The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

Some facts about credit you should know are: most credit scores are based on 5 key factors, most scores range from 300 to 850, checking your own score won’t hurt it, and you should check your credit scores (and reports) frequently.

With all of the misleading and incorrect information about credit floating around, it’s no wonder some of us feel lost when it comes to our credit reports and credit scores. Fortunately, we’re here to help set everything straight with these simple and clear explanations.

We’ve taken the time to compile the most important credit facts you need to know to understand your credit and everything that impacts it. Read on to learn everything you’ve always wanted to know about credit.

1. Your credit score is based on five key factors

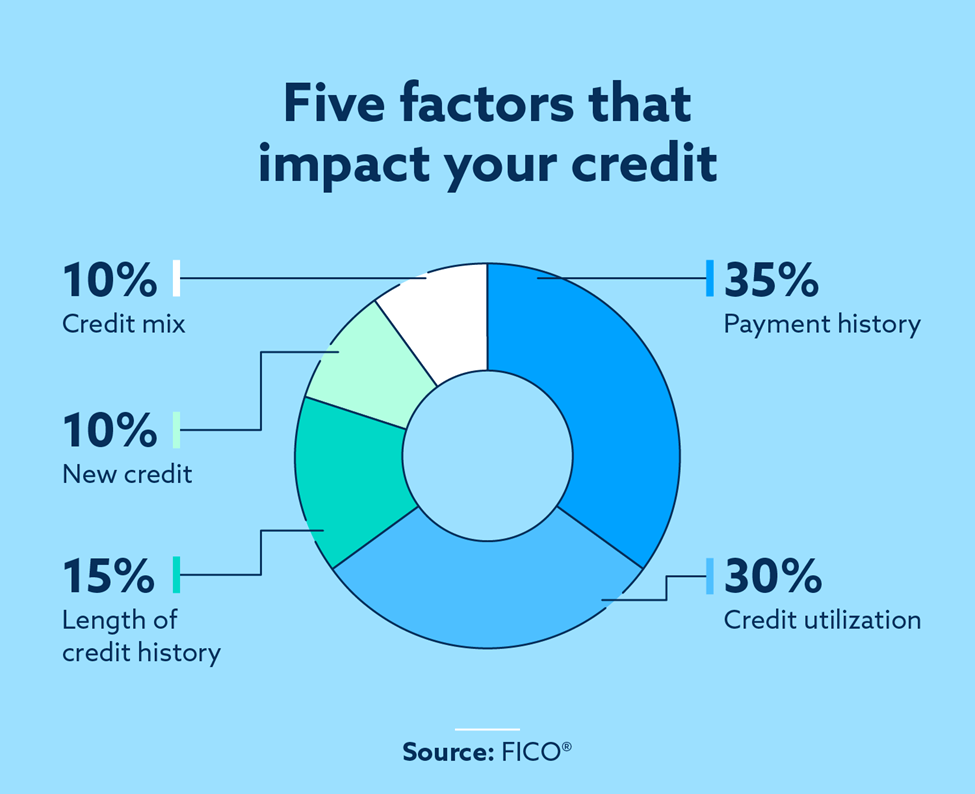

Most lenders make their decisions using FICO credit scores, which are based on five key factors. That means that when you apply for a new credit card or loan, these are the primary influences on whether you’ll end up getting approved. Here are the five factors, in order of importance: payment history, credit utilization, length of credit history, credit mix and new credit inquiries.

- 35% – Payment history. Your ability to consistently make payments has the biggest impact on your score. Having late and missed payments is detrimental to your credit score, while a streak of on-time payments has a positive effect.

- 30% – Credit utilization. Your utilization measures how much of your available credit you’re using across all of your cards. By using one-third or less of your total credit limit, you could help improve your credit.

- 15% – Length of credit history. In general, having a longer credit history is helpful, though it depends on how responsibly you’ve used credit over time. Using credit well over time signals to lenders that you can be trusted to manage your finances.

- 10% – New credit. Applying for new credit leads to hard inquiries, which can negatively impact your credit score. Spacing out your new credit applications—and only applying for credit when you need it—helps your score.

- 10% – Credit mix. Having a variety of different types of credit—like credit cards, an auto loan or a mortgage—can influence your score as well. A diverse credit portfolio demonstrates your ability to successfully manage different types of credit.

With the knowledge of exactly how your score gets calculated, you can make smarter decisions with credit.

Bottom line: Credit scores aren’t as mysterious as they first appear, and you have control over all of the factors that determine your score.

2. Credit reports are different than credit scores

Although they are related, a credit report and a credit score are different. Also, it’s a bit misleading to talk about a single credit report or a single credit score, because the reality is that you have several different credit reports, and your credit score can be calculated in many different ways.

- A credit report is a collection of information about your credit behaviors, like the accounts you have and when you make payments. Three main bureaus—Experian, Equifax and TransUnion—each publish a separate credit report about you.

- A credit score uses the information in your credit report to create a numerical representation of your creditworthiness. In other words, all of the information in your report is simplified into a single number that gives lenders an idea of how likely you are to repay a debt.

Surprisingly, your credit report does not include a credit score. Instead, lenders who access your report use formulas to determine a score when you apply for credit. The most common scoring models are FICO and VantageScore, but lenders can make modifications to the calculations to give more weight to areas that are more important to them.

Bottom line: You’ll want to be familiar with both your credit reports and your credit scores, as they each play a role in helping you obtain new credit.

3. Negative credit items will eventually come off your credit report

Negative items on your credit report can cause damage to your credit score. Negative items include late payments, collection accounts, foreclosures and repossessions.

Although these items can lead to significant drops in your credit score, their effect is not permanent. Over time, negative items have a smaller and smaller impact on your score, as long as your credit behaviors improve so that more recent items are more favorable.

Additionally, most negative items should remain on your report for seven years at the most due to the regulations set by the Fair Credit Reporting Act. A bankruptcy, on the other hand, can last up to 10 years in some cases.

Bottom line: Negative items can cause a decrease in your credit score, but they aren’t permanent. Start building new credit behaviors and your score can recover over time.

4. FICO credit scores range from 300 to 850

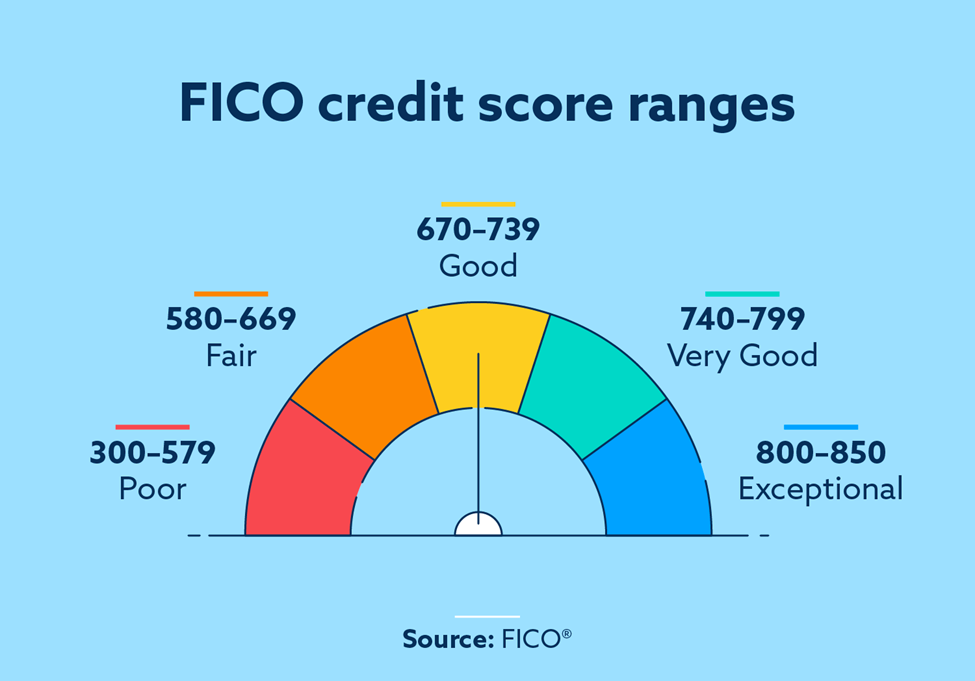

Although it’s possible to have a score that’s lower than 300 or higher than 850, most scores will fall between this range. Scores that are considered good, very good or exceptional often make it much easier to get new credit cards or loans when you need them. On the other hand, scores that are fair or poor can make getting new credit more difficult.

Here’s an overview of the FICO scoring ranges:

- 800 – 850: Exceptional

- 740 – 799: Very Good

- 670 – 739: Good

- 580 – 669: Fair

- 300 – 579: Poor

Remember, though: credit scores are not fixed and permanent. Your score responds to factors like payments, utilization and credit history, so positive decisions now will benefit your score in the long term.

Bottom line: The FICO scoring ranges lay out broad categories to give you a sense of how you’re doing with credit—and can also help you set a goal for where you want to be.

5. You have more than one score, but FICO is the most common among lenders

While there are multiple credit scoring models, the majority of lenders check FICO scores when making decisions. That means that when you apply for new credit—whether it’s a credit card, a loan or a mortgage—the score that’s more likely to matter is your FICO score.

That’s important to know, because many free credit monitoring services will show you score estimates or your VantageScore. Some credit card companies provide a FICO score, however, and you can also request to see the credit score that lenders used to make their decision during the application process.

Fortunately, credit scoring models tend to reference the same data and weight factors fairly similarly. That means if you make on-time payments, keep your utilization low, avoid opening up too many new accounts and have a consistent credit history with a variety of accounts, you’ll probably be in good shape regardless.

Bottom line: Knowing your FICO score can help you have an idea of how lenders will view your application for new credit.

6. You have many different types of credit scores

Credit scores vary based on the credit bureau reporting them and the credit scoring model used. The major credit bureaus all have slightly different information regarding your credit history. This means that these three, along with other credit reporting agencies, report several FICO credit scores to lenders to account for different information they’ve collected.

There are also different scores specific to particular industries. For example, auto lenders review different risk factors than mortgage lenders, so the scores each lender receives might differ. Although it can get confusing, the most important things to remember are the five core factors that affect your credit score.

Bottom line: Although many people reference their credit score in the singular, the truth is that there are many different types of credit scores that take into account different factors.

7. Checking your own credit won’t hurt your score

Many people believe that checking their credit score or credit report hurts their credit, but fortunately, this isn’t true. Getting a copy of your credit report or checking your score doesn’t affect your credit score. These actions are called “soft” inquiries into your credit, and while they are noted on your credit report, they shouldn’t have any effect on your score.

Hard inquiries, on the other hand, are noted when lenders look at your credit during an application process—and these can temporarily reduce your score. This is used to discourage you from applying for new credit too frequently. However, the effect is typically small, and after a couple of years the notation of a hard inquiry will leave your report.

Bottom line: You can check your own credit report and credit score without any negative effect—and we actually encourage you to do so to stay on top of your credit health.

8. You can check your credit score and credit reports for free

There are three main ways to check your credit for free. You’ll likely want to take a look at both your credit reports and your credit scores. Here’s how to get a hold of both of those:

- You’re entitled to a free credit report on a regular basis. You can access your reports by visiting AnnualCreditReport.com, a government-sponsored website that gives you access to your reports from TransUnion, Experian and Equifax.

- You may be able to check your credit score free by contacting your bank or credit card company. Additionally, many free services—like Mint—enable you to monitor your score for free. Just make sure to note which kind of credit score you’re seeing, because there are many different scoring methods.

The information you find in your credit report lays out the factors that determine your credit score. By scanning your report closely, you’ll likely find out the best strategy for improving your score—for instance, by improving your payment history or lowering your utilization.

Bottom line: Information about your credit is freely available, so take advantage of those resources to stay on top of your credit report and score.

9. Your credit score can cost you money

Ultimately, the purpose of credit scores is to help lenders determine whether they should offer you new credit, like a loan or a credit card. A lower score indicates that you may be at greater risk for default—which means the lender has to worry that you won’t pay back your debts.

To offset this risk, lenders often deny credit applications for those with lower scores, or they extend credit with high interest rates. These interest rates can cost you a lot of money over time, so working to improve your credit score can have a measurable effect on your financial life.

Consider, for example, a $25,000 auto loan. With a fair credit score, you may secure an interest rate of 5.3 percent—so you’ll pay a total of $3,513 in interest over five years. With an excellent credit score, your rate could drop to 3.1 percent, and you’ll save nearly $1,500 in interest charges over that same five-year period.

Bottom line: A good credit score can have a positive impact on your finances, and a bad score can cost you money in interest charges.

10. Canceling old credit cards can lower your score

If you have a credit card that you’re no longer using, you may be tempted to close the account entirely. Before doing that, though, consider how it could impact your credit score.

Recall that two credit factors are utilization and length of credit history. Closing an old account could affect one or both of those factors when it comes to calculating your score.

- Your credit utilization could drop after closing an account because your credit limit will likely be lower. Since utilization represents all of your balances divided by your total credit limit, your utilization will go up if your credit limit goes down (and if your balances stay the same).

- Your length of credit history could be lowered if you close an older account that is raising the average age of your credit.

Some people worry that having a zero balance on their credit card can negatively impact their score. This is just a credit myth. A zero balance means you aren’t using the card to make any purchases. Keeping the credit card open while not using it actually works to your benefit. You’re able to contribute to the length of your credit history, while not risking the chance of debt and late payments.

You may need to use the card every now and then to avoid having it closed. Additionally, if the card has an annual fee, you may need to close the card or ask to have the card downgraded to a version that does not have a fee. Still, if there’s a way to keep the card open, it’s often good to do so even if you don’t plan to regularly use it.

Bottom line: An old credit card can benefit your credit score even if you aren’t using it anymore.

11. You can still get a loan with bad credit

It’s true that getting a loan can be more difficult with bad credit, but it’s not impossible. There are bad credit loans specifically for people with lower credit scores. Note, however, that these loans often come with higher interest rates—or they require some sort of collateral that the lender can use to secure the loan. That means if you don’t pay your loan back, the lender will be able to seize the property you put up as collateral.

If you don’t need a loan immediately, you could consider trying to rebuild your credit before applying. There are credit builder loans, which are specifically designed to help you build up a strong payment history and improve your credit in the process. Unlike a traditional loan, you pay for a credit builder loan each month and then receive the sum after your final payment. Since these loans represent no risk to lenders, they’re often willing to extend them to people with poor credit history looking to raise their score.

Bottom line: You can get a loan even with bad credit—but sometimes it’s wise to find ways to raise your score before applying.

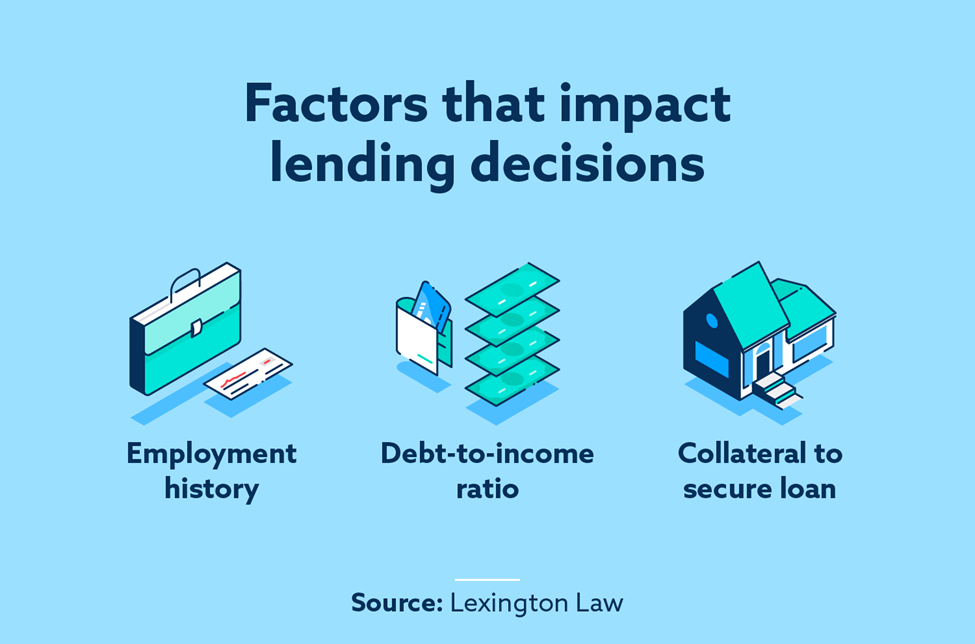

12. Credit scores aren’t the only deciding factor for lending decisions

While credit scores are important in lending decisions, lenders may take other factors into account when deciding whether to offer you new credit. For example, your income and employment can play a significant role in your approval odds. Additionally, some loans (like auto loans and mortgages) are secured by collateral that the lender can seize if you default. These loans may be considered less risky for the lender in certain cases because the asset can help offset any losses from nonpayment.

In many cases, your debt-to-income ratio is also an important factor in whether you’re approved for a loan or credit card. Lenders consider your current monthly debt payments (from all sources) as well as your monthly income to determine whether you may be overextended financially.

Two different people may pay $1,500 each month for student loans, a car payment and a mortgage. That said, if one individual makes $3,500 each month and the other makes $8,000 each month, their situations will be considered very differently by a potential lender.

Bottom line: Keeping your credit score high can help you secure credit when you need it, but you’ll want to stay on top of all aspects of your financial health.

13. Your credit report can help you spot fraud

Regularly checking your credit report can help you notice fraud or identity theft. If someone is using your information to open accounts, they will show up on your credit report.

If you notice an account that you did not open, you’ll want to start taking steps to protect your identity from any further damage. You may also want to freeze or lock your credit, which prevents anyone from using your information to open up more accounts.

Bottom line: Reviewing your credit report provides you an opportunity to notice when something is amiss.

14. Joint accounts affect your credit scores, but you do not have joint scores

If you have a joint account with someone else, that account will be reflected on both of your credit reports. For example, a loan that was opened by you and your spouse will show up for both of you—and will affect both of your credit scores. That said, your credit history, credit report and credit score remain separate. No one—including married couples—has a joint credit report or joint credit score.

In addition to joint accounts, you may also have authorized users on your credit card, or be an authorized user yourself. Authorized users have access to account funds, but they are not liable for debts. That means that if you make someone an authorized user on your credit card, they can rack up charges, but you’ll be on the hook if they don’t pay.

Because joint account owners and authorized users can influence credit scores in significant ways, we advise you to be careful about who you open accounts with or provide authorization to.

Bottom line: Even though joint account owners and authorized users can influence someone else’s credit, there are no shared credit reports or joint credit scores.

15. Many credit reports contain inaccurate credit information

The Federal Trade Commission found that one in five people has an error on at least one of their credit reports, and these inaccuracies can greatly impact your credit. (Also see this 2015 follow-up study from the FTC for more information regarding credit report errors.) This is why you should frequently check your credit report and dispute any inaccurate information. For example, since payment history accounts for 30 percent of your credit score, one wrong late payment can significantly hurt your score.

It’s important to get your credit facts straight so you understand exactly how different things impact your score. One of the first things you should learn is how to read your credit report so you can quickly spot discrepancies and ensure that the information reported is fair and accurate.

After scrutinizing your credit report, you can look into other ways to fix your credit, like paying late or past-due accounts, so you can help your credit with your newfound knowledge. You can also take advantage of Lexington Law Firm’s credit repair service to get extra help and additional legal knowledge to assist you.

Bottom line: Your credit report could have inaccurate information that’s hurting your score unfairly. Fortunately, there is a credit dispute process that can help you clean up your report and ensure all of the information on it is correct.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.