The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A personal loan works by providing you with a set amount of money, which you’ll pay back within a fixed time frame, along with an interest rate based on your qualifications. You can use these funds for almost any type of purchase or expense.

If you’re considering taking out a personal loan for home renovations, a family trip or another large expense, you’re not alone. Over 23 million Americans had personal loans during the second quarter of 2024, a 5.3 percent year-over-year increase.

Below, you’ll learn how personal loans work, how to take one out and how to get the best interest rates. You will also learn the pros and cons of taking out a personal loan so you can decide if it’s the best option for you.

Key takeaways:

- To apply for a personal loan, you’ll need recent pay stubs, proof of identification and residency, as well as your bank account information.

- You may prequalify for a personal loan with some lenders. Prequalifying can be beneficial it helps you avoid a hard credit check, which can temporarily lower your credit score.

- You may even get a lower interest rate by setting up automatic payments for your personal loan.

What is a personal loan?

A personal loan is a loan that you can use for just about anything. People typically take out personal loans to finance large purchases like home renovations, weddings or vehicles. Some people also take out personal loans to pay off debt. This can be a good strategy because it consolidates your debt into one payment, and you may get a better interest rate. In fact, one survey found that most people use personal loans to pay off debt, and the second most common reason is for home renovations.

How do personal loans work?

To acquire a personal loan, you can often go through your bank or credit union, and there are individual lending services that provide loans as well. When taking out this kind of loan, you’ll often have a fixed interest rate. Much like with other loans, you’ll have a minimum monthly payment, but you’ll often have the option to pay a larger amount to pay off the loan quicker and save on interest.

There are also multiple types of personal loans to choose from:

- Secured loans

- Unsecured loans

- Variable rate loans

- Fixed rate loans

- Personal lines of credit

- Debt consolidation loans

Secured loans require some form of collateral, like your vehicle, which lenders repossess if you miss your payments. While unsecured personal loans don’t require collateral, they often have higher interest rates and may have stricter approval requirements.

What you need to apply for a personal loan

There are a few items you’ll need to provide when you apply for a personal loan, including the following:

- Pay stubs

- Driver’s license and another form of government-issued identification

- Proof of residence

- Bank statements

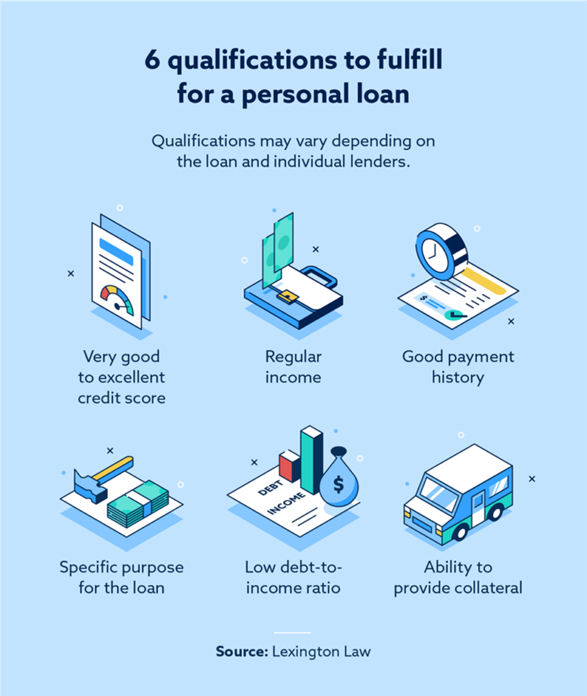

The lender is also going to look at your debt-to-income (DTI) ratio, and they’ll typically want to see less than 35 to 40 percent. If your DTI is higher than that, it may be a sign to the lender that it might be difficult for you to make your payments on the loan.

When applying for a personal loan, you may get the best interest rates and a higher chance of approval by going to your current bank or credit union. Being a loyal customer with a good history may allow you to negotiate your interest rate and the terms of the loan.

Applying for a personal loan

The application for a personal loan is much like any other loan. You’ll fill out an application with your Social Security number and additional information and provide documents, like pay stubs. The lender will then do a hard credit inquiry to check your credit report and score. A good credit score without derogatory marks on your credit report can improve your chances of getting approved.

Some lenders also have a prequalification process where they let you know if you’ll be approved without running a credit check. Prequalification can help the lender save time, and you won’t have a hard inquiry on your report lowering your credit score.

It’s also helpful to remember that each lender is different, so there are no standard qualifications or credit requirements. For example, if you have a longer history with your bank, it may have less strict requirements than a lender you’re approaching for the first time for a loan.

How you receive the personal loan

If you’re approved for a personal loan and accept the terms, the lump sum will go straight to your bank account. Once approved, the amount of time it takes for the funds to go into your account can vary depending on the lender and when you fill out your application. In some cases, the funds are in your account within 24 hours, but it may take a few business days in others.

How to pay back a personal loan

Different lenders have different repayment options, but you can usually pay online. Falling behind can hurt your credit and may lead to a repossession if you received a secure personal loan.

The best way to avoid this is to set up automatic payments, which could also earn you a lower interest rate. You can set automatic payments for the minimum amount, and you can make additional payments when you can pay more.

Your monthly payment amount will depend on the total amount you borrow, the interest rate and the term of the loan. For an idea of what your monthly payments will look like, use a loan calculator.

What can you use a personal loan for?

There are no limitations on what you can use your personal loan funds for. You can use personal loans as part of your debt repayment strategy or to fund large purposes. Here are some of the most common reasons people take out personal loans:

- Debt consolidation

- Home improvement expenses

- Paying off medical debt

- Moving expenses

- A wedding

- A vacation

- Tax debt

- Miscellaneous large purchases

How does a personal loan affect your credit score?

Making your payments on time each month can help improve your credit, but being late or missing payments can harm it. Like other loans, your lender will report your payment history to the major credit bureaus.

Your payment history accounts for 35 percent of your FICO® and 40 percent of your VantageScore®, which is why on-time payments are so important. Your credit utilization is also a major part of your credit score, but personal loans don’t directly affect your utilization because they’re a form of installment credit. However, using a personal loan to pay off credit card debt can help your credit health by lowering your utilization ratio.

How to get lower interest rates for personal loans

Regardless of your credit score, there are some ways you can get the best interest rate for your loan. Even with a great credit score, you may benefit from some of the following tips when taking out a loan:

- Improve your credit: It can take some time, but improving your credit score is a great way to get better interest rates. A relatively small point improvement may save you hundreds or even thousands of dollars overall.

- Compare multiple lenders: If you have been with your bank or credit union for a long time, they may give you the best deal for your loan, but it’s still a good idea to do some research and get a few quotes from different lenders.

- Consider the length of the loan: You may get better interest rates by opting for a longer term for the loan. If you choose to do this, look at the overall cost, because extending the loan may mean that you pay more overall.

- Get a cosigner: A cosigner with a high credit score may be able to help you get a better interest rate on your loan. Keep in mind that a cosigner is a responsible party for the loan and can also be negatively impacted by missed payments or defaulting on the loan.

Can you get a personal loan with bad credit?

Yes, there are bad credit personal loans, but it’s important to understand them before applying for one. Your credit score is a way for lenders to assess risk, and low credit scores may indicate a high-risk borrower. In order to make up for that risk, lenders have much higher interest rates for bad credit loans.

A recent survey shows that people with a credit score of between 300 and 629 receive interest rates as high as 32 percent. However, improving your score to 690 could lead to interest rates as low as 13.5 percent. To put that in perspective, with a 600 credit score, a five-year $10,000 loan would cost an additional $10,155.53 in interest at 32 percent. With a credit score of 690, the total cost of interest at 13.5 percent would only be $3,805.91. Here are the average interest rates by credit score to give a full picture:

| Credit score | Average interest rate |

|---|---|

| 720 – 850 | 10.73% – 12.50% |

| 690 – 719 | 13.50% – 15.50% |

| 630 – 689 | 17.80% – 19.90% |

| 300 – 629 | 28.50% – 32.00% |

Is a personal loan right for you?

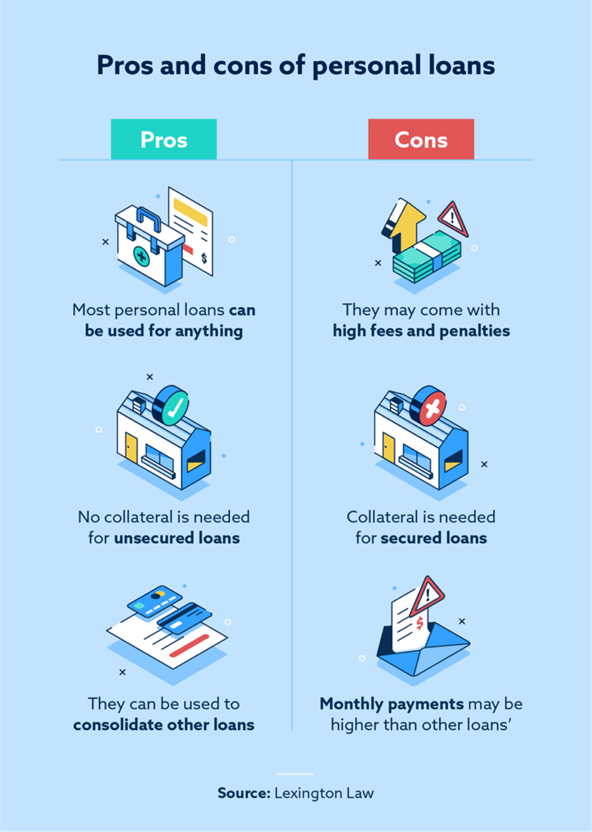

Much like any financial decision, there are pros and cons to taking out a personal loan. To make the best decision, it’s helpful to know the benefits and downsides of personal loans.

Some of the benefits include:

- They can be used for nearly any type of purchase

- No collateral is needed for unsecured loans

- They can be used to consolidate other debts

This type of loan can be helpful for different financial situations, but you may want to research other options due to potential downsides.

Some of these downsides include:

- There may be high fees and penalties

- There may be higher monthly payments than with other types of loans

- Collateral may be necessary for larger loans

If you’re in need of a large sum of money and can receive a good interest rate, a personal loan might be your best option. Just remember to do your research by shopping around and comparing lenders. However, if the payments are too high and you’re at risk of missing them or being unable to afford your other bills or expenses, it may be best to wait on a loan.

Why you should check your credit before applying for a personal loan

Now that you have a better understanding of personal loans, you know that your credit plays a major role in the cost of your loan. Your credit score can potentially save you thousands of dollars in interest on your loan, so the best place to start is by knowing what it is.

Sign up for Lexington Law Firm’s free credit assessment so you can see your score as well as additional information about your credit before applying for a loan.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.