The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

91 percent of millennials prefer to shop online, with only 9 percent choosing to shop in-store only.

The millennial generation is often cited as being drastically different from the generations that came before it. In some ways this is true, as millennials interact very differently with finances, shopping and companies, preferring to use their dollars to support responsive and socially active businesses. On the other hand, millennials are now in the midst of growing their careers and families, so they share many of the same concerns that previous generations had.

Saddled with student loans, millennials are delaying forming families and purchasing homes. However, these are still aspirations for this generation. Since it is now the largest living generation, brands must pay close attention to the desires of millennials in order to succeed at capturing their attention—and their hard-earned dollars.

Note: we reference the most updated data available, but sometimes that information is from several years ago—check each individual source for specifics.

Demographics

Millennials, also referred to as Generation Y, are currently between the ages of 25 and 41, and they are widely known as the first “connected” generation due to their savvy use of the internet. At about 80 million people, millennials account for around one-fifth of the population of the United States, making them the largest living generation. Like every generation, millennials are characterized by sharing similar worldviews, habits and traits.

- Millennials, born between the years 1981 and 1996, are now anywhere from 25 to 41 years old. [Source: Pew Research Center]

- There are 72.26 million millennials, which means this generation makes up the largest share of the U.S. population (21.9 percent). [Sources: Statista/Statista]

- A majority of millennials are not married (56 percent). [Source: Pew Research Center]

- Just 8 percent of the previous generation lived with an unmarried partner, but more than 1 in 10 millennials are cohabiting before marriage. [Source: Pew Research Center]

- 55 percent of millennial women have had a child. [Source: Pew Research Center]

- The average millennial mother has had 2.02 children. [Source: Pew Research Center]

- About 1 in every 5 millennial dads are single parents. [Source: Pew Research Center]

- 75 percent of married millennials with a bachelor’s degree have spouses who also have a bachelor’s. [Source: Pew Research Center]

Purchasing power

As many millennials have graduated from college with financial responsibilities—including debt—they have a growing obligation to act more responsibly with their money and spending habits. Millennial net worth has grown more than 200 percent since 2018, but this generation still possesses less than 10 percent of total net worth. Millennials have an average post-tax income just shy of $60,000, but a relatively small amount of that (around 10 percent) gets saved due to rising housing costs and burdensome student loan debt.

- The average post-tax income for millennials is $58,628 annually. [Source: SmartAsset]

- Millennials spend 21.6 percent of their income on housing—more than Gen X and baby boomers. [Source: SmartAsset]

- Millennials have an average savings rate of 9.8 percent. [Source: SmartAsset]

- The average yearly spending for millennials is around $52,000. [Source: SmartAsset]

- Millennials have a collective net worth of more than $8 trillion, but that is just 5.8 percent of total net worth for all generations. [Source: Federal Reserve]

- Millennial net worth has grown 235 percent since 2018. [Source: Federal Reserve]

- Millennials born in the 1980s have net worths 34 percent lower than expected due to economic recessions. [Source: New America]

Online shopping habits

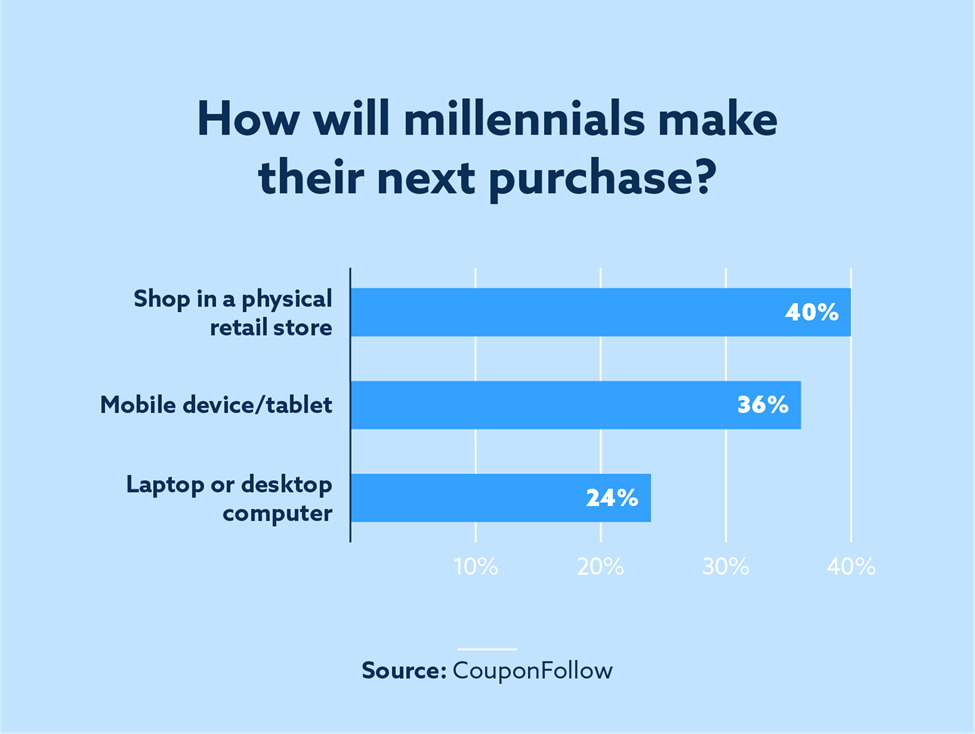

As the first generation raised on the internet, millennials are leading the pack in online purchases. With convenience and price in mind, online outlets offer more value to the average millennial shopper. In recent years, millennials have become more concerned about security when completing transactions online. Forty percent of millennials refer to reviews and testimonials before purchasing any products, and the number is even higher when they are purchasing products online.

Millennials are also using subscription services to replace regular shopping trips to grocery stores and other brick-and-mortar shops. In a recent study, 23 percent of millennials said they prefer purchasing a product online before going to pick it up in store. They also favor generic store brands over name brands if it means saving money.

- 23 percent of millennials would rather purchase an item online before going to get it at the store. [Source: Euclid]

- 42 percent of millennials complete online shopping transactions on their smartphones. [Source: Statista]

- 25 percent of millennials shop for groceries online. [Source: Morning Consult]

- 67 percent of millennials are worried about hackers stealing their personal financial information from online companies. [Source: Civic Science]

- 91 percent of millennials prefer to shop online, with only 9 percent choosing to shop in-store only. [Source: JungleScout]

- 44 percent of millennials prefer shopping online because of the fast shipping and wider variety of products available. [Source: JungleScout]

- 47 percent of millennials say they shop on Amazon at least once a week. [Source: JungleScout]

- 60 percent of millennials prefer to purchase generic brands over name brands. [Source: Millennial Marketing]

- 40 percent of millennials check online reviews and testimonials before purchasing a product. [Source: Millennial Marketing]

Brand perception

Millennials prefer brands that offer a unique experience, value for their money and great customer service. Although many brands have credited millennials for a downturn in business, 60 percent of millennials stay loyal to brands they purchase from. Millennials are also sensitive to how a company acts beyond its business interests, and they often prefer brands that are socially or politically active. Brands that own social media—either through clever messaging or a responsive account—are likely to succeed at winning the hearts of millennials.

- 30 percent of millennial consumers say they feel loyal to brands rather than products. [Source: InMoment]

- 60 percent of millennials say they’ve been loyal to specific brands for 10 or more years. [Source: InMoment]

- 52 percent of millennials prefer to shop at retailers that align with their values. [Source: Euclid]

- 44 percent of millennial parents say they will only shop with brands that share their social or political views. [Source: National Retail Federation]

- 19 percent of non-parent millennials say they always research a brand’s views on topics that are important to them. [Source: National Retail Federation]

- 14 percent of millennials say that they would visit a brand’s social media to give feedback. [Source: Retail Dive]

- 96 percent of millennials say that brands should find new ways to reward loyal customers. [Source: KPMG]

- 81 percent of millennial consumers say being a member of a rewards program encourages them to spend more money with a brand. [Source: KPMG]

- 61 percent of millennials prefer brands that offer unexpected rewards on social media as opposed to traditional reward points. [Source: HelloWorld]

Marketing and advertising

Data about millennials shows that they are far more responsive to social media advertisements and advertising in general than previous generations, but there are caveats. Millennials prefer ads that are relevant, informative or humorous—and they need to feel that the source is trustworthy. However, a growing number of millennials have shunned advertising entirely by installing ad blockers. In general, the best way to market to millennials seems to be through trusted individuals, like influencers or other popular personalities, whom millennials already view as thought leaders.

- 47 percent of millennials are using ad blockers on their computer, while 29 percent use an ad blocker on their smartphone. [Source: Civic Science]

- 74 percent of millennials have shared their password or login to stream content online, while 64 percent say they’ve used someone else’s streaming account. [Source: Bankrate]

- 75 percent of millennials believe attending an event in person has more impact than taking action online. [Source: Eventbrite]

- 92 percent of millennials use an app’s appearance to decide whether or not to provide personal information. [Source: Clever]

- 30 percent of millennials are not willing to engage with online advertisements. [Source: Clever]

- 77 percent of millennials say they worry about companies using their personal data. [Source: Clever]

- Millennials are 54 percent more likely than older generations to buy a product that was recommended by a social media influencer. [Source: Clever]

- 25 percent of millennials say they are more likely to purchase a product because of an advertisement on social media. [Source: Clever]

- Millennials are 25 percent more likely to engage with online advertisements. [Source: Clever]

- 43 percent of millennials engage with humorous ads. [Source: Clever]

- 29 percent of millennials engage with informative ads. [Source: Clever]

- 36 percent of millennials trust social media advertisements. [Source: Statista]

- Millennials spend an average of 211 minutes on apps or the internet per day. [Source: Statista]

Debt

Millennials are heavily burdened with debt from student loans and credit cards. As many borrow large sums of money to pay for education, millennials carry more than $500 billion in student loan debt. This large debt has a major impact on millennials as homeownership is down among the demographic, and over 50 percent have said their student loan debt has delayed their ability to save for a home.

- 14.8 million millennials have debt from student loans, a larger number than any other generation. [Source: Education Data]

- The average millennial student loan borrower owes $38,877. [Source: Education Data]

- Total student loan debt for millennials is now over $500 billion. [Source: Education Data]

- Millennials hold 31.94 percent of all debt from student loans. [Source: Education Data]

- 46 percent of younger millennials report having a median balance of $26,000 from student loans. [Source: NAR]

- 42 percent of millennials who took out student loans say taking out those was not worth it given their current financial situation. [Source: Morning Consult]

- On average, millennials carry $4,712 in credit card debt. [Source: Experian]

- Younger millennials carry an average debt of $2,288 from credit cards, while older millennials carry an average credit card debt of $6,675. [Source: Experian]

- More than 50 percent of millennials say student loan debt delayed their ability to save for a home. [Source: NAR]

- 56 percent of millennials say they do not have a retirement savings account. [Source: Morning Consult]

- 58 percent of millennials say they are living paycheck to paycheck. [Source: Magnify Money]

- 76 percent of millennials carry some kind of debt. [Source: Bank of America]

- Of those with debt, 16 percent of millennials say they owe $50,000 or more. [Source: Bank of America]

- 76 percent of millennials say debt interferes with their personal and financial goals. [Source: Bank of America]

Now that millennials have become the largest living generation in America, there is a growing need for brands and companies to design their sales tactics and marketing strategies to appeal to this demographic. Though millennials are often criticized for their spending habits, they are one of the generations that paved the way for brands to adapt to an online way of thinking via social media and other online platforms. With millennials being a generation that plays a major part in the U.S. economy, it is important for brands to stay educated on the spending habits of this growing powerhouse.

Related links

- American spending habits

- Baby boomer spending habits

- College student spending habits

- Gen Z spending habits

- Teen spending habits

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.