The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

By 2028, women are projected to own 75 percent of discretionary spending in the United States.

Considering women make up 51 percent of the U.S. population, female consumer trends have a strong influence on the economy. Collectively they make up a sizable growth market that can’t be ignored.

Women are increasingly invested in the quality of the items they buy and how well they fit their lifestyle. Since they’re more likely to shoulder the responsibility for things like household purchases, grocery shopping and meal preparation, convenience is a high priority in women’s spending habits and something they seek out in their everyday lives.

Businesses that fail to understand the unique characteristics of female consumers are ultimately losing out on a valuable market. Greater effort will be required to keep up with the evolving consumer landscape that is driven largely by women. By analyzing the statistics associated with women’s spending habits, we can gain insight into their preferences, values and thought processes when it comes to what and how they buy. Read on to learn more.

Note: We reference the most updated data available, but sometimes that information is from several years ago—check each individual source for specifics.

Table of contents:

- Overview of how women spend

- Men’s vs. women’s spending habits

- Online vs. in-store shopping habits

- What consumer goods are women buying?

- Women’s purchasing values

- Opportunities for financial success

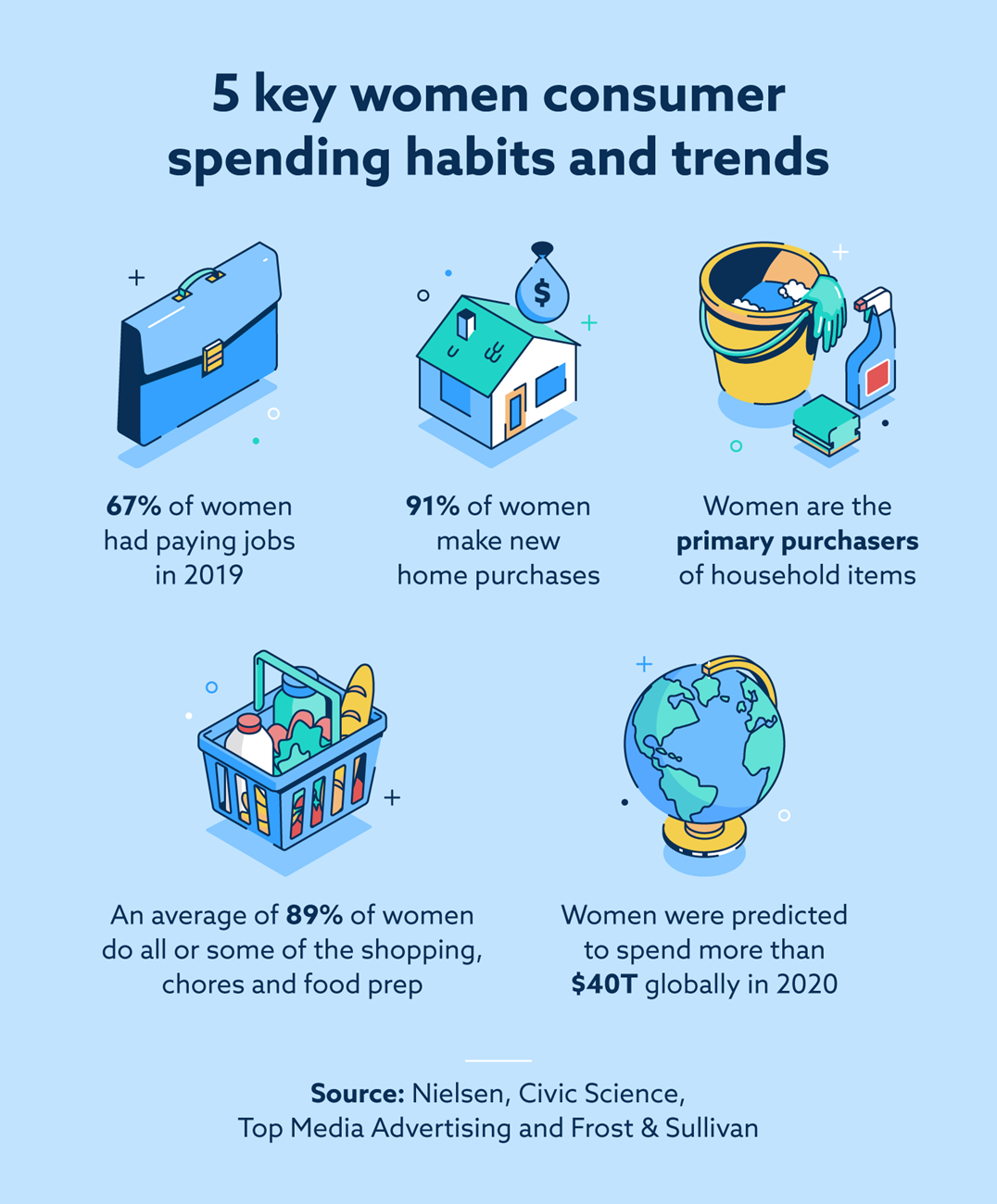

An overview of female consumer trends

The impact of female consumerism in the U.S. is hard to understate, as they make the majority of all consumer purchases. This could be attributed to the fact that women often buy not only for themselves but also for their families and children.

With women leading the majority of household purchases, retailers could benefit from focusing on how they can best serve the vast number of female consumers who stimulate their sales year after year.

- By 2028, women are projected to own 75 percent of discretionary spending in the United States. [Source: Nielsen]

- Women make 91 percent of new home purchases. [Source: Girlpower Marketing]

- An average of 89 percent of women across the world reported controlling or sharing daily shopping needs, household chores and food prep compared to an average of approximately 41 percent of men. [Source: Nielsen]

- Women are the primary purchasers of everyday household items. [Source: Nielsen]

- 61 percent of women in the U.S. believe that they are worse off or about the same compared with five years ago when it comes to finances. [Source: Nielsen]

- 67 percent of women in 2019 were employed for pay. [Source: Civic Science]

Men’s vs. women’s spending habits

There are often notable differences between the minds of men and women, including what motivates them when it comes to their spending habits. While neither gender can be placed in a box and a broad range of characteristics exist for each, there are general patterns that can shed light on their financial lives and choices.

The answer to the question “Do women shop more than men?” is a bit complex. Women are often far more selective in their purchases than men and are willing to spend the time necessary to find products that fit their needs and requirements. While men are usually more straightforward and goal-oriented in their shopping, women are more detail-oriented, paying attention to the quality of an item before purchasing. The majority of men prefer to get in and get out of a store as quickly as possible, while women generally enjoy the shopping process as a whole.

Female buying behaviors indicate that they want a risk-free and convenient shopping experience, which goes hand in hand with their desire for their purchases to enhance their lifestyles. They frequently prioritize ensuring that their purchases check every box and fulfill their needs, and usually spend more time than men making sure of this before spending any money.

- 43 percent of women and 52 percent of men prefer making technology purchases online. [Source: First Insight]

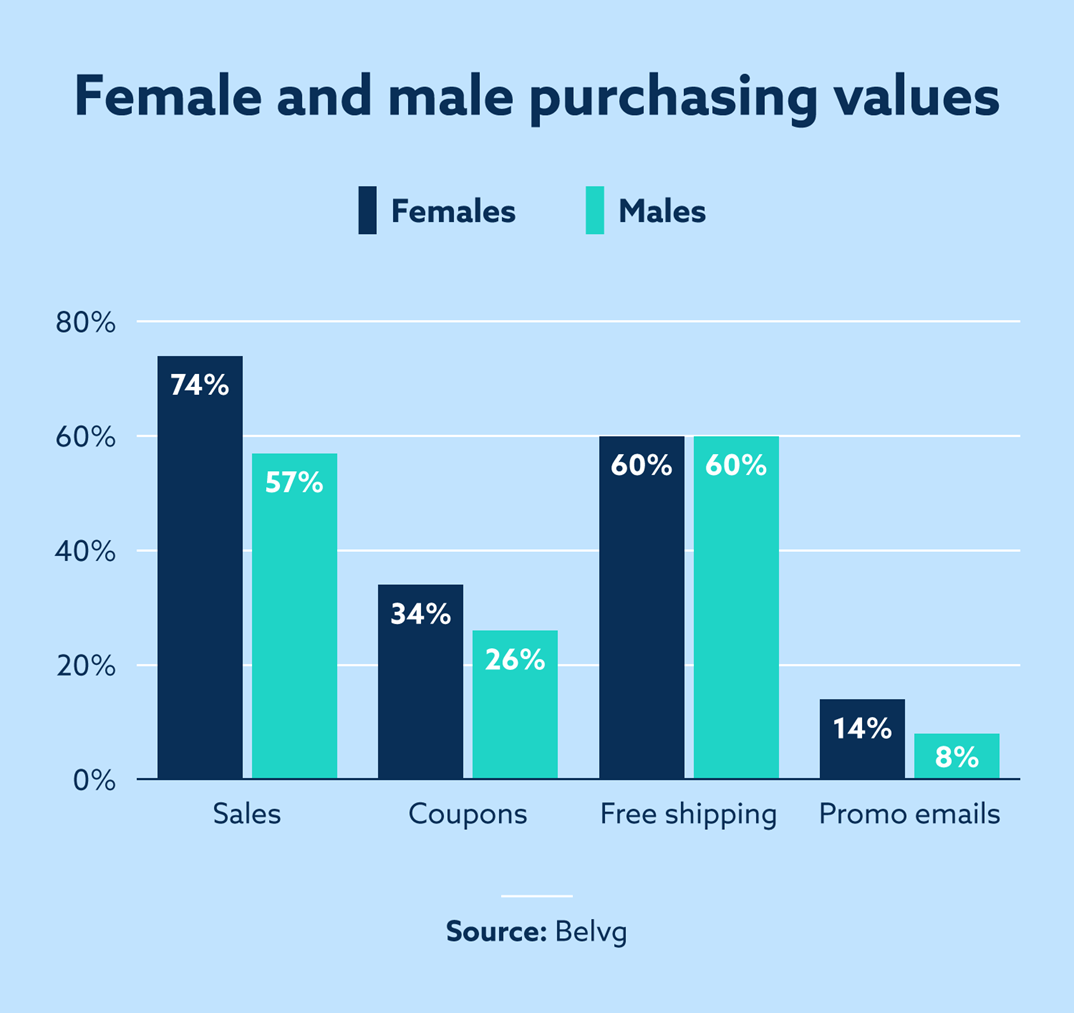

- 74 percent of women report finding items on sale matters to them in their purchasing habits, compared to just 57 percent of men. [Source: Belvg]

- 34 percent of women report caring about applying coupons and promotions to their purchases, compared to 26 percent of men. [Source: Belvg]

- 14 percent of women are inclined to study promotional emails, compared to only 8 percent of men. [Source: Belvg]

- 58 percent of women report checking products and prices on Amazon.com before looking elsewhere, compared to 64 percent of men. [Source: First Insight]

- 42 percent of women are encouraged to buy online if free delivery is included, as opposed to 35 percent of men. [Source: Nielsen]

- 91 percent of women buy food and groceries in-store, compared to 86 percent of men who do the same. [Source: First Insight]

- Women are 48 percent more likely to use reusable shopping bags than men. [Source: Civic Science]

- 30 percent of women are encouraged to shop online if they receive text or email updates on product availability, as opposed to 27 percent of men. [Source: Nielsen]

- 42 percent of women are encouraged to buy online when the purchase includes a money-back guarantee, as opposed to 31 percent of men. [Source: Nielsen]

- 67 percent of women examine food labels to determine if a product is healthy, while only 48 percent of men do the same. [Source: Nielsen]

- Women are 13 percent more likely than men to deem a product premium based on whether it contains high-quality ingredients. [Source: Nielsen]

- Slightly more women than men prefer to shop online at 72 percent, compared to 68 percent of men. [Source: Belvg]

Online vs. in-store shopping habits

While the digital shopping landscape continues to grow more robust and popular with each passing year, women are still making more in-store purchases than they are online. However, even though women consumers are more inclined to spend more in-store, they aren’t as inclined to visit a store in person unless they have a specific purchase in mind. Retailers can capture this opportunity by making sure they’re offering the exact products women are specifically searching for when they visit a store.

- 72 percent of women shop online. [Source: OptinMonster]

- When shopping online, 77 percent of women say they add extra items to their carts that they didn’t originally intend to purchase. [Source: First Insight]

- Adding extra unplanned items to their cart is more common among in-store shoppers, with 89 percent of women saying they sometimes or always do so when shopping in person. [Source: First Insight]

- 69 percent of women choose in-store shopping when they need something specific. [Source: First Insight]

- 56 percent of women choose online shopping when they have a specific need for something. [Source: First Insight]

- 70 percent of women usually spend $50 or more when shopping in-store, compared to only 49 percent who spend more than $50 when shopping online. [Source: First Insight]

- 33 percent of women spend over $100 during an average in-store shopping trip, while only 17 percent say they spend over $100 when shopping online. [Source: First Insight]

- 91 percent of women buy food and groceries in-store. [Source: First Insight]

- 47 percent of women shop on eBay, and 80 percent of women use Etsy. [Source: RepricerExpress]

- 46 percent of women shop for clothing and sporting goods online. [Source: Belvg]

- 25 percent of women purchase books, magazines and learning materials online. [Source: Belvg]

- 10 percent of women buy medicine online. [Source: Belvg]

- 35 percent of women spend on travel and holiday accommodations online. [Source: Belvg]

- 30 percent of women purchase household items online. [Source: Belvg]

- 26 percent of women purchase event tickets online. [Source: Belvg]

- 16 percent of women buy music or movies online. [Source: Belvg]

What consumer goods are women buying?

With data pointing to women as most often responsible for the majority of grocery shopping and meal preparation, the food industry represents a significant opportunity for companies to find ways to connect with their female consumers.

Women also spend significant amounts on beauty products, clothes and travel. With clothing ranking as a top spending category among women, the continued evolution of the retail world represents a chance to lean further into the habits of women consumers.

Beauty and skin care spending

Women have historically spent a considerable amount on personal care, cosmetics and skin care, and it’s no different today. While makeup and beauty products aren’t a part of every woman’s routine, almost everyone uses some type of skin care product—even if it’s just sunscreen or hand lotion. This sheds some light on the astonishing size and increasing growth of the skin care market, particularly among women.

While older consumers used to lead the demand for products in these industries, an increasing number of younger women now play a significant part. This could explain the shift in the market, indicating women’s increasing desire for more natural and organic products, which continues to go up as consumers become more knowledgeable about toxic ingredients in their products and factors like sun damage. Cosmetics and skin care brands that recognize these emerging values among their consumers will outgrow those that don’t.

- The global skin care industry is estimated to reach $189.3 billion in the U.S. by 2025. [Source: Statista]

- Natural cosmetics had a global market value of $34.5 billion in 2018, and are expected to increase in value to $54.5 billion by 2027. [Source: Statista]

- Women who spend money on their appearance will spend roughly $225,360 in a lifetime. [Source: OnePoll]

- When it comes to beauty-based purchases, women spend the most on facials, haircuts, makeup, manicures and pedicures. [Source: OnePoll]

- Women spend $91 a month on facial products. [Source: OnePoll]

- The fragrance industry will reach an estimated $91.17 billion globally by 2025. [Source: Health Careers]

- Women in their 30s buy more anti-aging products than women between the ages of 40 and 60. [Source: OnePoll]

- Women in their 20s make more makeup purchases than any other age group. [Source: OnePoll]

Household and grocery spending

Data shows that women do the majority of household spending, grocery shopping and meal preparation. With women generally spending more time on household duties than men, it’s no surprise that much of their spending is allocated to these categories.

- Women are twice as likely to take charge of household grocery shopping than men. [Source: Civic Science]

- 80 percent of women who have children and live with a spouse or partner say they are typically in charge of meal prep. [Source: Pew Research]

- 75 percent of women without children who live with a spouse or partner say they are typically in charge of meal prep. [Source: Pew Research]

- 80 percent of women who have children and live with a spouse or partner say they are typically the grocery shopper. [Source: Pew Research]

- 68 percent of women without children who live with a spouse or partner say they are typically the grocery shopper. [Source: Pew Research]

- Women spend more money per grocery shopping trip than men, averaging $44.43 per trip. [Source: Nielsen]

Clothing spending

Clothes have always been a large category of spend among women. The market value for women’s retail is expected to rise to around $394 billion by 2025, and retailers are becoming more aware of what women want in their clothing. They value versatility and functionality without sacrificing function and utilize their fashion choices as a source of empowerment and confidence.

Growth in the retail industry among women could be due to the fact that economically empowered female consumers who maintain the majority of control of spending in American homes have more purchasing power, much of which continues to be allocated toward clothes.

Digital trends are also impacting women’s shopping habits, and almost three-quarters of women now shop online. Women are increasingly utilizing social media platforms for fashion discovery, product inspiration and finding authentic reviews from their peers online.

- On average, the clothes in a woman’s wardrobe equal between $1,000 and $2,500. [Source: CreditDonkey]

- 9 percent of women have over $10,000 worth of clothing in their closet. [Source: CreditDonkey]

- 32 percent of women in the U.S. own over 25 pairs of shoes. [Source: CreditDonkey]

- Over half of women estimate that 25 percent of their wardrobe goes unworn. [Source: CreditDonkey]

- Every three months, 73 percent of women refresh one quarter of their closet. [Source: CreditDonkey]

- Around 15 percent of women don’t have clothes older than five years old in their closet. [Source: CreditDonkey]

- Women who are 16 and older spend an average of 76 percent more on clothing than men every year. [Source: CreditDonkey]

- Women between the ages of 45 and 54 spend $793 per year on clothing, the highest spent of any age group. [Source: CreditDonkey]

- 75 percent of women over 18 would choose Target for undergarments over Victoria’s Secret. [Source: Civic Science]

Women’s purchasing values

Diversity and inclusion factors have a larger impact than ever on women’s shopping decisions and expectations. With diversity and inclusivity growing increasingly important in the world of retail and beyond, women consumers expect brands to evolve with the cultures they serve. Among women today there is more scrutiny of brands’ and retailers’ values, hiring practices, product-to-market placements and ability to truly listen to their customers.

Women, like all people, are driven by their values and habits, so understanding what’s important to them, what their day-to-day lives look like and what makes them unique is crucial in fostering a true connection that might influence purchasing behavior.

- About half of women in the U.S. believe that having minority-held leadership positions is important and believe that retailers would benefit from hiring Chief Diversity Officer positions. [Source: First Insight]

- 45 percent of women say cultural inclusivity in brands is important. [Source: First Insight]

- 44 percent of women believe it’s important for influencers to represent diverse points of view. [Source: First Insight]

- 67 percent of women say that inclusivity in extended sizing is the top diversity factor to consider. [Source: First Insight]

- 55 percent of women in the U.S. say they would temporarily stop shopping at a brand or retailer who released an offensive product. [Source: First Insight]

- 71 percent of women believe brands and retailers should make it at least six months without any offensive items released before they would feel comfortable purchasing from them again. [Source: First Insight]

Opportunities for financial success

Women who are active in their own financial planning are less stressed on average than those who avoid it. There are many ways to prioritize financial success such as committing to your retirement savings, learning investment strategies and managing your personal credit and debt.

Managing credit card debt or poor credit is an important starting point on the road to financial success. Taking responsibility for debt or bad credit will help you secure a more prosperous financial future, and utilizing the help of a credit repair team could help you manage the process. If you are a woman moving toward financial independence, know that it’s never too late to take steps toward a brighter financial future.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.