The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law’s editorial disclosure for more information.

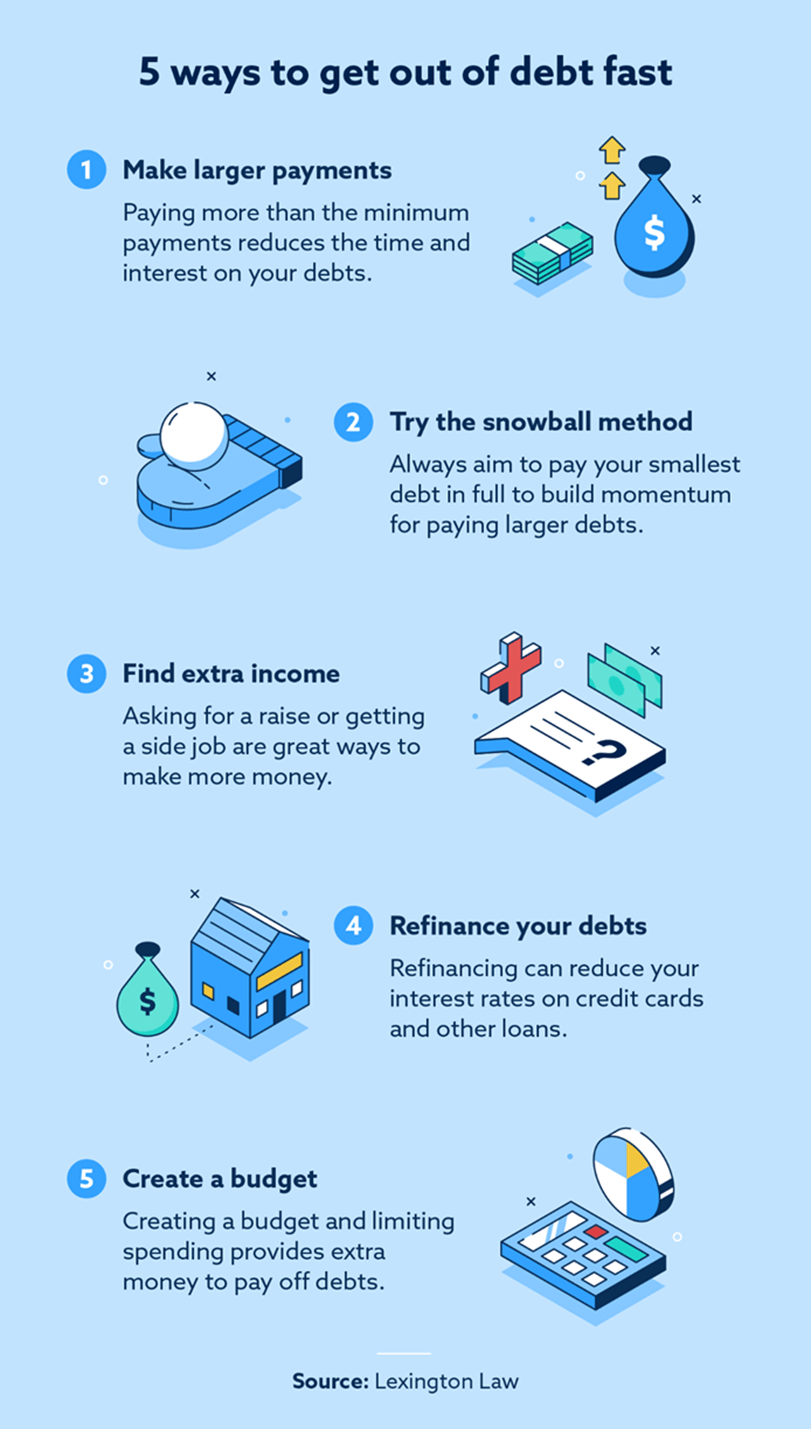

There are many ways to get out of debt, including the debt snowball and avalanche methods, refinancing, finding extra income, making larger payments and more. You can combine strategies to get out of debt faster.

If you’re struggling to get out of debt, you’re not alone. Recent data from Experian® found that consumer debt rose to $17.1 trillion by the end of 2023. Whether you have credit card, personal loan, auto loan or mortgage loan debt, it can cause stress and make it difficult to manage your finances.

Learning how to get out of debt fast is the key to creating a better financial future and can help you avoid accumulating more debt.

We put together 10 simple tips to help you pay off your debt fast and get your finances under control. Depending on your specific situation, you can use more than one of these methods, so test them out and see which ones are the best for you.

Table of contents:

- Assess your debt

- Create a budget using S.M.A.R.T. Goals

- Try the snowball or avalanche method

- Enter a debt management plan

- Shorten your loan length with refinancing

- Consolidate your debts

- Pay more than the minimum

- Use the 2x budgeting rule

- Seek more income opportunities

- Negotiate a debt settlement

1. Assess your debt

Best for: Not knowing where to start

The first step toward getting out of debt is knowing exactly what you owe. It’s hard to create a map when you don’t know where to start.

Before diving into the rest of the tips, start by creating a list of all of your debts. These can include:

- Credit card debt

- Student loans

- Car loans

- Mortgage loans

- Personal loans

- Medical debt

- Overdraft fees

- Late fees

Once you have a list of the accounts and the amounts, you can begin creating a strategy for getting out of debt. Start by categorizing your debts into short-term and long-term categories, and review your credit report to check for potential errors.

If there are errors on your report, you can dispute them to potentially improve your credit score.

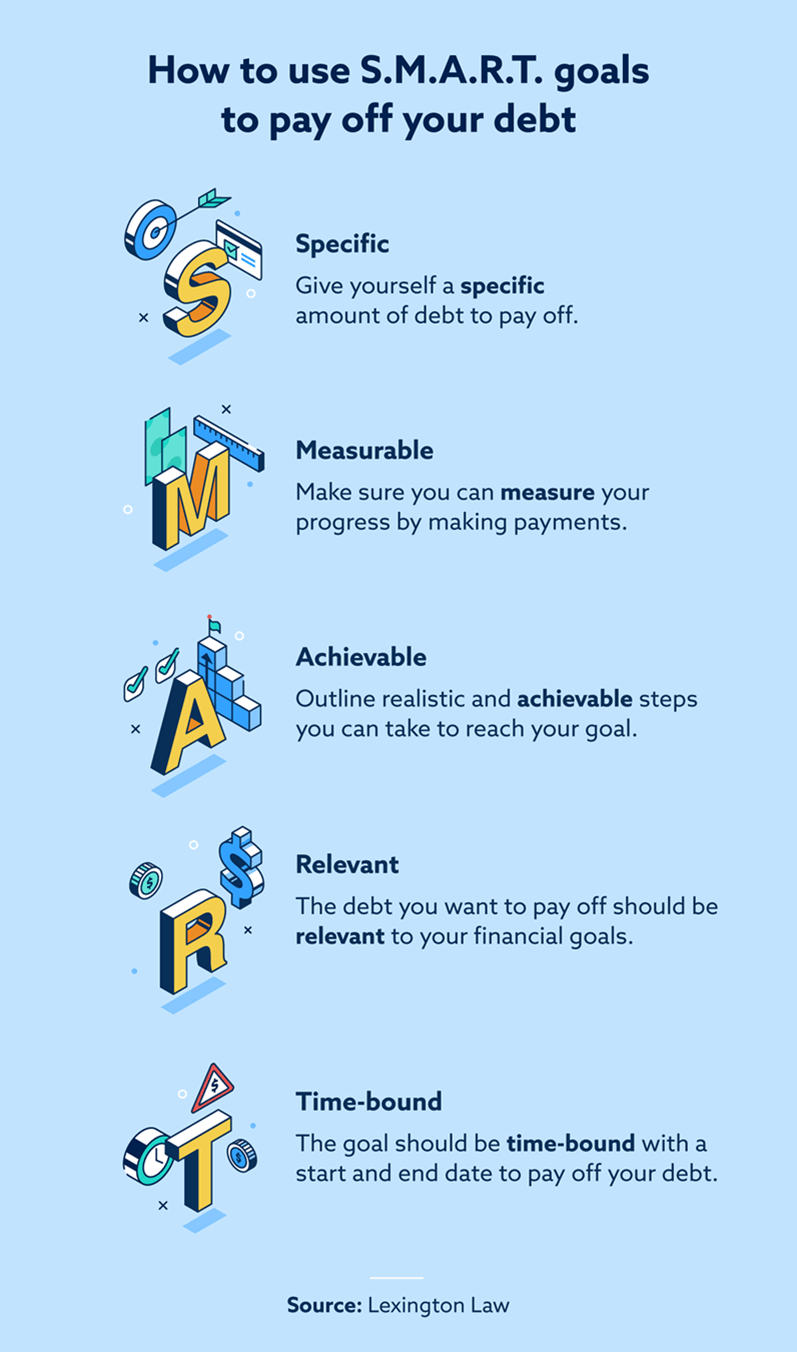

2. Create a budget using S.M.A.R.T. Goals

Best for: All forms of debt and all income levels

S.M.A.R.T. goals are specific, measurable, achievable, relevant and time-bound. People often use them to complete projects or for self-improvement, so they’re ideal to help with paying off debt.

Here are some questions to help you set S.M.A.R.T. goals:

- Specific: What’s the exact dollar amount of debt you want to pay off?

- Measurable: How much will you pay monthly to reach your goal?

- Achievable: Be honest — is your debt payoff goal realistic and attainable?

- Relevant: Why is this specific goal important to your overall finances?

- Time-bound: When do you want to have paid off this amount of debt?

There are a wide range of financial tools available to help you do this, too.

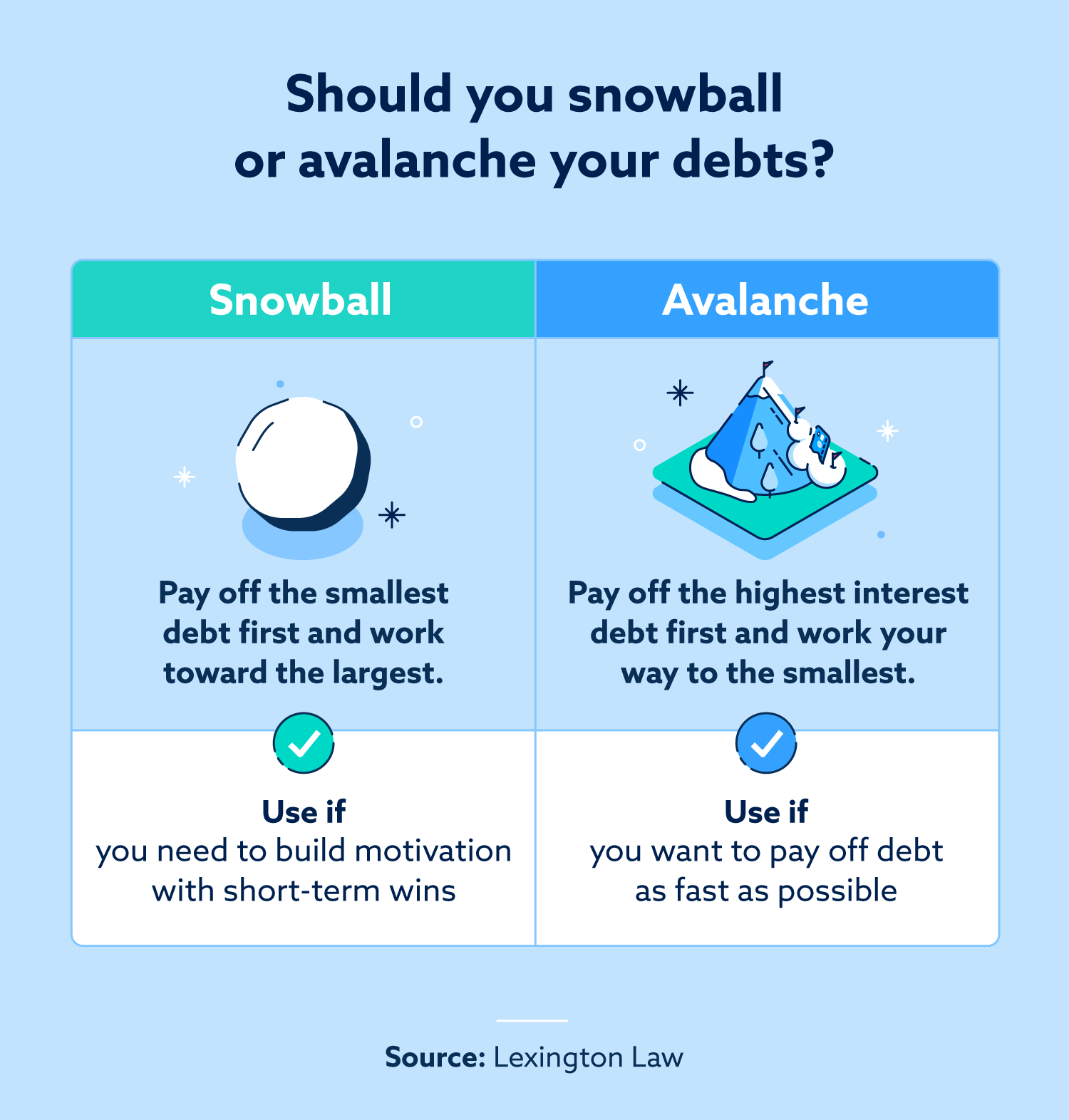

3. Try the snowball or avalanche method

Best for: Low- and medium-level debts (snowball) or debts with high interest rates (avalanche)

The snowball and avalanche methods are two of the best ways to get out of debt. They’re primarily useful for credit card debt, and they’re simple to get started with.

The debt snowball method helps you get small wins to build momentum by paying off your smallest debt in full. Once that’s paid off, you do the same with the next one.

For example, let’s say you have three credit cards with balances of $100, $500 and $1,000. You’d start paying down the $100 balance first, then the $500 balance and finally, the $1,000 one.

The debt avalanche method is better for those with high-interest credit cards, and it works in the opposite way. Start with the highest balance first and work your way down. This helps you avoid monthly interest charges that can extend the time you’re in debt.

Just remember to make your minimum payments as you save up to pay off the next balance.

4. Enter a debt management plan

Best for: Overwhelming debt and people who feel they cannot tackle debt alone

Debt management plans are programs typically run by nonprofits. They help people create a plan to pay off their debt. This is a helpful resource because many people never learned strategies for managing debt and avoiding more debt in the future. These organizations set you up with a financial advisor who works with you and can sometimes help you with debt consolidation as well.

Resources: Some debt management agencies to look into include InCharge Debt Solutions and the National Foundation for Credit Counseling.

5. Shorten your loan length with refinancing

Best for: High-interest debts

If you’re looking to get out of debt fast, a great strategy is to shorten the length of your loans through refinancing. Refinancing has pros and cons, but if your goal is to pay off your debt fast, they can help. One of the primary downsides is higher monthly payments, but you may also get a better interest rate in addition to paying off your debt faster.

Some of your debts that you may be able to refinance include:

- Credit cards

- Auto loans

- Mortgage loans

- Student loans

- Personal loans

Banks and financial institutions often refinance as a way to keep you as a customer. You have a better chance of being approved for a refinance due to your loyalty if you’ve been a customer for a long time or if your credit is much better than when you originally received your loan.

6. Consolidate your debts

Best for: Numerous debts from multiple lenders

Debt consolidation allows you to combine multiple debts into one. People often use this method because it can lower your interest rate and simplify paying back your loans with one payment. You can get a debt consolidation loan from banks and credit unions via a personal loan or a home equity loan.

If you have credit card debt, you can use a balance transfer credit card to transfer the balances of multiple cards to one. Balance transfer cards often have low interest rates if you pay them back in a certain amount of time, but they can increase later.

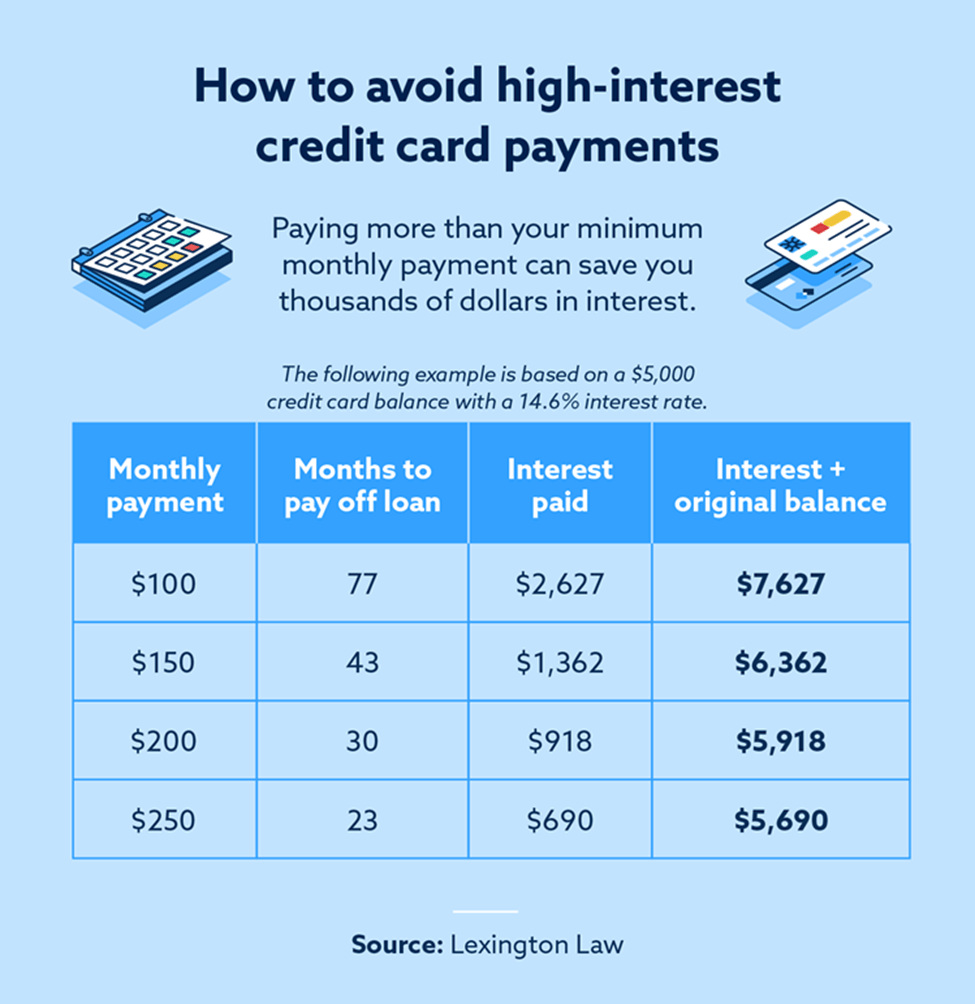

7. Pay more than the minimum

Best for: All forms of debt for people with additional disposable income

Making the minimum payment on your credit cards extends the amount of time it takes to pay off the balance while increasing your interest fees as well. This is why it’s extremely beneficial to create a budget. You can take the extra money you’re saving to make more than the minimum payments.

It’s also helpful to make extra payments whenever possible. For example, if you get paid twice each month, you can dedicate $100 from each paycheck to paying down your credit card balances.

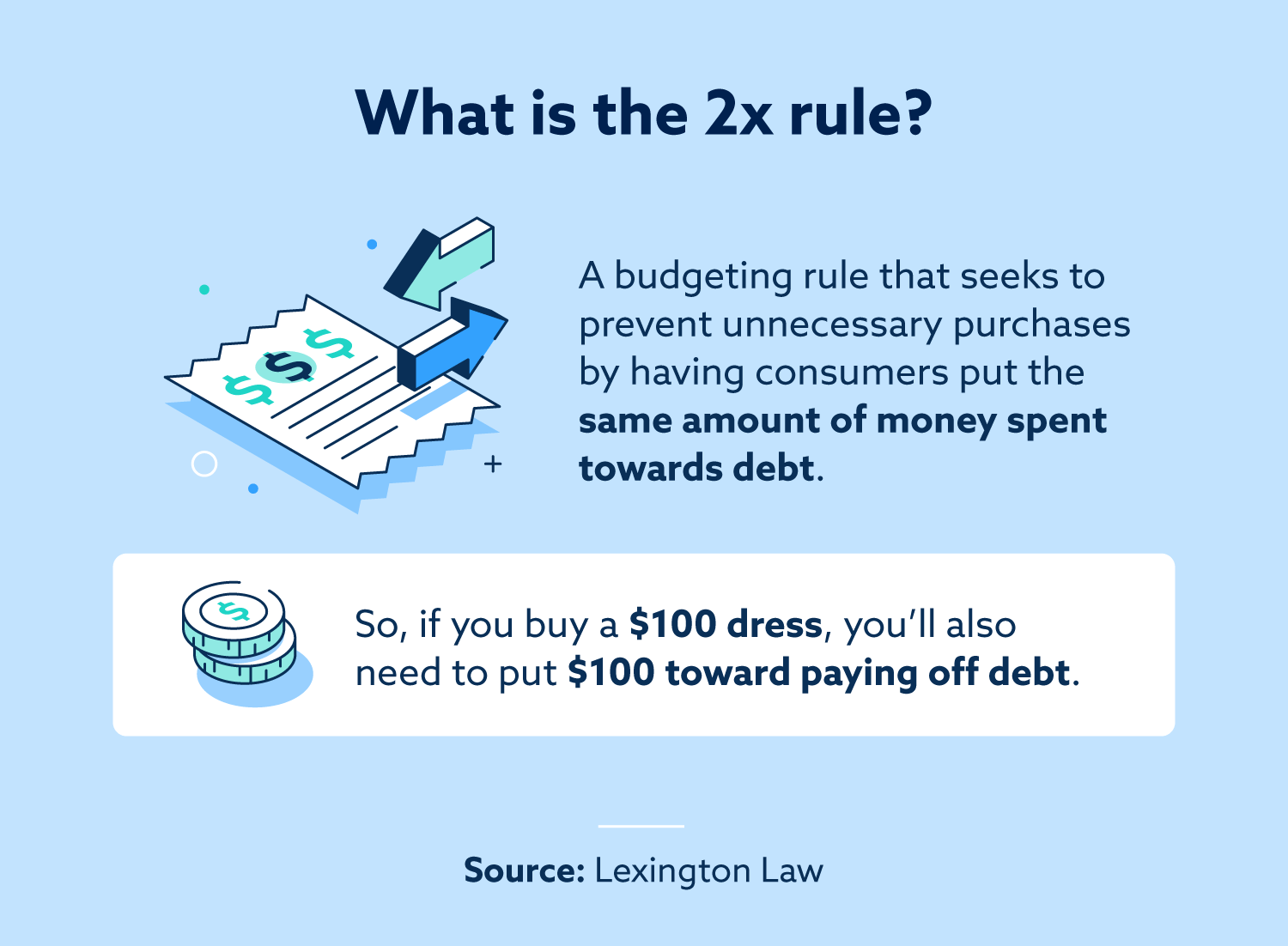

8. Use the 2x budgeting rule

Best for: People with additional disposable income

Some people avoid creating a budget because it seems too restrictive. Ideally, you can create a situation where you can still have fun while paying down your debt as well. That’s where the 2x rule comes into play.

In short, it’s a rule that before you buy anything that isn’t a necessity, you ensure you have twice as much money available so the same amount can go into paying down your debt.

This is a great way to strike a balance between treating yourself and paying down your debts fast.

9. Seek more income opportunities

Best for: Anyone with debt who is currently employed or has additional skills for side hustles

Finding ways to make more money is a sure-fire way to have the ability to pay down your debt faster. Your debt-to-income ratio (DTI) is a good barometer for whether or not you need to seek more income opportunities. Wells Fargo recommends having a DTI of 35 percent or less.

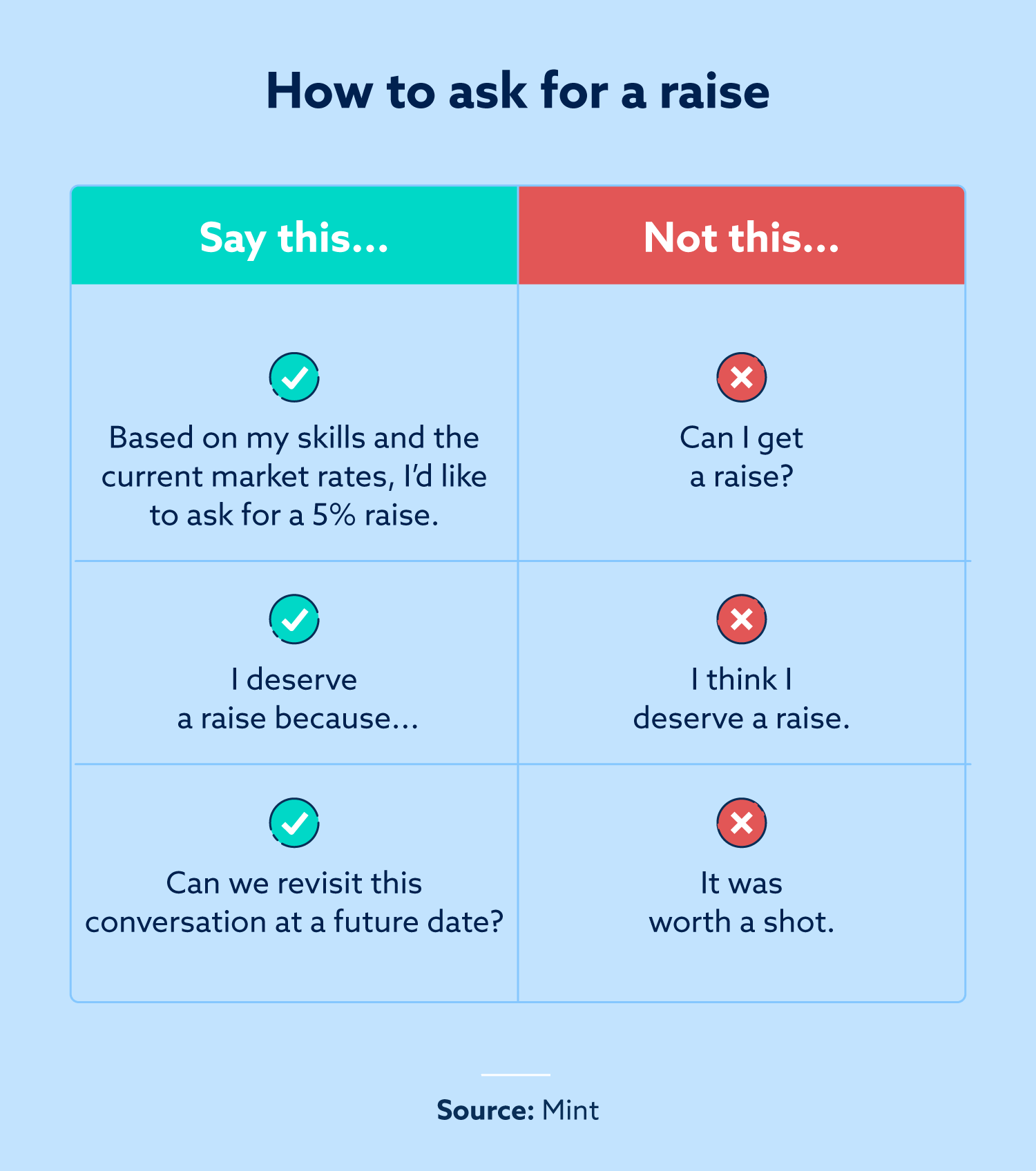

The two best ways to make extra money are asking for a raise and finding additional sources of income.

Asking for a raise may seem like a risky move, but it works more than you think. According to a survey conducted by Payscale, 70 percent of employees who ask for a raise receive one. About 39 percent received their asked amount, and 31 percent received an offer less than they asked for.

You can also find a side hustle. There are many ways to make money, and there are ways to do it from home. You can pick up gig work by doing rideshare driving or using websites like UpWork and Fiverr. You can also sell items you don’t use or no longer need and use that extra money to pay down your debts.

Tip: If increasing your income isn’t an option at the moment, many nonprofit organizations offer various financial services for free. Not only can these programs help you find ways to pay off your debt, but they can also help you avoid debt in the future through different strategies. Some of these services can include:

- Debt counseling

- Credit card forgiveness

- Debt consolidation

- Debt management programs

10. Negotiate a debt settlement

Best for: Older debts and debts in collections

Many people don’t realize they can actually settle their debts for less than what they owe. Debtors would rather get some money than nothing, which is why you can sometimes negotiate with your creditors. It’s more difficult to use this method with active accounts, but you may have a lot of success with accounts in collections.

Debt collection agencies buy debts for far less than the actual amount. When you settle your debt with them, they make a profit, and you pay less than you owe. Keep in mind that these accounts hurt your credit score, but you may be able to improve your score by paying off collections.

FAQ about paying off debt

Here are some answers to other common questions about paying off debt.

How do you get out of debt when you are broke?

One of the best ways to get out of debt when you don’t have much money is to work with a debt management company and to try to negotiate settling your debts for less.

You can also file for bankruptcy, which can eliminate your debt or put you on a manageable payment plan, depending on the chapter you file.

What’s the fastest way to get out of debt?

The debt avalanche and snowball methods are common ways to get out of debt fast. You can also create a budget and make extra income to speed up the debt repayment process.

What’s the best way to pay off student loan debt?

You can check to see if your degree is eligible for the Public Service Loan Forgiveness (PSLF) program. If it’s not, you can try refinancing your loan to get better interest rates, helping you pay off the loan faster.

Don’t let debt get in the way of good credit

Having debt can hurt your credit if it causes you to have a high credit utilization ratio or to miss payments or make payments late. This is why it’s helpful to use these different strategies to pay off your debts sooner rather than later.

As you pay off your debts, you want to ensure that your payments are reported properly, but sometimes, there are errors that you may be unaware of.

To find out exactly where you’re at with your credit score, take advantage of Lexington Law Firm’s free credit assessment today.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice; instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.