankruptcy means test?

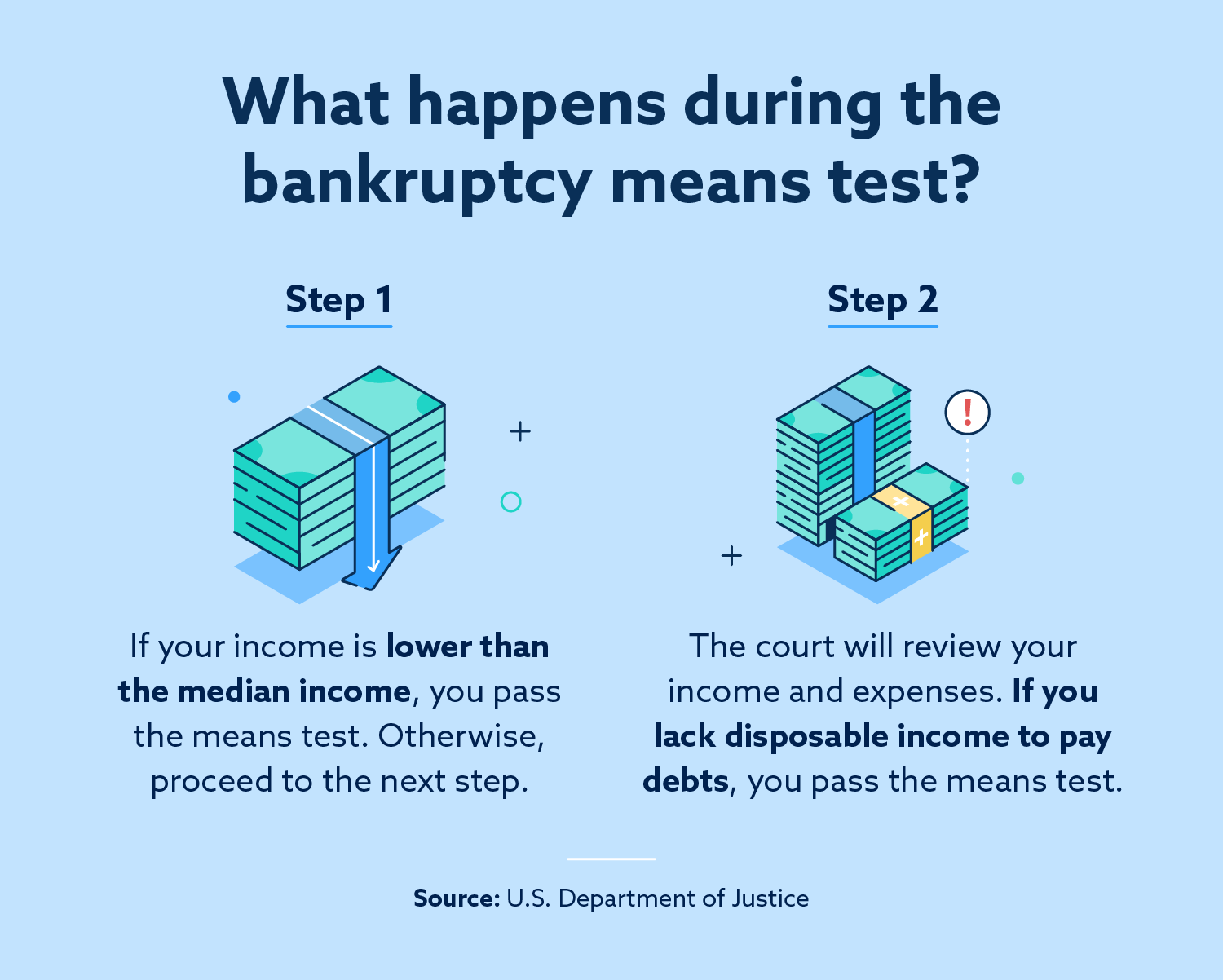

Passing the means test enables you to file for Chapter 7, but it requires you to share relevant financial information about your income and expenses. The test has two components, and if you pass the first step, you don’t need to continue on to the second step.

First, the court will compare your income to the median income of your geographic area. If necessary, the court will also look more closely at your income and expenses to determine whether you have disposable income to repay your creditors in part or in full.

Read on to learn more about how these two steps of the bankruptcy means test work.

Step 1: Comparing your income to the median income

The first step of the bankruptcy means test is straightforward: if your household income is lower than the median income of your geographic area (and considering the number of people in your household), you’re eligible to file for Chapter 7 bankruptcy.

You can think of finding the median income as lining up everyone in your geographic area according to income, with the highest earners in the front of the line and the lowest earners in the back. If your income places you in the back half of the line, you pass the bankruptcy means test.

Since the median income is always changing, you’ll need to refer to the Department of Justice’s median income table, which is regularly updated. Note that the median income varies significantly based on how many people are in your family as well as which state or territory you live in.

As long as your total household income is less than the number you find for your area and family size, you qualify. If your income is higher, you may still qualify, but the process becomes a bit more complicated. Read on to learn about the income and expense calculations that the court uses to determine disposable income.

Step 2: Determining your disposable income

To determine your disposable income, the court will require you to document your income as well as qualified expenses.

Since the Department of Justice sets out complicated rules for what counts as a qualified expense, most people enlist the support of a bankruptcy lawyer to file for Chapter 7, which would include assistance with the means test.

In general, the following categories are expenses that would be subtracted from your income to determine how much disposable income you have:

- Food and clothing

- Healthcare expenses

- Housing and utilities

- Transportation

- Tax liabilities

- Child support

However, you may have other qualified expenses, so you’ll likely want to work closely with an attorney to fill out the required documentation for the court. It’s extremely important to fill out these forms fully and honestly, as failure to faithfully report your income and expenses could lead to charges of bankruptcy fraud—including potential fines, jail time or nullification of your bankruptcy discharge.

What forms are needed for the bankruptcy means test?

There are several forms that you may need to fill out for the bankruptcy means test depending on your income, expenses and other eligibility criteria. One form, a Statement of Exemption, is available for people who may not need to complete the means test, like disabled veterans.

Here are the most common forms required for means testing, all of which are available on the United States Courts website.

- B122A-1: Statement of Current Monthly Income

- B122A-1Supp: Statement of Exemption from Presumption of Abuse Under § 707(b)(2)

- B122A-2: Chapter 7 Means Test Calculation

- B122C-1: Statement of Your Current Monthly Income and Calculation of Commitment Period

- B122C-2: Chapter 13 Calculation of Your Disposable Income

Collectively, these forms will provide the court a basis for making a determination about whether you qualify for Chapter 7 using the means test.

Common errors with the means test

As you work to fill out the above forms, rather than trying the do it yourself Chapter 7 route, it’s often recommended that you work with a qualified bankruptcy attorney who can check that you’re documenting your income and expenses correctly. That said, your lawyer will only know as much as you share, so it’s important to be thorough, accurate and truthful as you work through the paperwork.

Still, it’s possible to make mistakes even if you’re aiming for accuracy. Here are some of the most common errors people make when undertaking the bankruptcy means test:

- Not considering family size: Your family size and marital status will affect how your income and expenses are considered, so ensure that you take this into account.

- Incorrectly adjusting for taxes: While your tax liability counts as a qualified expense in most cases, some people mistakenly count all of their paycheck deductions instead.

- Miscalculating expenses: Not all expenses are qualified for the means test, so make sure you exclude expenses determined nonessential by the forms.

- Including Social Security: While most income counts for the means test, Social Security and some other forms of government assistance typically don’t, so make sure to omit these.

Once you have all of the forms filled out correctly and filed with the court, you’ll know whether you’ll be able to file for Chapter 7 bankruptcy. If you do not qualify for Chapter 7 bankruptcy, you may consider the qualification requirements for Chapter 11, 12 or 13, Each has different rules and limitations. It is possible, in rare circumstances, that you won’t qualify for any bankruptcy chapter.

What happens next?

Regardless of whether you pass the means test, you’ll have options for proceeding toward filing for bankruptcy.

- If you pass: You will have the option to file for Chapter 7, which leads to the immediate discharge of debt without further payment. You can nonetheless opt to file for Chapter 13 instead.

- If you fail: You may be able to appeal, but more likely you will only have the option to file for Chapter 11, 12 or 13, which involve their own qualification procedures and limitations. If you do not qualify for Chapter 7, it’s good to see an attorney to look at your other options.

After filing for bankruptcy and having your debt discharged, you’ll experience relief from your creditors and debts that may have burdened you for many years. However, you’ll also likely face both short- and long-term effects on your credit score.

Your credit report will note the bankruptcy, which can lead to a dramatic decrease in your credit score as well as difficulty securing new credit, as lenders may view you as a significant risk. This notation can remain on your credit report for seven to 10 years, though the effects will diminish over time with good credit behavior like on-time payments and a lower credit utilization rate.

As you work to recover your credit, you may benefit from working with a credit repair company, as they are likely familiar with the effects of bankruptcy and the steps required to rebuild credit after filing for bankruptcy.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.