The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Not all types of debt are bad, and having at least one loan or credit card can help you boost your credit score over time. When you apply for a loan or a new line of credit, you’ll typically find that you have two options: secured and unsecured.

Unsecured debt is only backed by a personal guarantee that you’ll repay what you borrow — no collateral required. If you fail to make payments on these debts, your lender may have a harder time recouping their losses.

Understanding how unsecured debt works and how it can impact your credit can help you make more informed decisions. This article will delve into the world of unsecured debt, explain its definition and give examples, explore the differences between secured and unsecured debt, shed light on the impact of bankruptcy and more.

Key takeaways:

- Unsecured debt refers to loans or credit lines without collateral.

- Common examples include credit card debt, medical bills and personal and student loans.

- Failing to pay unsecured debts can hurt your credit score, making it harder to apply for credit in the future.

- Unsecured debt is backed by your promise to repay what you borrow while secured debt is backed by collateral like a car or home.

What is unsecured debt?

Unsecured debt is defined as a financial obligation that does not require collateral. Unlike secured debt which is backed by specific assets, unsecured debt relies solely on the borrower’s creditworthiness and promise to repay what they borrow. Examples of unsecured debt include credit card debt, medical bills and personal loans.

It’s important to note that unsecured debt can be both good and bad debt. It depends on how you use it and whether you’re making payments to your lender on time and in full each month.

Unsecured debt vs. secured debt

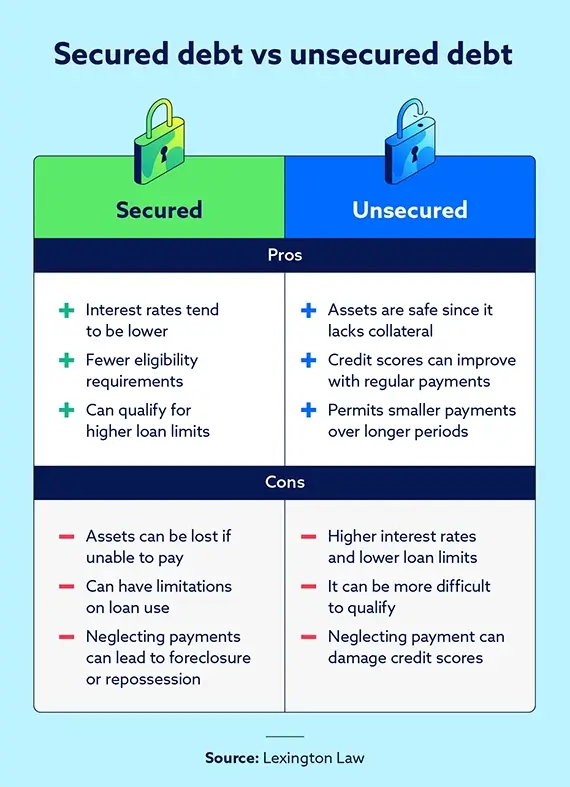

Understanding the differences between secured and unsecured debt is crucial for effective financial management. Let’s take a look at some of the key differences you’ll want to keep in mind.

| Unsecured debt | Secured Debt | |

| What the debts are backed by | Backed by your creditworthiness and promise to repay what you borrow. | Backed by acceptable collateral such as a car or house. |

| What happens if you default | Lenders can report your missed payments to collections agencies and may sue you for what you owe. | Lenders can take possession of the collateral and use it to settle your debt. |

| The eligibility requirements | Lenders may set stricter eligibility requirements like higher credit scores or lower debt-to-income ratios. | Lenders typically set more relaxed eligibility requirements since loans are backed by collateral. |

| The amount lenders offer | Lenders may offer smaller loans since they’re not backed by collateral. | Lenders may offer larger loans since they’re backed by collateral. |

| The cost of the loan over time | Lenders typically charge higher interest rates, making the loan more expensive over time. | Lenders typically charge lower interest rates, making the loan less expensive over time. |

| Your risk if you default | Lenders have few options to recoup their losses, but you may see your credit score drop. | You risk losing your assets as lenders can take possession of the collateral. |

Unsecured debt examples

Now that you understand the differences between unsecured and secured debt, Examples of unsecured debt include:

- Credit card debt: When you make purchases using a credit card, you accumulate unsecured credit card debt. The credit card company extends you a line of credit without requiring collateral.

- Personal loans: You can obtain these from banks, credit unions or online lenders. They have various purposes, such as debt consolidation, home improvements and unexpected expenses.

- Student loans: Student loans are used to finance education expenses. The government or private lenders offer them, and they can have long repayment terms.

- Peer-to-peer loans: These loans are personal loans issued between individuals rather than traditional banks or lenders. The terms of these loans vary but can be more relaxed and more flexible than loans issued through a bank.

- Certain business loans: Business lines of credit and certain business loans may be unsecured. Business owners can use these loans for business expenses subject to any restrictions specified by the lender.

Secured debt examples

Though unsecured debts offer flexibility in the way you can use the funds, secured debts still play an important role in your financial situation. Here are some common examples of secured debts:

- Mortgage loans: These home loans are backed by the property you’re financing. If you default on the loan, the lender can seize the property and sell it to settle your debt.

- Home equity loans: These loans let you borrow against the equity (the amount of your mortgage principal you’ve repaid). Like your mortgage, home equity loans are secured by the home itself.

- Auto loans: These loans let you finance the purchase of a new or used vehicle. They’re secured by the vehicle you’re buying, so the lender can take possession of the vehicle to settle your debt if you default on the loan.

- Secured credit cards: These credit cards are available through select credit card issuers and are popular with people looking to build their credit score. Secured credit cards require you to deposit a set amount of money into your account. The money you deposit guarantees the line of credit and can be used to settle your debt if you default.

- Home equity lines of credit (HELOCs): HELOCs are a type of line of credit secured by your home. They function similarly to credit cards, as you can make charges on that line of credit up to your credit limit for a set time. If you fail to repay what you borrow, the lender can take possession of your home and use it to settle your debt.

Is secured or unsecured debt better?

Both secured and unsecured debt can help your financial situation in different ways. Choosing the right debt type means looking at the following factors:

- Your financial situation

- Your credit score and credit history

- Your willingness to risk collateral

- Your short- and long-term financial goals

Though using secured debts may seem safer, falling behind on mortgage or car loan payments can lead to foreclosure or repossession.

However, neglecting unsecured debts can still have significant consequences, including damage to credit scores, having to deal with collections agencies and potential lawsuits.

If you’re struggling to choose between these types of debts or you’re worried about how each type of debt may impact your finances, speak with a financial professional. They’ll be able to explain each debt type in detail and can help you choose the right option for your situation.

What happens if you don’t pay an unsecured debt?

If you fail to pay your unsecured debt, there may be significant consequences. While specific actions may vary depending on the creditor, here are some potential outcomes to beware of:

- Collection efforts: Creditors may employ collection agencies or pursue legal action to recover the debt. These efforts can involve phone calls, letters or even lawsuits.

- Negative impact on credit: Unpaid unsecured debt can harm your credit. Late payments, defaults and charge-offs can contribute to a lower credit score, making obtaining future credit or loans more challenging.

- Legal proceedings: In extreme cases, creditors can file lawsuits to obtain a judgment against you. This can result in wage garnishment or liens on your property.

If you don’t pay a secured debt, your lender can takesimply takes possession of the collateral securing your loan.

Unsecured debt FAQ

As you continue to explore the world of unsecured debt, we want to address some frequently asked questions.

How do I know if my debt is unsecured?

Think about the type of debt you have. If you took out a loan to purchase an item like a home or car, it’s likely a secured debt. But if you took out a loan without a clear purpose in mind or opened a normal credit card, it’s likely an unsecured debt. You can always call your lender to learn about the terms and details of your loan.

Is a car loan an unsecured debt?

Car loans are a type of secured debt. The car you’re financing is the collateral for the loan, and if you stop making payments or default on the loan, the lender can sell your car to settle your debt.

What is an unsecured debt called?

Unsecured debt is commonly referred to as personal debt. It is a financial obligation that is not tied to specific assets.

What happens if an unsecured debt is not paid?

If you don’t pay an unsecured debt, the creditor may report your debt to a collections agency or pursue legal action to recover the debt. If this happens, your credit score will likely take a hit.

Can unsecured debts harm your credit?

Defaults, collection actions and late or unpaid payments can harm unsecured debtors’ credit scores. Prioritizing timely debt repayment is crucial to maintaining healthy credit. On the other hand, your credit score can improve if you pay on time regularly since that shows your commitment.

Are credit cards unsecured debt?

Credit cards are typically unsecured debt since they don’t have an asset associated with the line of credit. However, if you open a secured credit card, that line of credit is a secured debt. It’s guaranteed by the money you deposit with the card issuer.

Unsecured debts can strengthen your credit

Unsecured debt can be a helpful financial tool as long as you use it responsibly. By making payments on time and in full each month, you can work toward improving your credit score and strengthening your financial situation.

But it’s still helpful to see where you stand and to keep tabs on how your credit score is faring based on your spending and your debt levels. Get a free credit assessment from Lexington Law Firm today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.