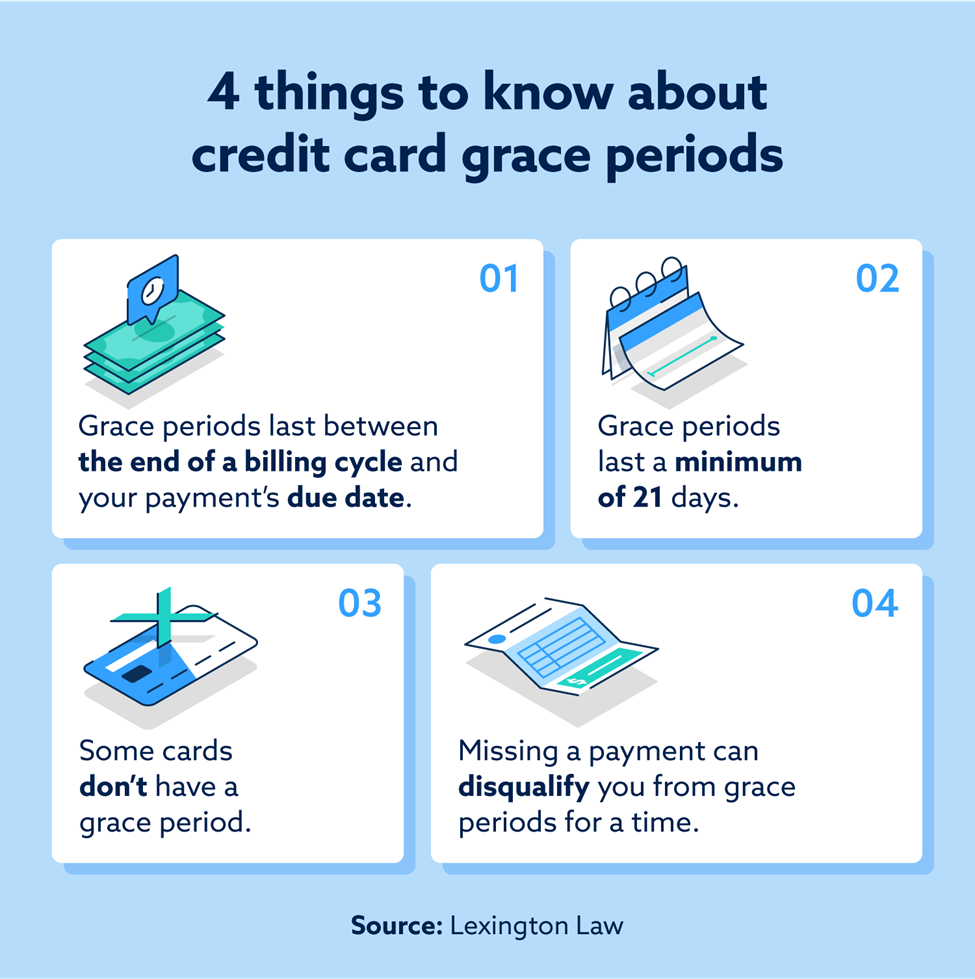

A credit card grace period is a set amount of time that lets you pay your balance without accruing interest. Grace periods start at the end of your billing cycle. Under federal law, grace periods last a minimum of 21 days.

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

A credit card grace period refers to the time between the end of your billing cycle and the moment when you’re required to make your credit card payment. During this grace period, you typically won’t be charged interest on your balance. This guide will delve into questions like “what is a credit card grace period,” share tips to help you limit your interest charges and explain how Lexington Law Firm can help you consider your debt relief options.

Key takeaways:

- A grace period gives you extra time to pay your balance without garnering interest.

- Grace periods are required by law to last a minimum of 21 days.

- A late or missing payment can harm your credit and challenge your eligibility for future grace periods.

How does a credit card grace period work?

Credit card companies charge interest on balances that haven’t been paid in full. However, a grace period gives you extra time to pay off your balance without accruing interest. If you pay the balance in full during the grace period, the credit card company usually won’t charge any interest fees.

At the end of each billing cycle, you’re responsible for either paying off your remaining balance or making a minimum payment toward it. If you leave a balance by making a partial payment, your interest rate determines your additional costs until you pay the rest.

Here’s what to pay attention to when you receive your bill:

- Your statement balance: This encompasses everything on your current bill, which may exclude any transactions that were made after the closing date.

- The closing date: This is the day the statement is generated, which means if you made purchases after the closing date, you don’t need to pay them off until the following due date.

- The minimum payment: This is what you’re required to pay before the due date to avoid late payment fees.

- The due date: The very last day your payment is due, usually at the end of your grace period.

How long is a typical credit card grace period?

The grace period is normally 21 – 25 days after your closing date. This means credit card companies give customers three weeks to pay their bills after the statement closes before charging interest. You can find your card’s grace period in the terms and conditions section of your credit card agreement or by contacting your card provider.

Some credit card companies offer an introductory interest rate for balance transfers that can be as low as 0 percent APR. Though that introductory APR can be a boon, you’ll need to watch out for interest charges once the promotional period ends.

Not every credit card has an introductory rate for balance transfers, so repositioning funds with the wrong card can generate interest charges right away. Pay attention to the fine print when you select a card so you aren’t surprised.

Can grace periods hurt your credit score?

Capitalizing on a grace period won’t negatively affect your credit. In fact, they largely exist to help people maintain their scores during periods when funds aren’t readily available. Payment history makes up 35 percent of your FICO® score, so a late or missed payment can result in a steep decline.

Late payments show up on your credit reports and generally do harm your credit. Plus, carrying a balance increases your credit utilization. This figure reflects how much of your available credit you’re currently using, and the higher your utilization ratio is, the worse it is for your credit. Learning more about what affects your credit score can prevent these dips from occurring.

What happens if you don’t pay the full amount due by the end of the grace period?

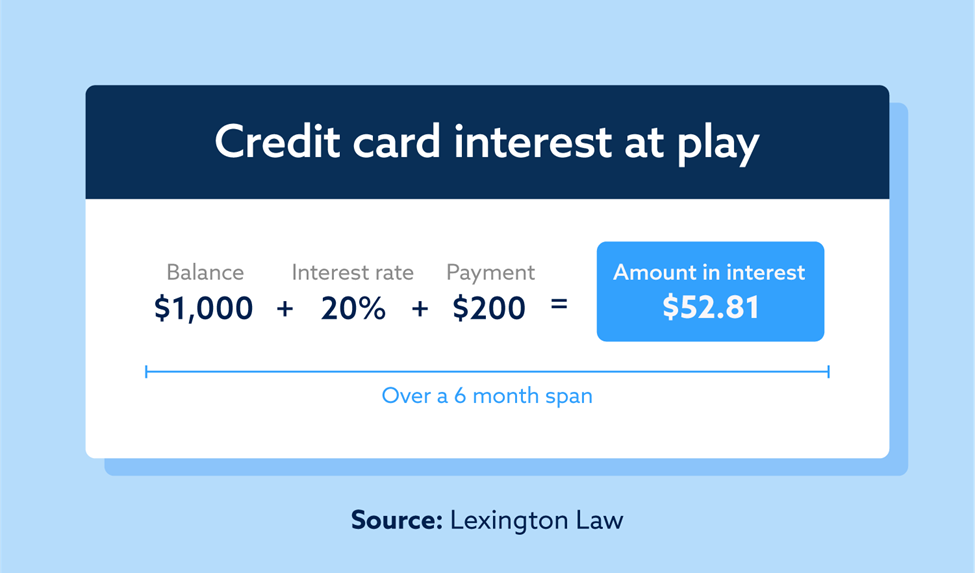

If you don’t pay the full balance, you must pay interest on your balance after the due date. The answer to the question “How is credit card interest calculated?” is straightforward: your interest fees are based on your remaining balance each day. If you make payments throughout the month to lower your balance, you would reduce the amount of interest you pay.

Once you carry a balance of $0, you’re no longer charged interest for the days that your balance is paid off. However, you likely won’t get your grace period back until you’ve paid the entire balance for two consecutive months. For example, if you made only the minimum payment in April and then paid your entire balance in May and June, you wouldn’t get a new grace period until July.

Do all credit cards have a grace period?

Credit card companies aren’t required to offer grace periods, so it’s prudent to double-check your card’s features. The good news is that most major credit cards do have grace periods. As previously mentioned, an extended grace period may also be available for balance transfers.

A credit card grace period won’t apply to cash advances, so only take a cash advance if you’re willing to pay interest on what you take. Cash advances and cash-back rewards aren’t the same thing. So, if you’re at the grocery store and get cash back, the amount you take is simply added to the transaction total.

What does the CARD Act say about grace periods?

The Credit Card Accountability, Responsibility and Disclosure (CARD) Act was signed into law in 2009 and altered how credit card companies could charge fees and interest. It’s one of many consumer rights laws passed to protect consumers. Another law that protects consumers is the Credit Card Competition Act of 2023 (CCCA).

According to the CARD Act, if your credit card has a grace period, you must be given at least 21 days to pay your bill before the company can begin charging interest on your purchases. While grace periods differ slightly between credit card companies, three weeks is the minimum period.

Maximize your credit card grace period

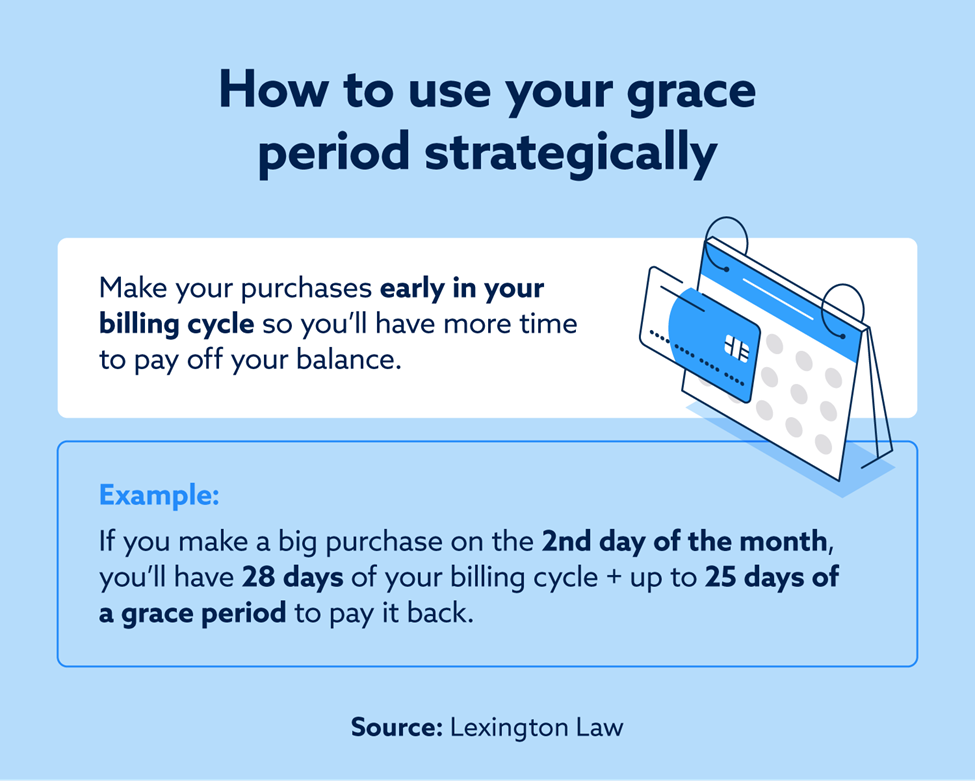

If you plan your purchases correctly, you can stretch your grace period to up to 55 days. If you make a purchase one day after your statement closes, for example, it won’t show up on your current statement. The transaction shows up on your next statement instead, giving you an extra month before you’re required to pay interest on what you’ve bought.

Some savvy consumers plan larger purchases for a day or two after their statement closes to get almost two months to pay their bill interest-free.

If you’d like to line up your due dates with when you get paid, most credit card companies allow you to request a new billing cycle and due date. If you change the due date to a couple of days after you’re paid, it makes it much easier for you to pay the full balance each month.

If the credit card company agrees to change your due date, there might be a waiting period before you can request a change again.

Protect your credit health with Lexington Law Firm

While paying your credit card balance in full each month is a great way to build your credit, there may be errors on your credit reports that are costing you money. You should check your score at least once a year and see if any of your reports have negative marks that might keep you from getting a better interest rate on your next loan.

If you’ve lost the grace period on your credit cards, interest fees can make it more difficult for you to manage your debt and keep your credit healthy. Our services could help you address the inaccurate derogatory marks on your credit report and work on your credit health in other ways, too.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.