A balance transfer is a way to move debt, and many people use this strategy to pay off debt faster and get lower interest rates.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

As of the end of 2022, the total household debt in the United States was almost $17 trillion. The total credit card debt was over $980 billion, with the average consumer credit card debt at $5,910 per person. If you’re one of the millions of Americans with credit card debt, balance transfer credit cards may be a way to help you pay the debt off faster and benefit from a lower interest rate as well.

Although balance transfers can be beneficial, there are drawbacks as well. Here, we go over what balance transfer credit cards are, how they work and their pros and cons. With this information, you will be better able to make the right decision for your specific debt situation.

What is a balance transfer credit card?

A balance transfer is when you transfer an outstanding balance from one account to another, such as from one credit card to a different card with a lower interest rate. In essence, a credit card balance transfer is a way of moving debt around. A balance transfer can be a great way to manage existing debt.

If you transfer your balance to a new credit card that features an interest-free introductory period, you could give yourself a window of time to pay off your debt without incurring additional interest. AARP advises looking for interest-free periods of 12 months or more.

What is a balance transfer fee?

A balance transfer fee is a cost the lender charges for you to move a debt over from another institution.

This amount varies by lender, and many even waive balance transfer fees for an introductory period (typically 60 days) after opening an account. For example, Bank of America balance transfer credit cards charge 3 percent of your transferred balance with a $10 minimum.

How do balance transfers work?

Balance transfers work by allowing cardholders to “pay off” the balance on a card with a high interest rate, using a card with an interest rate that’s lower, even if only temporarily.

Many banks offer balance transfer credit cards specifically for people who are looking to take advantage of introductory zero-interest offers. While you still technically owe the debt you transferred, a balance transfer allows you to pay the debt off gradually with no added interest for a period of time.

Be aware, however, that you are still required to make on-time payments. Your interest rate may increase once the introductory period ends, and issuers will apply it to an unpaid balance going forward.

How to choose a balance transfer credit card

Before choosing a balance transfer credit card, there are some steps you can take to help make the right decision for you. As with many financial decisions, it’s a good idea to have as much information as possible before making a decision.

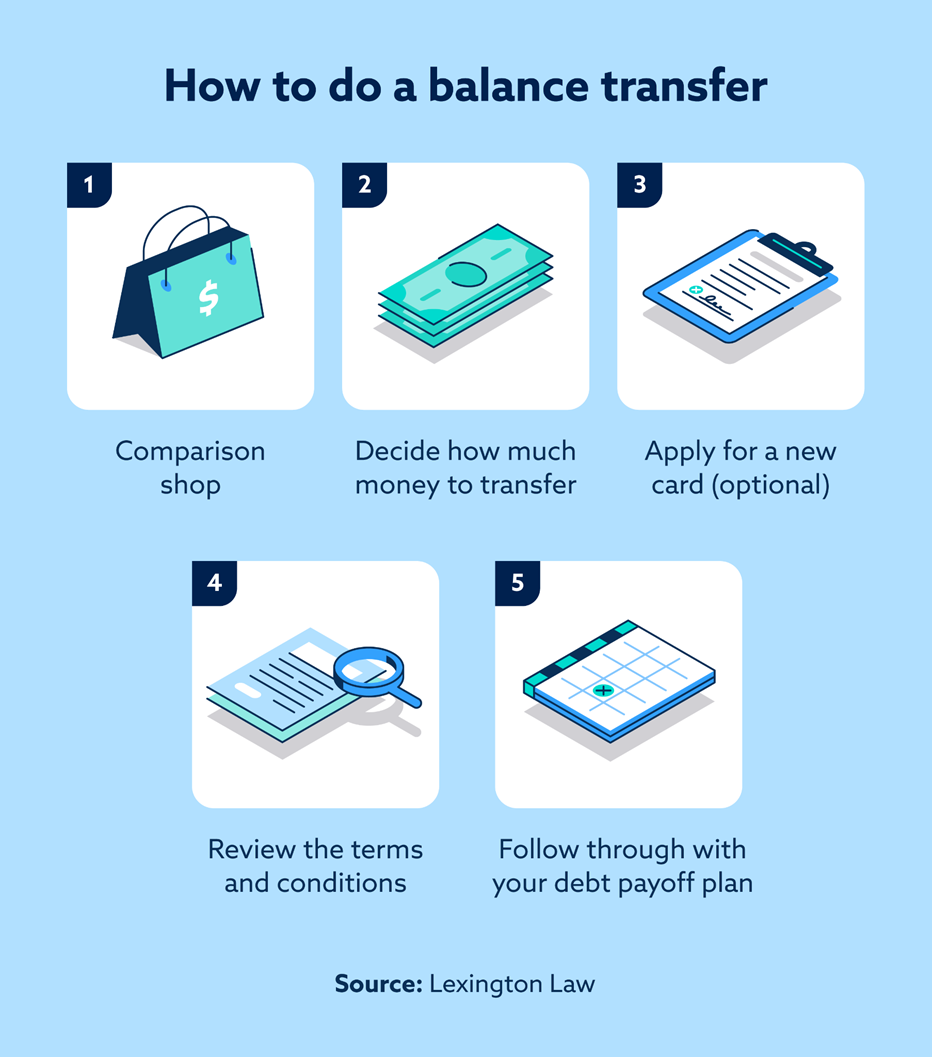

Step 1: Comparison shop

First, compare details such as the balance transfer fee, interest rate, length of the promotional period, annual fee, credit limit and basic requirements to qualify. If possible, narrow your search down to cards that offer a 0 percent interest rate period. This type of promotion will allow you to put all the money you save in interest back into paying off your debt.

If you already have multiple credit cards, you may be able to transfer your balance to one of them. This option can save you from a hard inquiry, which can temporarily hurt your credit.

Step 2: Decide how much money to transfer

You can transfer part of your balance to a new card or all of it. However, transferring the full balance might not always be an option due to your new credit limit. It also might not be the best option if the card’s fee is based on the transfer total. Determine what amount is best based on your credit utilization ratio, balance transfer fees and card transfer limits.

Step 3: Apply for a new card (if not transferring to an existing card)

You can apply for most balance transfer credit cards online in just a few minutes. You’ll need basic personal information like your address, Social Security number and annual income. Remember that this will result in a hard inquiry.

Step 4: Review the terms and conditions

Whether you transfer debt to an existing card or a new one, the fine print on a balance transfer can be lengthy. Review it thoroughly so that you’re aware of the potential fees, terms and official agreements of the transfer.

Step 5: Follow through with your debt payoff plan

This is especially important if you have a temporary low- or a zero-interest period because you want to avoid paying more money in interest. Try to avoid making new purchases on the balance transfer card. Your priority is to get your debt under control. Consider using autopay to help you make payments on time and in full.

How to do a balance transfer

To transfer your balance, start by determining which balances are best to transfer if you aren’t doing all of your balances. If you’re only doing some balances, it’s a good idea to start by transferring the balances from cards with the highest interest rates.

After this, you can calculate the transfer fees. If there’s not a cap on the amount that you can transfer, it’s beneficial to transfer some of the larger balances because it can save you on interest, even though the fee may be higher. When you’re ready to transfer the balance, just make sure the balance isn’t higher than the maximum credit limit on the new card.

Pros and cons of a credit card balance transfer

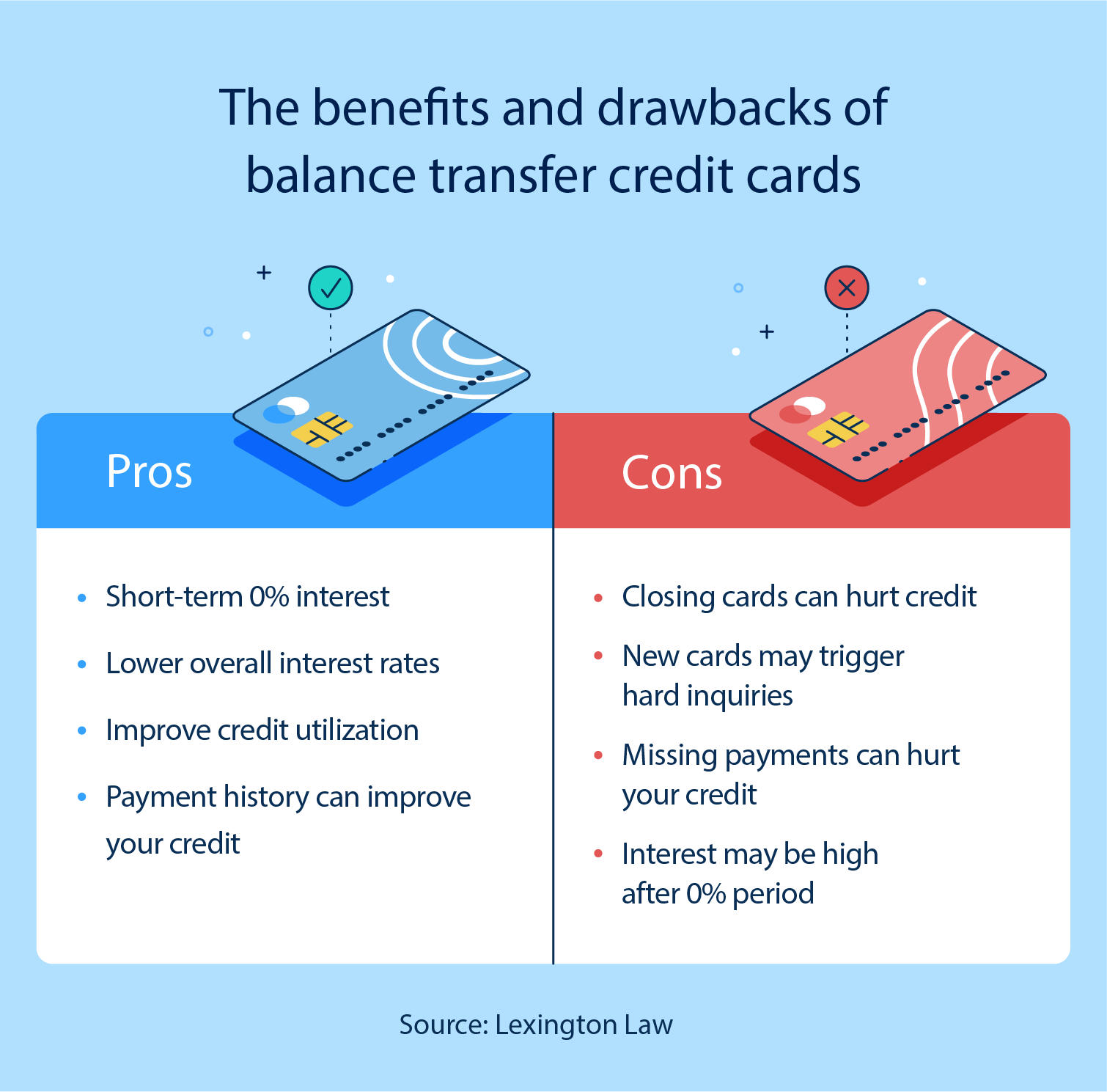

There are several potential advantages to using balance transfers to pay off credit card debt. When done effectively, they can help you by:

- Granting you a short-term interest-free window: Cards with attractive introductory offers could give you a year or more to pay off your debt interest-free.

- Lowering your interest rate: By transferring your balance to a card with a lower interest rate, you can potentially lower your monthly payments and total debt.

- Improving credit utilization: Having multiple credit cards open increases your available credit while leaving your usage the same, which improves your overall utilization. This can be good for your credit.

- Improving your payment history: If you make payments on your new card on time and in full, you’ll build up a positive payment history, which is likely to improve your credit over time.

While there are clear benefits to balance transfers, you should be aware that there are some potential drawbacks as well:

- Lowering credit utilization: If you elect to close your old credit card and it has a higher credit limit than your new one, you will lower your available credit while keeping your usage the same. This could hurt your credit.

- Hard inquiries: Hard inquiries are required for any credit card application and result in a slight drop in your credit score. Though multiple applications of the same type in a short period sometimes count as only one inquiry, it can be good to try to limit your credit card applications. Some experts recommend spacing out applications by at least six months.

- Missed payments: If you miss a payment on your new card, you could end up damaging your credit.

- Debt cycle: If you aren’t able to pay off your debt during a zero-interest period, you could fall into a balance transfer debt cycle of opening new credit cards, requiring more inquiries and transfer fees.

Balance transfer FAQ

Balance transfer credit cards may seem complicated, but they can be a great tool to help improve your financial well-being. Below, we answer some common questions about balance transfer cards.

How long do balance transfers take?

This period can vary from a few days to a few weeks. This will depend on the financial institution.

Do balance transfers hurt your credit?

If you transfer the balance to a credit card you already have, the transfer itself should not hurt your credit. If you have to apply for a new balance transfer card, it will trigger a hard inquiry, which temporarily negatively affects your credit.

Who qualifies for a balance transfer credit card?

Each credit card company will have different criteria for who qualifies, but many will use your credit score as a primary determining factor. A higher score will increase your chances of being approved.

Balance transfer credit considerations

It’s good to check your credit reports and credit scores regularly, and this is especially true when you change something about your finances, like when you complete a balance transfer. If the consequences of your balance transfer hurt your credit, there are steps you can take to work on improving your credit.

If you find yourself struggling to understand your credit—or how to repair it—consider professional help. The credit repair team at Lexington Law Firm can help you review your credit report to make sure it’s a fair, accurate and substantiated representation of your credit profile.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.