The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

On average, each American carries $5,010 in credit card debt as of early 2022, according to TransUnion®. Alaskans have the highest credit card balance, with an average of $7,758 per person.

With inflation and interest rates on the rise in America, so is credit card debt. American credit card debt is now at $986 billion, which is higher than the pre-pandemic spike of $927 billion. Due to these and other financial stressors, people have turned to credit cards more than ever to help cover costs.

We can look at the credit card debt statistics in the United States and see that inflation and cost of living increases are affecting the economy. The average American credit card debt increased by 13.2 percent from September 2021 to September 2022, according to Experian®.

Today, we’ll look at the latest data for the average credit card debt in America by state and demographics, such as age and income. You’ll also learn how this information can help you improve your credit score and your overall financial future.

Note: we reference the most updated data available, but sometimes that information is from several years ago—check each individual source for specifics.

Table of contents

- Key credit card debt statistics

- Top 10 states with the least credit card debt

- Top 10 states with the most credit card debt

- General credit card debt statistics

- Average credit card debt by state

- Average household credit card debt

- Average credit card debt by age

- Average credit card debt by income

- Average credit card debt by race or ethnicity

- Delinquency rates in America

- Average interest rates are rising

- How to get out of credit card debt

Key credit card debt statistics

Some of the most interesting findings for credit card debt using the most recent data from TransUnion® include:

- Credit card debt in the U.S. increased by $61 billion and is now a total of $986 billion. (Federal Reserve Bank of New York)

- The average U.S. credit card debt is a balance of $5,910 per person. (Experian)

- Between Q1 2019 and Q1 2022, the total number of credit cards in America has risen by almost 8 percent to 492.5 million. (TransUnion)

- The average FICO® credit score for all generations rose by three points to 714 between 2020 and 2021. (Experian)

- In Q1 2022, credit card holders were paying more than the minimum at an average of $328 per month compared to $307 per month in Q1 2018. (TransUnion)

- The average max limit for new credit cards is $4,634, which has increased by 21.6 percent in 2021. (TransUnion)

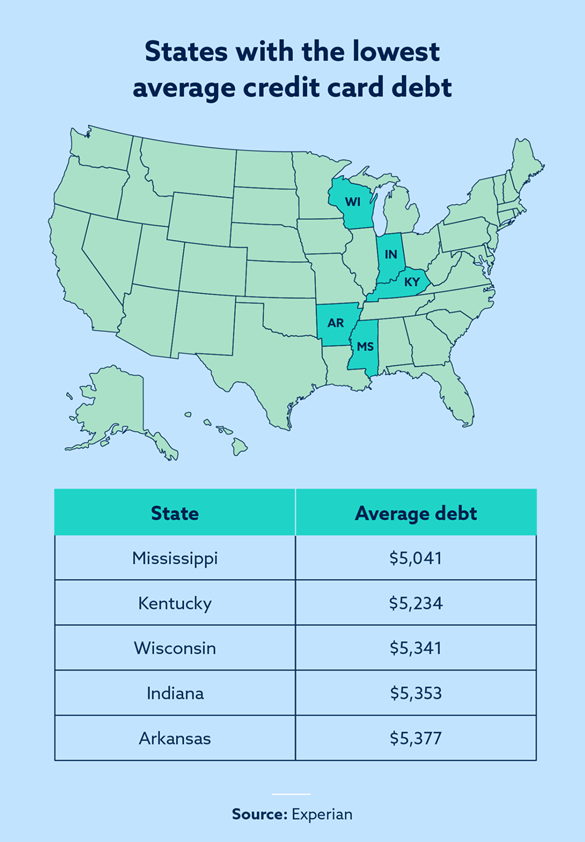

Top 10 states with the least credit card debt

A 2022 Experian report tracking debt changes from 2021 to 2022 found that many states increased balances. Two states that saw the lowest increase in debt year over year were Oklahoma and Connecticut. Oklahoma increased its average debt by only 0.5 percent, and Connecticut’s debt increased by 0.9 percent.

The most recent data for average credit card debt by state in 2022 comes from Credit Karma, using data from over 73 million of its members.

| State | Average credit card debt | |

|---|---|---|

| 1 | Mississippi | $5,041 |

| 2 | Kentucky | $5,234 |

| 3 | Wisconsin | $5,341 |

| 4 | Indiana | $5,353 |

| 5 | Arkansas | $5,377 |

| 6 | Alabama | $5,440 |

| 7 | Idaho | $5,455 |

| 8 | West Virginia | $5,464 |

| 9 | Iowa | $5,496 |

| 10 | Michigan | $5,547 |

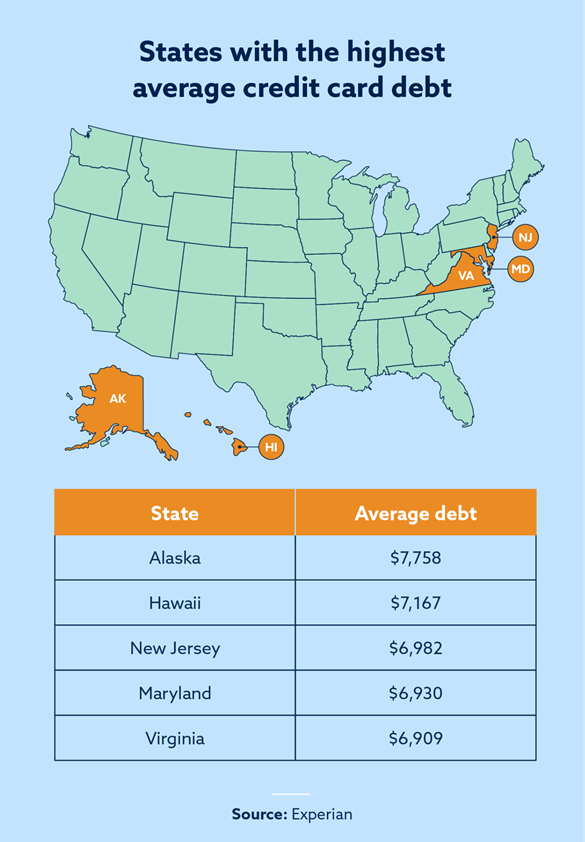

Top 10 states with the most credit card debt

Using the same 2021 to 2022 data from Experian, the state that saw the highest increase of debt year over year was Idaho, whose credit card debt increased by 9.3 percent.

The individualized state data from Credit Karma’s 2022 report shows the following:

| State | Average credit card debt | |

|---|---|---|

| 1 | Alaska | $7,758 |

| 2 | Hawaii | $7,167 |

| 3 | New Jersey | $6,982 |

| 4 | Maryland | $6,930 |

| 5 | Virginia | $6,909 |

| 6 | Connecticut | $6,751 |

| 7 | New York | $6,709 |

| 8 | California | $6,651 |

| 9 | Washington | $6,576 |

| 10 | Florida | $6,524 |

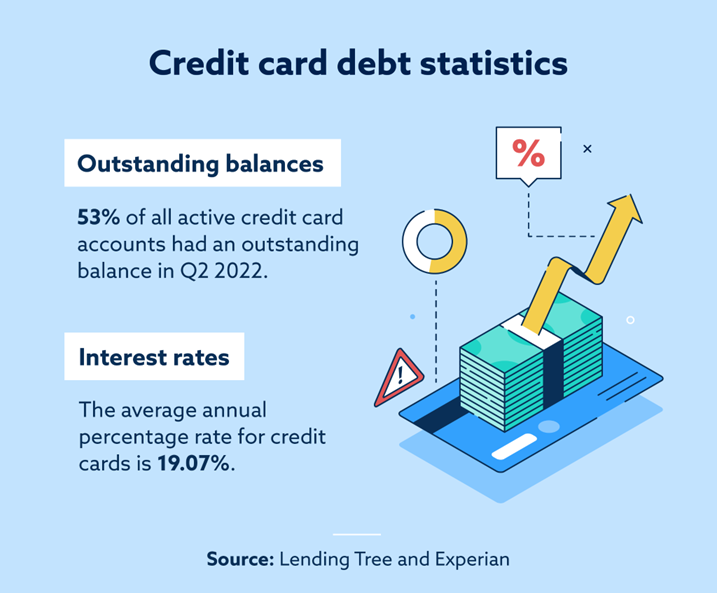

General credit card debt statistics

The Federal Reserve Bank of New York’s most recent data shows that the total amount of consumer debt has increased to $16.9 trillion as of Q4 2022. The primary increases were for mortgages, credit card debt and auto loans. With all types of debts increasing, keeping your credit card debt low can help you keep up with your overall debt.

- The average credit card interest rate in Q4 2022 was 19.07 percent. (Lending Tree)

- Those with an exceptional credit score of over 800 had an average utilization rate of less than 7 percent in Q3 2021. (Experian)

- The average credit card limit for Americans is $30,233. (Experian)

- The total number of credit card accounts rose by over 3 percent in 2021 to 494.5 million. (Experian)

- Average credit card utilization in the U.S. stayed at 25 percent during 2020 and 2021, but it was at 29 percent in 2019. (Experian)

Average credit card debt by state

Average credit card debt differs between each state. We’ve listed out the average credit card debt for each state according to Credit Karma.

Average household credit card debt

NerdWallet conducted a 2022 survey and found that the average household credit card debt is $5,944, not much higher than the individual average TransUnion reported of $5,010. This may mean that households are sharing credit cards, keeping a minimal amount of cards, or just being very mindful of their spending.

- Household credit card debt increased by 15.25 percent between 2021 and 2022. (NerdWallet)

- The increase in debt has led to increased interest charges. (NerdWallet)

- Over 180 million credit accounts were closed in Q4 2021. (Federal Reserve Bank of New York)

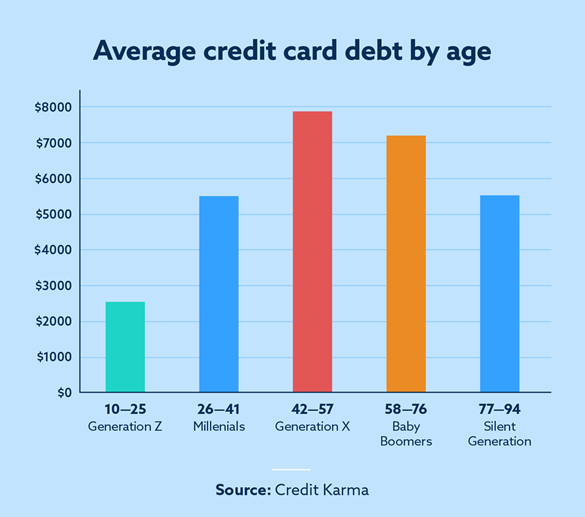

Average credit card debt by age

The Credit Karma survey also collected the average amount of credit card debt by generation to see which age group has the most and least credit card debt.

Average credit card debt by income

The most recent data for credit card debt by income is from a 2019 survey conducted by the Federal Reserve. A lot has changed since 2019 with the pandemic starting in 2020, but data from the survey found the following:

| Income range | Average credit card debt |

|---|---|

| Less than $25,555 | $3,800 |

| $25,555 to $49,000 | $4,700 |

| $50,000 to $78,000 | $4,900 |

| $79,526 to $126,000 | $7,000 |

| $130,000 to $175,847 | $9,700 |

| $184,200 to $475,116 and above | $12,600 |

The subsequent Federal Reserve survey took place March – December 2022. This survey should be available later this year.

Average credit card debt by race or ethnicity

The Federal Reserve’s survey also generated data for credit card debt by race or ethnicity. As the United States works toward more social justice and equality, this information can be extremely helpful.

| Race | Average credit card debt |

|---|---|

| White (non-Hispanic) | $6,900 |

| Black or African American (non-Hispanic) | $3,900 |

| Hispanic or Latino | $5,500 |

| Other or multiple races | $6,300 |

Delinquency rates in America

Credit card delinquencies are when a person is at least 30 days past due. This can lead to late fees and the inability to increase the card’s max limit. Delinquency can also lead to an individual’s credit score dropping and can make it difficult for them to acquire new lines of credit or loans.

Experian’s report tracked delinquency rate changes from 2021 to 2022. Here’s what they found:

- The percentage of accounts 30 to 59 days past due increased by 0.63 percent.

- The rate of delinquencies between 60 and 89 days increased by 0.43 percent.

- The percentage of accounts 90 to 180 days past due increased by 0.29 percent.

Average interest rates in America are rising

The Board of Governors of the Federal Reserve System (BGFRS) tracks banking trends, and this includes credit card interest rates, also known as annual percentage rates. Here’s some of the latest data from their report:

- Interest rates were down 0.7 percent from 2020 to 2021. (BGFRS)

- Interest rates rose 3.63 percent between December 2021 and May 2022. (BGFRS)

How to get out of credit card debt

The average credit card debt in the U.S. is going up, but you can still work on lowering your debt and improving your credit. There are a few simple strategies you can use to help you get out of credit card debt:

- Pay off your smallest balance in full each month

- Automate your credit card payments

- Create a budget and payoff strategy

Sometimes, additional debt is due to errors that show you have missed payments when you haven’t. These errors can also hurt your credit, and that’s where Lexington Law Firm can help. Not only do we have a team of consultants who can help you address errors, but we also offer additional financial services. To learn more, reach out to us today for your free credit report consultation.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.