The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

If you’re planning to buy a house in the near future, you may be paying extra attention to your credit. While good credit can help you qualify for the best terms and interest rates, bad credit can stand in the way of your dream home.

If your credit could use a little TLC, continue reading to learn more about credit repair for first-time home buyers and discover helpful tips to improve your credit.

Table of contents:

- 1. Pay your bills on time

- 2. Look for errors on your credit report

- 3. Dispute any inaccuracies

- 4. Lower your credit utilization

- 5. Consider consolidating your debt

- 6. Leave old credit accounts open

- 7. Avoid opening new credit accounts

- 8. Get help from a credit repair company

1. Pay your bills on time

Since payment history is the number one factor that affects your credit score, the first step in repairing your credit is getting current with your bills. Late payments, especially those over 30 days past due, can cause your credit to take a significant hit. Not to mention late payments can stay on your credit report for seven years and continue to negatively impact your credit, although the effect lessens over time.

If you’ve missed payments in the past, it’s important to get back on track with making your payments on time. Consider creating a budget, making a list of all your bills, noting their due dates and setting reminders so you don’t forget to pay them. Set up automated payments wherever possible.

Pro tip: Build an emergency fund so you’re still able to pay your bills even if you get hit with an unexpected expense.

2. Look for errors on your credit report

Errors on your credit report could negatively impact your ability to secure a mortgage. In fact, a recent study by Consumer Reports found that 34 percent of participants had at least one error on their credit report.

According to the Consumer Financial Protection Bureau, common errors to look for include:

- Identity errors: These include inaccuracies regarding your personal information. For instance, your name, address or phone number may be incorrect or misspelled. Make sure to look for accounts that don’t belong to you and could be the result of identity theft.

- Reporting errors: These are errors regarding the state of your accounts. For example, accounts you previously closed that are inaccurately reported as open.

- Data errors: These could be duplicate accounts or incorrect information that had previously been corrected.

- Balance errors: These include wrong balances or credit limits.

While not all errors affect your credit score, incorrect payment dates or account statuses can have a significant adverse effect, so it’s important to review your credit report before buying a house.

Pro tip: You can get a copy of your credit report from each of the three credit bureaus for free at AnnualCreditReport.com.

3. Dispute any inaccuracies

If you identify any errors on your credit report, you will want to get the inaccurate information removed if you can. File a dispute with the credit bureau via their website, mail or phone.

Regardless of the method you choose, make sure to clearly state what items you’re challenging and why the information is wrong. Consider including a copy of your credit report and highlighting or circling the errors.

Once you file a dispute, the credit bureau has 90 days to complete an investigation into your claim. If the bureau confirms that the error is inaccurate, they will remove it from your credit report. You should see the correction reflected in your score within a few weeks.

Pro tip: Use the Federal Trade Commission’s sample letter as a guide when writing your letter.

4. Lower your credit utilization

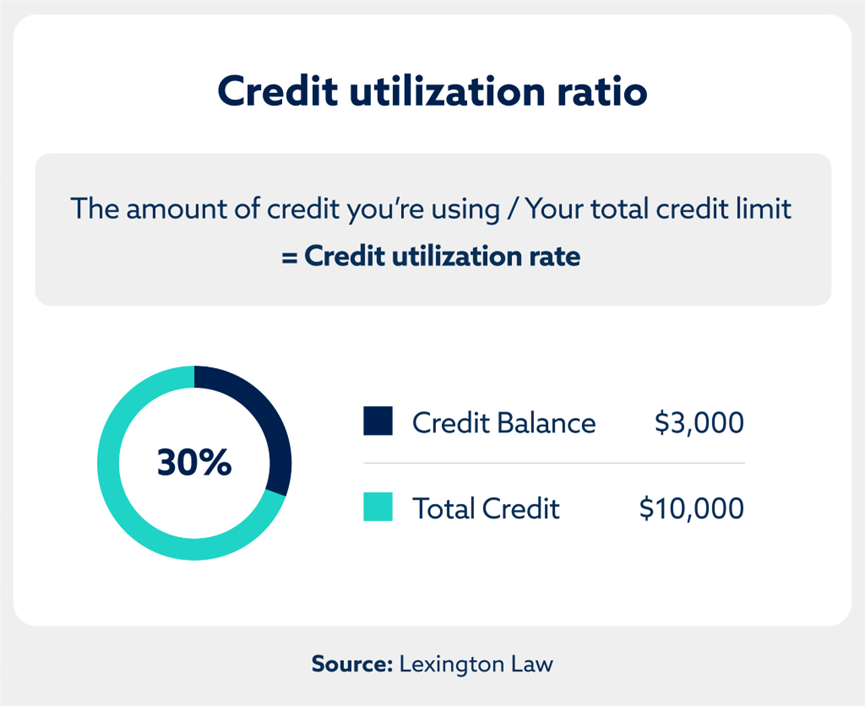

Credit utilization is another factor that influences your credit. Your credit utilization ratio is the amount of credit you’re using in relation to the amount of credit available to you.

Keeping your credit utilization low shows mortgage lenders that you aren’t too reliant on credit. Meanwhile, a high credit utilization ratio could indicate that you may struggle to pay your mortgage.

Here are a few strategies to lower your credit utilization ratio:

- Pay off large purchases immediately: If you make a large purchase on your credit card, consider paying it off the same day if possible.

- Make multiple payments each month: Get in the habit of paying your balance multiple times each month so the credit bureaus are more likely to see a lower number when your credit card issuer reports your statement balance.

- Request a credit limit increase: Contact your credit card issuer to see if you qualify for a credit limit increase. Keep in mind that this may result in a hard inquiry, which could temporarily lower your score.

- Lower your spending: Consider switching to cash or a debit card to decrease the amount of money you charge to your credit card each month.

Pro tip: Generally, experts recommend keeping your credit utilization below 30 percent. For example, if you only have one credit card and the limit is $10,000, you should aim to spend less than $3,000 each month.

5. Consider consolidating your debt

If you struggle to keep track of your different credit accounts and their due dates, consider consolidating your debt into a single monthly payment. This strategy can help you pay off debt quicker and avoid late payments. However, in order for debt consolidation to make sense, you should aim to get a lower interest rate.

There are a few different ways to consolidate your debt, including:

- Zero-percent APR balance transfer credit card: Transfer your credit card debt to a new card, specifically during the 0 percent APR introductory period. Aim to pay down your debt before the introductory period ends—typically between 12 and 21 months.

- Debt consolidation loan: Get a debt consolidation loan from a bank, credit union or online lender. Compare options to find the lowest interest rate.

- Home equity loan: A home equity loan involves using the equity in your home as collateral to borrow money. While home equity loans typically have lower interest rates, you could end up losing your home if you fail to make payments.

- 401(k) loan: If you have a retirement account, you can borrow money from your savings. Keep in mind that taking out a 401(k) loan can hurt your retirement savings since you cannot continue to invest until you pay back the loan.

Pro tip: Weigh the benefits and drawbacks to find the best debt consolidation option for your financial situation.

6. Leave old credit accounts open

You may consider closing old credit accounts that you don’t use anymore, but that can actually hurt your credit. FICO® takes into account your length of credit history when calculating your score.

A long credit history signals to mortgage lenders that you have experience using credit and provides a more thorough track record of your credit history.

You should leave old credit accounts open unless you have another reason for closing them, such as an annual fee.

Pro tip: If your oldest account charges an annual fee, consider calling the credit card issuer to see if you can get it waived.

7. Avoid opening new credit accounts

Opening too many credit accounts in a short time frame can be a red flag to lenders. They may come to the conclusion that you’re financially unstable and are relying on credit to get by. As a result, they may consider you more likely to fall behind on payments.

Additionally, too many hard inquiries can hurt your credit. While a single hard inquiry typically only lowers your score a small amount, multiple hard inquiries may cause a noticeable drop in your score.

Pro tip: Try to wait six months between credit card applications.

8. Go through the credit repair process

Before applying for a mortgage loan, you may want to see if there are errors on your credit report. Credit repair involves closely examining your credit report to identify negative items that might be wrongfully hurting your score. You can then dispute the inaccuracies to potentially have them removed fro your report.

Pro tip: Research each company and read reviews to avoid running into credit repair scams.

Why is credit important when buying a home?

Credit is important when buying a home if you plan to take out a mortgage. A good credit score will boost your likelihood of qualifying for a mortgage with a lower interest rate and better terms. This can end up saving you thousands of dollars over the course of your mortgage.

What does your credit score need to be to buy a house for the first time?

The credit score needed to buy a house varies depending on the type of loan you want. For most conventional mortgages, borrowers need a credit score of 620 or higher to qualify. Meanwhile, an FHA loan requires a minimum credit score of 500. Generally, the higher your credit score, the more favorable interest rates and terms you’ll be approved for.

Need help repairing your credit before buying a home? Lexington Law Firm could help you identify and address inaccurate negative items that may be damaging your score. Sign up for a free credit assessment to establish your starting point and see what services may be right for you.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.