The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

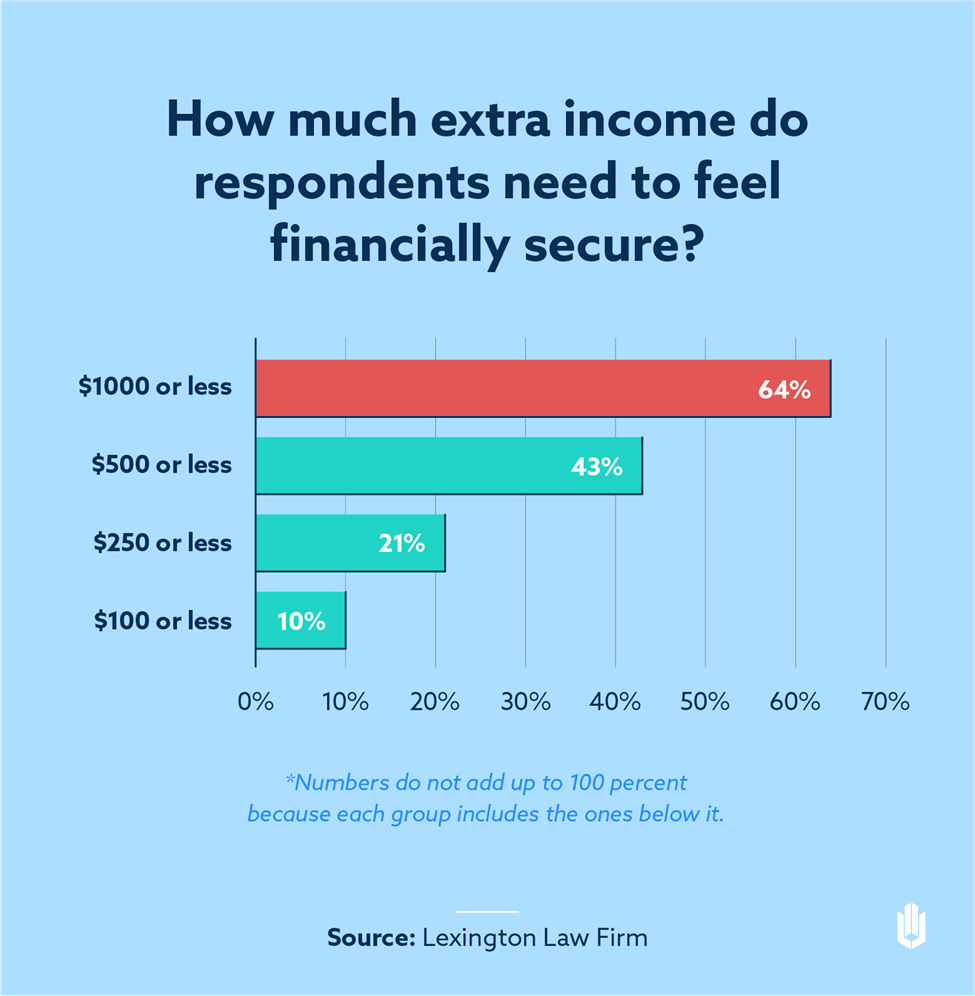

More than half of all respondents would feel financially stable with an additional $1,000 each month.

Financial stress has always affected people, but the economic effects of the COVID-19 pandemic have significantly increased worries about money, according to Pew Research Center.

The American Psychological Association reports that almost two-thirds of American adults view their finances as a major stressor. For households making less than $50,000 annually, nearly 3 out of 4 American families are experiencing significant financial stress. While the specifics of these fears vary—including housing, healthcare and childcare costs—it’s obvious that concerns about money are a driving force in the lives of millions of Americans.

One proposed solution is universal basic income (UBI), which would provide all Americans with a fixed monthly stipend to help defray rising costs and stimulate the economy. Proponents of UBI suggest that a small stipend could increase employment, entrepreneurship and equity among different racial groups and genders. On the other hand, some studies have argued that the cost of UBI would be astronomical and could potentially lead to an increased poverty rate over time.

Within the past few years, some states and cities have been piloting universal basic income programs. For example, in California, a UBI program provides $1,000 each month to around 3,000 families in Los Angeles. There are similar programs being tested in Washington, Alaska, Virginia, South Carolina and New York.

We conducted a survey of more than 1,500 Americans to determine how financial stress affects them as well as whether UBI could potentially remedy this problem.

Here are our key findings:

- More than half of all respondents would feel financially stable with an additional $1,000 each month.

- More than 1 in 5 respondents say their health suffers due to financial difficulties.

- Financial stress is most often related to retirement, credit cards, student loans and housing payments.

Read on to learn more about all of our findings.

More than half of respondents would feel financially stable with an additional $1,000 each month

Eliminating financial stress may seem to be an impossible task, but most respondents only want a modest increase in their monthly income to achieve financial stability.

According to our survey, over 60 percent of respondents report that $1,000 each month would decrease their financial stress. Nearly half of respondents say that $500 or less each month would provide financial stability. And finally, 20 percent of respondents noted their financial situation would be more stable with a monthly influx of $250—an amount that Jeff Bezos makes on average every one-tenth of a second.

Including Medicare and Social Security, the United States spends around $3.3 trillion on welfare programs each year. With around 330 million Americans living today, that means total U.S. welfare spending per capita is around $10,000. Supporters of UBI argue that a simplified welfare system that simply provided cash deposits for all Americans would reduce administrative costs and increase financial stability.

While the effects of implementing UBI cannot be perfectly predicted, our survey does suggest that the U.S. welfare budget likely has enough money to satisfy the financial needs of many Americans by providing modest monthly stipends. Considering that 43 percent of respondents desire $500 or less for financial stability, per capita spending of $6,000 annually ($500 per person per month) could play a huge role in reducing financial stress.

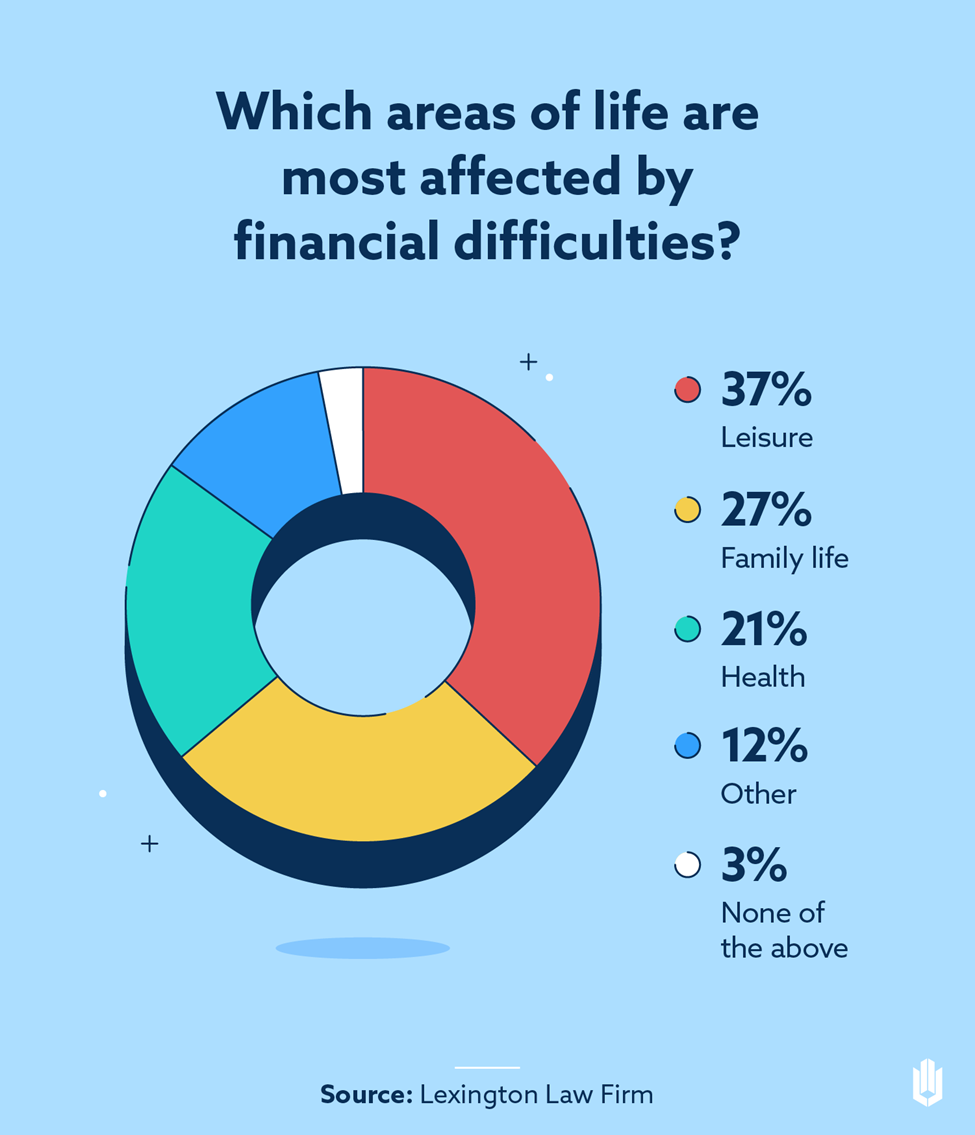

More than 20 percent of respondents say their health suffers due to financial difficulties

Financial stress has a profound impact on the lives of many Americans. In fact, 48 percent of our survey respondents identify health and family life as being affected the most.

Notably, financial concerns seem to be a nearly universal concern: just 3 percent of survey respondents reported that financial difficulties did not affect their lives at all.

Most prominently, respondents find that their leisure (37 percent), family life (27 percent) and health (21 percent) are negatively influenced by financial troubles. All of these struggles are mirrored in trends reflecting the economic difficulties of Americans.

For example, data from the Bureau of Labor Statistics (BLS) reveals that just 4.7 percent of average American household expenditures go to entertainment—a percentage that has decreased each year since 2017. During that time span, increased costs for food, housing, healthcare and transportation have left an ever smaller amount of money for recreation.

Meanwhile, the average American spends nearly half of their waking hours alone, according to the BLS Time Use Survey. American adults between the ages of 22 and 65 spend more of their time with coworkers than family members—the average 40-year-old, for example, spends three times as much of their day with colleagues than family. Inflation-adjusted wages have remained stagnant for decades, according to the Pew Research Center, making it even harder for people to get on top of their debt and sufficiently make ends meet.

The effect of financial strain on health is evident after a closer look at how quickly healthcare costs are rising relative to income. Currently, Americans spend almost $500 billion collectively on out-of-pocket medical expenses each year—or roughly $1,650 for each individual.

As a result, more than half of Americans report delaying or skipping medical care due to cost. Despite high costs and massive medical spending, the U.S. still lags behind peer countries in outcomes: Americans have lower life expectancy, higher rates of hospitalizations from preventable illness and the largest burden of chronic disease.

Respondents worry most about retirement, credit cards and student loan debt

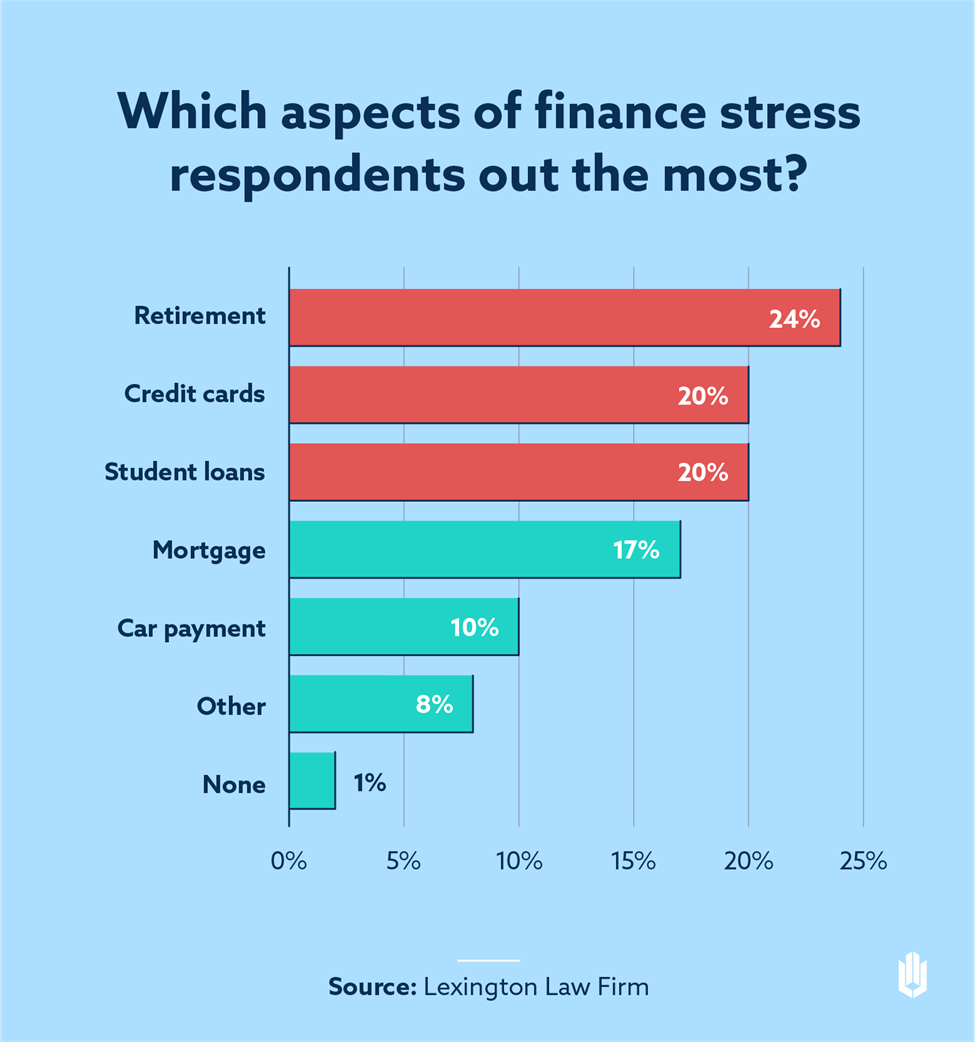

While financial difficulties can arise in a number of ways, most respondents are stressed by retirement, credit cards, student loans and mortgages.

When we surveyed Americans about the most stressful aspect of their finances, the top answers were pretty evenly split among four categories: retirement (24 percent), credit cards (20 percent), student loans (20 percent) and mortgage (17 percent). Together, these four areas represent the most stressful areas of finance for 4 in 5 Americans.

While the average age of retirement is increasing, our collective preparedness is often lacking. A survey looking at retirement readiness indicates that more than half of older Americans have saved less than $50,000 for retirement. However, this same group of survey respondents believed that their post-retirement income would be more than $55,000. It’s no wonder that retirement looms large and causes stress as many struggle to save enough to make ends meet after their employment years end.

Credit cards are useful financial tools, but they can be a significant source of stress as well. The average American carries a credit card balance of more than $5,000, while the total amount of credit card debt shared among all Americans is $800 billion. Of those who have credit card debt, around 8 percent are more than 90 days delinquent in making payments.

Student loan debt has been a topic of fierce debate in recent years, as the total amount of education-related debt has soared to $1.5 trillion—an increase of more than 60 percent in just over a decade. Among people with student loan debt, the average owed is nearly $40,000, an amount that can be crushing when combined with debt from other sources.

As the United States looks to climb out of the economic conditions brought on by the coronavirus pandemic, finding ways to ease Americans’ stress related to their finances may be crucial for a successful recovery.

Where to find help with financial stress

While universal basic income continues to be discussed as an option by politicians, there are ways that consumers can start tackling financial stress now.

Here’s some information that could help you get started with areas of your finances that create worry:

- How to consolidate debts

- What is debt forgiveness?

- How to pay off debt

- Student loan payoff strategy

- Retirement planning guide

- Seniors’ guide to retirement

- How to repair your credit

Even with average credit scores on the rise, many Americans have still found that credit usage has caused them major strain over the past few years. Lower credit scores can make it more difficult to get a mortgage or car loan, and your score could be affected by incorrect negative items on your credit report.

Lexington Law Firm offers credit repair services, which could help you with your credit by disputing inaccurate information on your credit report. If your credit is causing you financial stress, reach out to our credit repair professionals for support.

Methodology

This survey was conducted for Lexington Law Firm using Google Consumer Surveys. The sample consisted of a minimum of 1,500 responses per question. Post-stratification weighting was used to ensure that the general population is represented accurately by the results of this survey, which was conducted in November 2021.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.