The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A bankruptcy discharge is the final step of the bankruptcy process when you’re no longer liable for specific types of debts. The discharge time frame and types of debts differ between Chapter 7 and Chapter 13 bankruptcy.

In October 2022, the United States Courts released the latest data for bankruptcy filings and found that non-business bankruptcy filings make up nearly 97 percent of all cases. Although the number of filings decreased, there were still over 370,000 non-business bankruptcies filed in 2022. Anyone can find themselves in the position of needing to file for bankruptcy, and in the event that you need to file, it’s beneficial to know how a bankruptcy discharge works.

Understanding the entire bankruptcy process and the completion through the discharge phase can help you better prepare for the situation and, ultimately, how to repair your credit afterward. Here, we’ll discuss the details of bankruptcy discharges for Chapter 7 and Chapter 13 bankruptcies, the steps to get there and what you can do to repair your financial situation.

Key takeaways:

- The bankruptcy discharge is the last phase of a bankruptcy and releases you from personal liability for specific types of debts.

- Once discharged, creditors can no longer pursue old debts or contact you about those debts.

- The time frame for discharge varies depending on whether you file Chapter 7 or Chapter 13 bankruptcy.

- Debts that aren’t covered under a bankruptcy discharge include taxes, court ordered fees, child support, alimony and student loan debts.

Table of contents:

- What is a bankruptcy discharge?

- How a bankruptcy discharge works

- When does the discharge occur?

- Chapter 7 vs. Chapter 13 bankruptcy discharge

- What debts can be discharged in a bankruptcy?

- Limitations of a bankruptcy discharge

- Can a bankruptcy discharge be denied?

- How a bankruptcy discharge affects your credit

What is a bankruptcy discharge?

A bankruptcy discharge relieves a borrower from their legal obligation to pay certain debts. Not all types of debt can be discharged, but those that can may not be pursued by creditors—via phone, letter or other communication. This is because a bankruptcy discharge relieves the borrower of personal liability to pay certain debts.

How a bankruptcy discharge works

The goal of a bankruptcy discharge is debt relief. However, when and how your debts will be relieved largely depends on which type of bankruptcy you file and the amount of outstanding debt you have.

For a Chapter 7 bankruptcy, your nonexempt assets—like investments, valuables and property that is not your primary residence—may be divided among your creditors. Any remaining debts may be discharged. For a Chapter 13 bankruptcy, you propose and prosecute a Chapter 13 plan to repay certain debts. If approved by the bankruptcy court, any leftover debt that is not repaid at the end of your plan may be discharged.

The following are general steps from first filing for bankruptcy to the final discharge:

- Consult a legal professional if needed

- File with the court and pay bankruptcy fees

- Organize your debts

- Meet with the bankruptcy trustee

- Take mandatory debtor education classes

- Receive discharge

If you’re filing for Chapter 13 bankruptcy, you’ll need to complete the scheduled repayment plan of your debts before the court will discharge your bankruptcy.

When does the discharge occur?

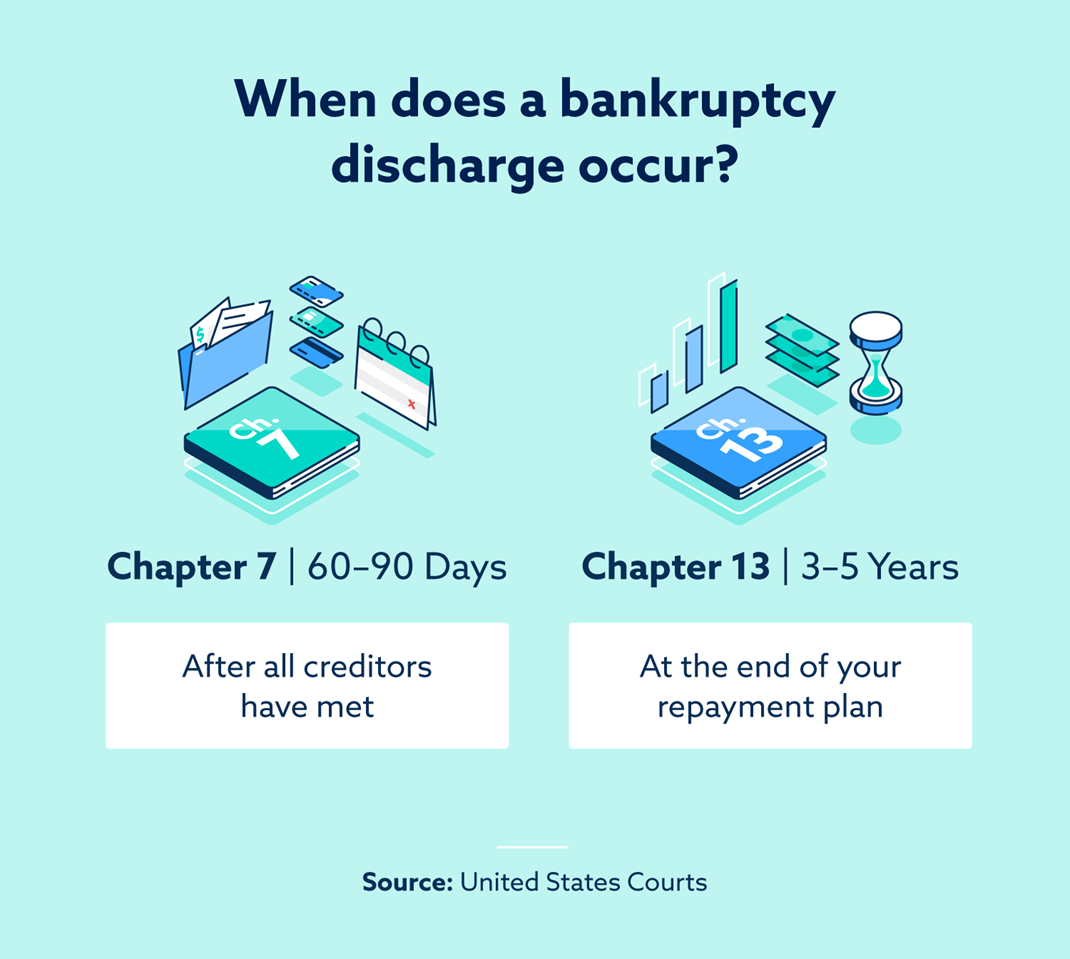

The time to reach a bankruptcy discharge varies depending on which chapter you file.

If you file for Chapter 7 bankruptcy, the process can take four to five months from the time you file to the point of the discharge. When filing for Chapter 13 bankruptcy, you’re put on a repayment plan of your debts, and this lasts anywhere from three to five years.

As long as you follow the court orders for the bankruptcy, your chances of receiving a discharge are much better. This includes taking the mandatory classes and making your payments for Chapter 13.

Chapter 7 vs. Chapter 13 bankruptcy discharge

The main differences between Chapter 7 and Chapter 13 bankruptcies are that Chapter 7 has you liquidate assets to pay back your creditors, and Chapter 13 puts you on a repayment plan. Under Chapter 7, you meet with a bankruptcy trustee who will decide which assets are nonexempt and must be liquidated, and once that’s complete, your remaining debts are eliminated.

When filing Chapter 13 bankruptcy, you prepare and file a proposed plan. Your creditors and the Trustee review the proposed plan. They’ll go through your income, personal finances and decide whether to object to your plan. If they accept your proposal, you’re given three to five years to repay your debts. If they deny it, you may have to file a new plan.

What debts can be discharged in a bankruptcy?

When considering bankruptcy, it’s key to first identify the type of debts from which you’re seeking relief. Below we provide commonly discharged debts and debts that can’t be discharged.

What can be discharged

Debts that can be discharged are typically unsecured debts, which means they don’t have collateral.

- Credit card debt

- Personal loans

- Utility payments

- Medical bills

What cannot be discharged

It’s a common misconception that bankruptcy eliminates all of your debts. Court-ordered debts and some others cannot be discharged, such as:

- Child support

- Alimony

- Court-ordered fees and fines

- Retirement plan loans

- Mortgages and car loans must continue to be paid if you’re keeping the home or vehicle

- Student loans

The U.S. Courts website also states that overall, there are 19 categories of debt that cannot be discharged.

Limitations of a bankruptcy discharge

Sometimes, a bankruptcy isn’t the best option for some individuals, as a bankruptcy discharge may not relieve you from all of your debts. In addition to the debts that aren’t discharged by a bankruptcy, there are downsides to filing for bankruptcy, like how it affects your credit.

One of the main factors to consider is that you may not have your bankruptcy approved by the court. This can be due to not meeting the means test requirements, improperly filling out paperwork or not disclosing income or assets.

If it seems like bankruptcy isn’t the best option for you, here are some ways to pay down your debt without filing for bankruptcy:

- Sell assets

- Find additional sources of income

- Create a budget

- Borrow from friends or family

- Consolidate your debt

Can a bankruptcy discharge be denied?

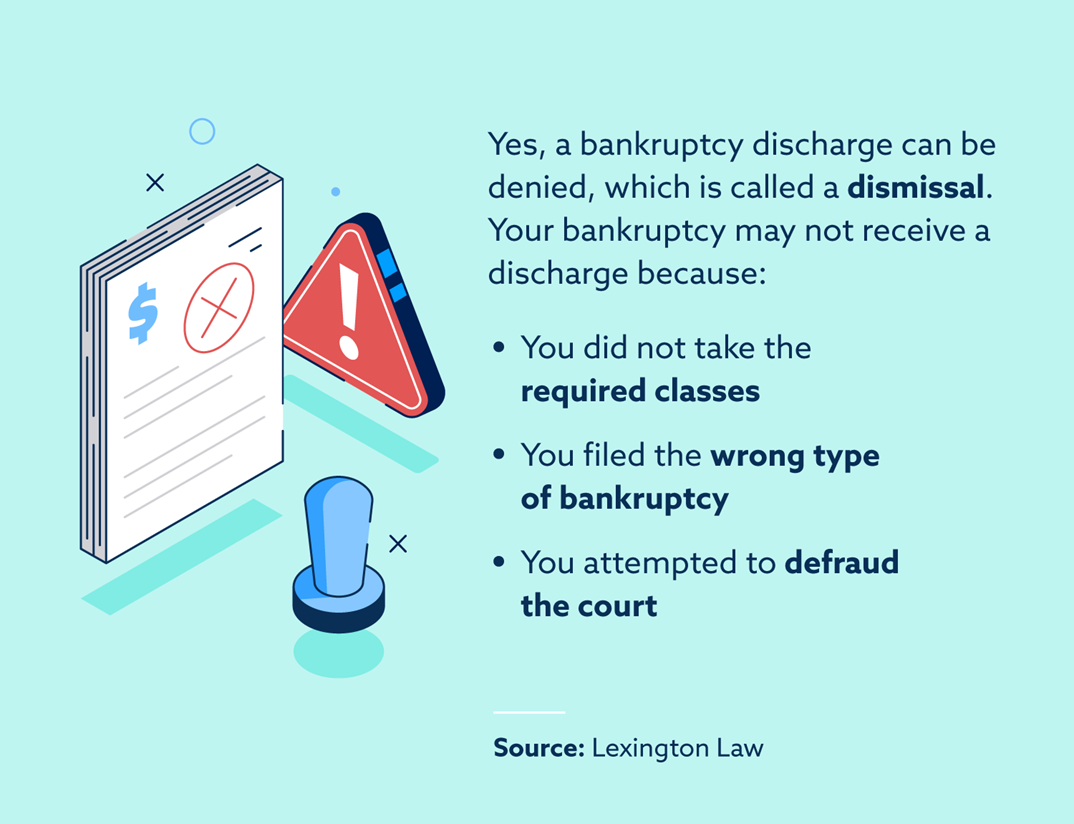

Yes, a bankruptcy can be denied, which is also known as a “dismissal.” There are a few reasons your bankruptcy may be denied, so if you decide to file for bankruptcy, it’s helpful to know how to improve your chances of an approval and discharge.

The following are reasons a bankruptcy may not receive a discharge:

- You didn’t take the required credit counseling and debtor classes

- You filed for the wrong type of bankruptcy

- You attempted to defraud creditors or the court

If you previously filed for bankruptcy, you may not be eligible to file again. There are time frames for how often you can file for bankruptcy, which also depends on which chapter you previously filed.

How a bankruptcy discharge affects your credit

Generally, a bankruptcy discharge does not affect your credit, but the bankruptcy itself does. Once discharged, the bankruptcy will not disappear from your credit report, nor will the discharge affect the length of time that it remains there.

When you file for bankruptcy, it can stay on your credit report for up to seven years (for Chapter 13) or up to 10 years (for Chapter 7). This makes it difficult to apply for new lines of credit and get loans. This also means that you’ll receive higher interest rates when you are approved for lines of credit. Fortunately, there are ways to improve your credit after a bankruptcy.

Lexington Law Firm has a team of credit consultants who have experience helping people work to repair and improve their credit. We offer a wide variety of services to help you better understand your credit and get back on the right track after a bankruptcy. To learn more about how we can help, contact us today.

DUTY TO CO-OPERATE WITH TRUSTEE.

It is important to note that you have a duty to co-operate with your Trustee. Even though the discharge order is granted, this does not mean that your case is over. The trustee has many duties and some of those require your assistance. If you fail to co-operate with the Trustee, the your discharge order can be “revoked” or set aside. After the Discharge has been entered and the Trustee has completed the Trustee obligations in the case, the case will be Closed. Once the case is closed, your bankruptcy is officially over.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.